What Are Some Of The Biggest Risks Retirees Face?

Retirement can be the time of one’s life, where dreams of traveling the world and enjoying life to its fullest finally come true. But retirement is not without risks and without proper planning and financial discipline, the worst fear of many retirees could come true: they could run out of money.

While there are many factors that could cause a retiree to have to lower expenses in retirement or cut back on their lifestyle to avoid running out of retirement savings. In this post, we’re going to look at three common post-retirement risks that people approaching retirement age are likely to have to deal with down the line: longer lifespans, potential cuts to social security, and high inflation rates.

Retirement Risk #1: Longevity Risk

The Financial Challenges of Longer Lifespans

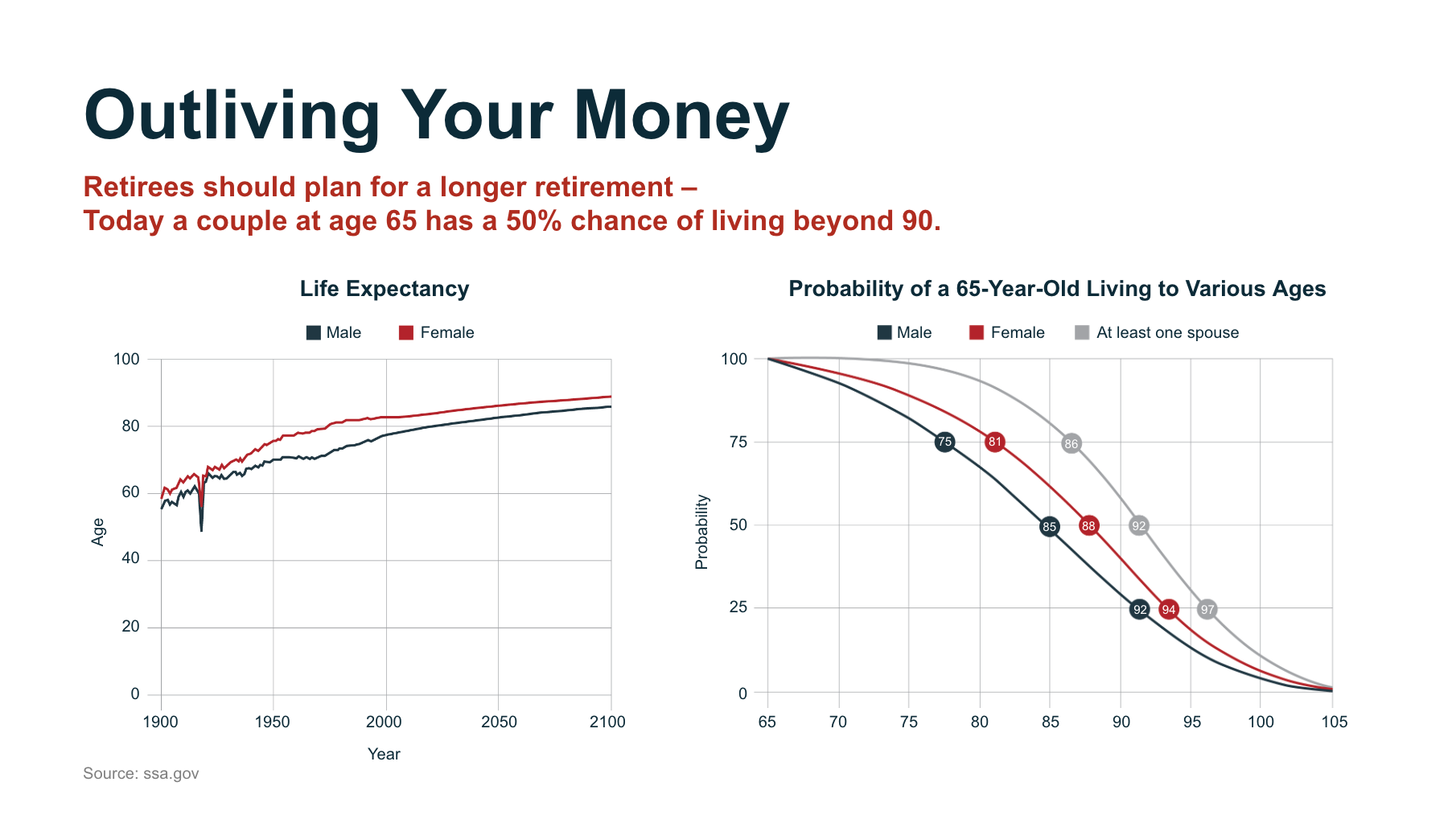

Having a longer life expectancy is objectively a good thing, but living longer brings its own challenges and retirement risks. With life expectancies at all times highs due to advances in healthcare and technology, retirees are living longer than ever before — according to the Social Security Administration, the life expectