How much should you save for retirement?

For many, reaching the coveted $1 million mark is a financial milestone that signifies a comfortable retirement. But is this the number that truly provides the financial security you need to live out your golden years with peace of mind? This article attempts to answer the million-dollar question and outlines the factors that determine whether $1 million is enough to retire.

Key Takeaways

- Geography is crucial in retirement planning, as living expenses and taxes vary significantly from state to state. It’s essential to consider the cost of living in different areas when deciding where to live in retirement.

- Longevity is a key factor, as increased life expectancy can lead to higher healthcare and living expenses throughout retirement. Planning for longer life and potential healthcare costs is essential.

- Inflation varies by region, so retirees need to account for its potential impact on their retirement income. Investing in assets that have historically kept up with or exceeded inflation rates can help mitigate the effects of inflation on savings.

Geography: Location, Location, Location

Retirement planning can be complicated, and expenses vary greatly depending on location. An analysis by GOBankingRates found that $1 million could last significantly longer in some US states than others. This highlights the importance of considering living expenses when deciding where to live in retirement.

California Vs. Alabama Retirement

The cost of living is generally higher in California than in Alabama, particularly in major metropolitan areas like San Diego, San Francisco, and Los Angeles. As a result, retirees in California may need to save more money to maintain their standard of living in retirement, especially if they are moving from another state with a lower cost of living and taxes.

Secondly, taxes can also vary significantly between these two states. California is known for having high state income taxes and property taxes, which can eat into retirees’ budgets. On the other hand, Alabama has lower state income taxes and property taxes, which can make retirement more affordable for some.

Healthcare expenditures can also differ by state. California has some of the highest healthcare prices in the country, particularly for long-term care. In contrast, Alabama has lower healthcare costs, making it more affordable for retirees to access the care they need.

In addition, there can be differences in how pensions and other sources of income are taxed in different states. Given these differences, a retirement plan in California will probably require a larger nest egg to account for all the higher costs. To understand your situation, seeking retirement advice from financial experts is always a good idea.

Longevity: Planning for a Longer Life & Health Care Costs

As medical advances and technology continue to lengthen the average lifespan, retirees or those near retirement years need to consider the possibility of a long-term future when planning their finances. With increased longevity comes an increase in costs throughout retirement; adequate savings must cover necessities like healthcare and basic living expenditures. It may be prudent to factor in additional income sources, such as part-time work or investments, that can help supplement retirement funds over a longer period of life.

Inflation Can Vary by Region.

Not all states or areas are created equal when it comes to inflation, either. Certain areas of the country may have high inflation. In contrast, other states have low inflation since various factors, including supply, production, transportation, and other supply chain factors, determine the cost of goods sold. Therefore, the cost of groceries or gas is likely not uniform from one state to the next.

Retirees need to consider the potential impact of inflation on their retirement income and savings. This means they must plan for a potentially higher cost of living and ensure their savings and retirement income can keep up with the rising cost of inflation.

To combat the effects of inflation, retirees should consider investing in assets that have historically provided returns that keep up with or exceed inflation rates, such as stocks or real estate. They should also consider strategies like inflation-adjusted annuities or other investment products that provide a steady stream of income, which increases with inflation.

Lifestyles

Depending on the active lifestyle you want, how you spend your time after work may determine just how long $ 1 million in annual income will last. Whether traveling around the world or staying close by to help with grandchildren, understanding what life looks like as a millionaire is also key.

Despite common assumptions about fancy restaurants and private jets, most millionaires live modestly within their means, even when money is no longer a significant issue. Use this information wisely as you create plans for yourself; practicality matters, regardless of whether you retire or not.

Adopting the Millionaire Lifestyle:

- Understand that the perception of a “millionaire lifestyle” doesn’t always align with reality.

- Research shows that many millionaires live below their means, emphasizing responsible spending even in retirement.

- The National Study of Millionaires reveals that they often practice frugality, budgeting modest amounts on dining out, and actively seeking good deals using coupons. (1)

- Adopting a similar mindset can help you maintain financial security and make your retirement savings last longer.

Price of Travel and Adventure:

- If you strongly desire to travel and explore new places, it’s important to account for the associated costs, including transportation, accommodations, dining, and sightseeing.

- Determine the frequency and destinations of your travel plans to estimate the financial resources needed.

Lifestyle Preferences:

- Engaging in high-end hobbies, such as golfing or sailing, may entail additional costs for memberships, equipment, and maintenance.

- Attending community activities might require fewer financial resources, but could involve certain fees depending on the specific commitments.

- Time with family and grandchildren may involve occasional trips or contribute to their needs.

Define Your Retirement Lifestyle:

- Think about how you want to spend your time in retirement. Do you plan to travel extensively, pursue hobbies, volunteer, or spend quality time with family and friends?

- Consider the activities and experiences you desire, such as dining out, attending events, or maintaining certain hobbies or memberships.

Health care

Determining whether 1 million dollars will be sufficient for your retirement also involves considering the potential impact of healthcare expenses, especially since Medicare may not cover all your financial needs. Here’s why healthcare can influence your retirement plans:

Average Life Expectancy:

As mentioned above, longevity can play a significant role in planning for retirement and determining whether a million dollars can provide the lifestyle you want.

- The average life expectancy in the US is around 77 years, with slight variations for men (74 years) and women (79 years). (2)

- If you enjoy a longer life and reach your 90s, your retirement savings may deplete several years before the end of your life.

- Considering healthcare fees becomes crucial as you plan for potential medical expenses during your retirement years. The older you get, the more expensive these expenses become.

Impact of Poor Health and Long-Term Care:

- Unforeseen health issues or the need for long-term care can significantly affect your retirement finances.

- Healthcare expenses can quickly deplete your savings, leaving you with financial burdens that may disrupt your retirement plans.

Medicare Coverage Limitations:

- While Medicare provides essential healthcare coverage for retirees, it does not cover all expenses.

- Medicare has deductibles, copayments, and gaps in coverage that can leave you responsible for substantial out-of-pocket costs.

Consider Supplementary Insurance:

- You may need to consider supplementary insurance options to address potential gaps in Medicare coverage and alleviate financial strain.

- Medigap policies or Medicare Advantage plans can provide additional coverage for services not included in original Medicare.

Other Sources of Income

Pensions and Social Security are two significant sources of income that can play a crucial role in your retirement plans. There are, however, many different sources of income in retirement, and it is best to plan for it all.

Pensions

- Employers provide pension plans, offering regular income payments to retired employees.

- Your assistance income typically depends on your years of service, salary history, and the structure of your pension plan.

- Pensions provide a stable and predictable income stream throughout your retirement.

Pension Considerations:

- Determine the estimated monthly or annual pension income you’ll receive.

- Understand the eligibility requirements and any potential adjustments or reductions.

- Consider whether the pension income will cover your essential expenses or if you need to save more.

Social Security

- Social Security is a government program that provides financial support to retirees, individuals with disabilities, and survivors.

- The amount of Social Security benefits (SSB) you receive is based on your work history, earnings, and the age at which you start claiming benefits.

- Social Security benefits can provide income, especially for individuals who have worked and paid into the system.

Social Security Considerations:

- Understand your full retirement age and the implications of claiming or delaying benefits early.

- Estimate your projected SSB using online calculators or by consulting with the Social Security Administration.

Employer-Sponsored Retirement Plan (ESP)

- Employer-sponsored plans are employee benefits that organizations offer, such as a 401(k).

- These plans provide several advantages, including tax benefits, for employees.

- Sponsorship does not always involve direct employer contributions; some may match employee contributions.

Other Income Sources to Consider

- Pensions and Social Security can interact with other retirement income sources, such as investment accounts and part-time work, which can influence your financial situation.

Examples:

- Pensions and Social Security may reduce the amount you need to withdraw from your investment portfolio, potentially extending longevity.

- Higher pension or Social Security income may make you more conservative with your investment allocation or take calculated risks.

- Changes in pension or Social Security benefits due to cost-of-living adjustments (COLAs) or policy changes can impact your budget and planning.

Figuring Out How Much Is Enough for Retirement

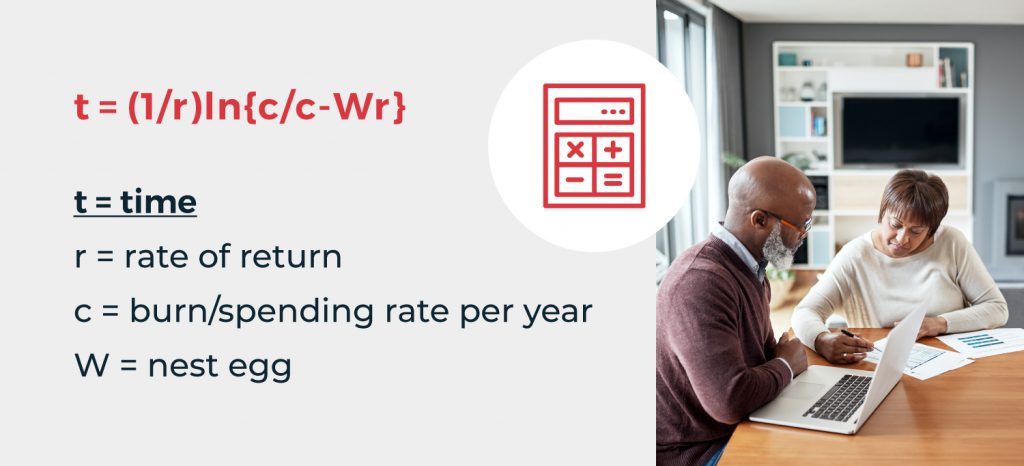

While each person’s situation is unique, four factors apply to everyone’s plan:

t = Time: Consider the years you have left before retirement. The longer the planning horizon, the more time you have to save and potentially benefit from compounding returns.

r = Rate of Return: Consider the return on your investments after adjusting for inflation. This rate determines how quickly your nest egg can grow and how much money you will have to support your desired retirement lifestyle. Cash equivalents have a .05% return rate, while a large-cap investment like the S&P 500 yields 28.71% (1).

c = Burn/Spending Rate Per Year: Determine your retirement expenditure. Assessing your anticipated living expenses, such as housing, healthcare, leisure activities, and travel, will help you determine how much money you need.

W = Nest Egg: Evaluate the money you have already saved for retirement or the amount you need to save. This includes savings, investments, pensions, and other sources of income that contribute to your nest egg.

By considering these four factors in your retirement plan, you can better understand how long your nest egg needs to last and what steps you can take to achieve your financial goals. Leveraging the 4% with your retirement savings withdrawals is the recommended course of action.

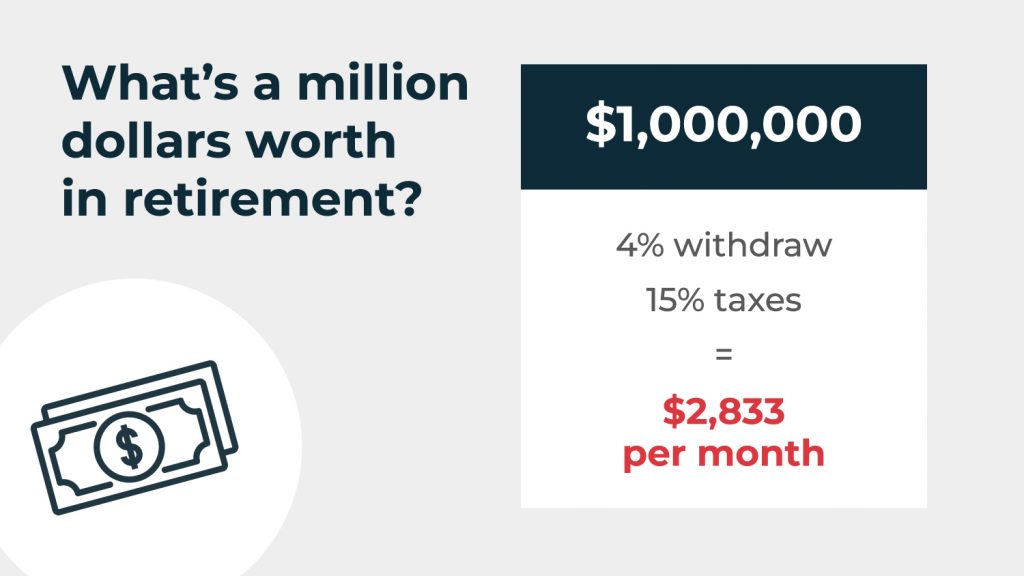

4% Rule

The 4% rule suggests that retirees can safely withdraw an amount equal to 4 percent of their savings each year they retire and then adjust for inflation in subsequent years for 30 years.

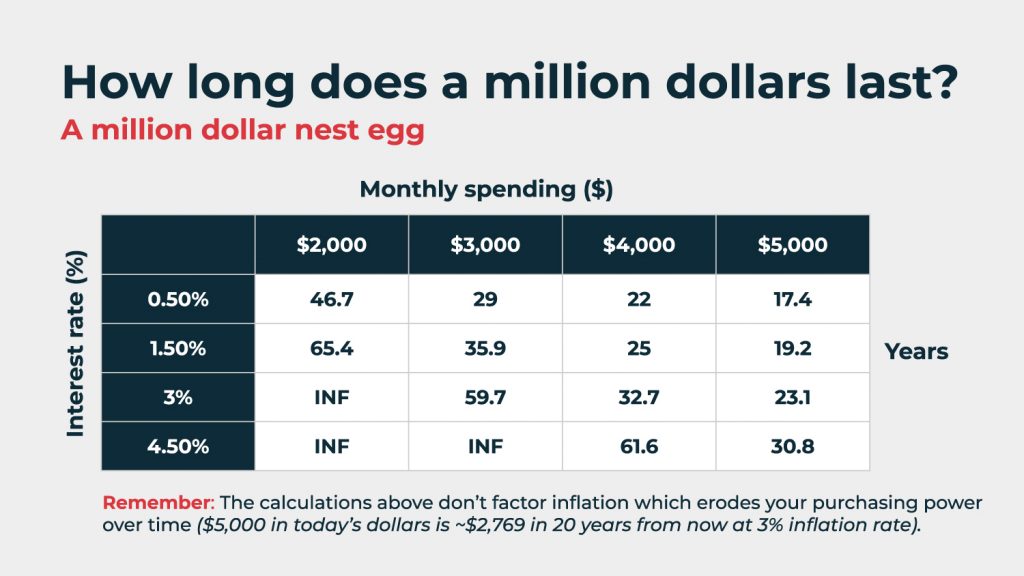

How long does 1 million dollars last?

The answer: That depends on a lot of factors, but for this article, the longevity of $ 1 million in retirement is based on the combination of interest rates (your investment return) and monthly budgets (your monthly spending). The calculations below don’t factor in inflation, which erodes your purchasing power over time. ($5,000 in today’s dollars is approximately $2,769 in 20 years from now at a 3% inflation rate).

Let’s explore how different scenarios unfold:

(These are hypothetical and in addition to other sources of income)

For monthly spending of $2,000:

- At an interest rate of 0.50%, 1 million would last approximately 46.7 years.

- At an interest rate of 1.50%, it would last around 65 years and 4 months.

- At an interest rate of 3%, the money would last indefinitely.

- At an interest rate of 4.50%, it is indefinite, like above 3%.

For monthly spending of $3,000:

- At an interest rate of 0.50%, 1 million would last about 29 years.

- At an interest rate of 1.50%, it would last around 35.9 years.

- At an interest rate of 3%, the money would last approximately 59 years and 7 months.

- At an interest rate of 4.50%, the money would last indefinitely.

For monthly spending of $4,000:

- At an interest rate of 0.50%, 1 million would last approximately 22 years.

- At an interest rate of 1.50%, it would last around 25 years.

- At an interest rate of 3%, it would last about 32.7 years.

- An interest rate of 4.50% would last approximately 61.6 years.

For monthly spending of $5,000:

- At an interest rate of 0.50%, 1 million would last about 17.4 years.

- At an interest rate of 1.50%, it would last around 19 years and 2 months.

- An interest rate of 3% would last approximately 23 years and 1 month.

- At an interest rate of 4.50%, it would last about 30.8 years.

Consulting with a financial advisor can provide personalized guidance tailored to your circumstances, helping you make informed decisions and optimize your retirement savings.

How Much Money Do You Need To Retire

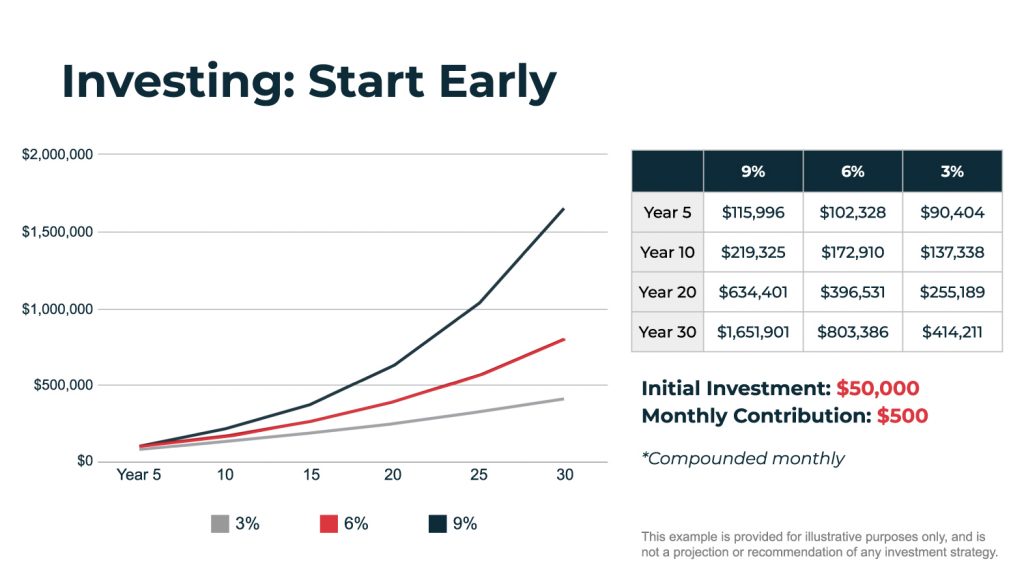

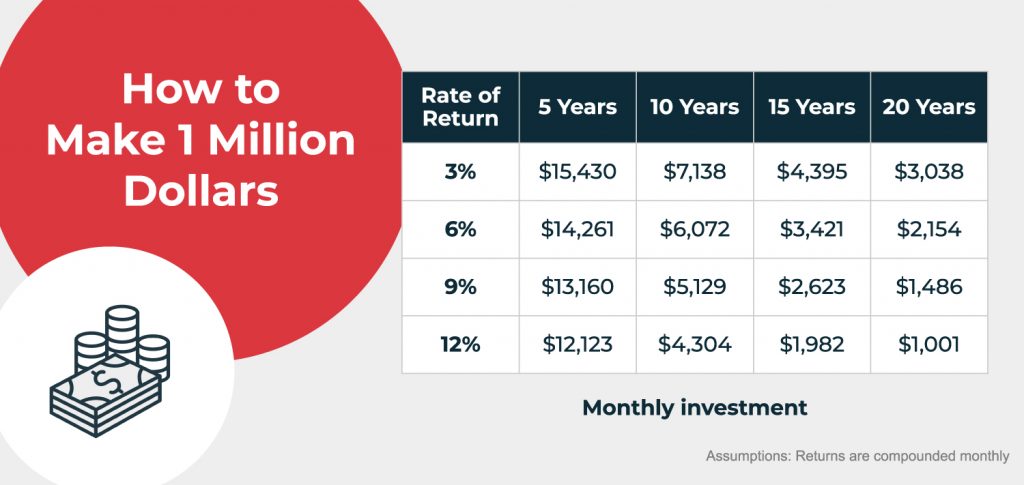

Saving for 1 million dollars is achievable with innovative strategies:

- Take advantage of compound interest by saving early and increasing your money exponentially.

- Begin investing early to reap the benefits of long-term growth, even with small and consistent contributions.

- Stay invested in the stock market for higher potential returns and focus on consistent growth rather than trying to time the market.

- Avoid common behavioral biases by maintaining a disciplined investment approach and sticking to your long-term goals.

- Maximize contributions to tax-advantaged retirement accounts and take advantage of your employer’s matching contributions.

- Review and adjust your investment strategy to align with your goals and risk tolerance. Seek guidance from a financial advisor if needed.

Remember, achieving a million-dollar goal requires discipline, patience, and a long-term perspective. By following these strategies, you can increase your chances of reaching this significant financial milestone.

Key Takeaways: How to Determine the Right Amount to Retire

Whether you currently have 1 million dollars or aspire to retire with 1 million dollars, seeking the guidance of a financial advisor is invaluable. A financial advisor can provide personalized advice tailored to your financial situation, goals, and risk tolerance. They can help you develop a comprehensive financial plan, optimize your investment strategy, and navigate potential challenges. With their expertise and careful planning, you can make informed decisions, avoid costly mistakes, and maximize the growth potential of your savings.

A financial advisor can also help adjust your plan as your circumstances change and help you stay on track toward your million-dollar goal. By working with a trusted advisor, you gain a partner who can provide ongoing support, accountability, and expertise throughout your financial journey. Don’t underestimate the power of professional advice, whether you’re just starting to save or already have a significant sum. Contact a financial advisor today and take the necessary steps toward achieving your financial dreams.

Request a no-cost, no-obligation advisor consultation today!

Get StartedSubscribe to our newsletter to stay updated.

-

Previous

3 Financial Phases of Life

-

Next

Financial Spring Cleaning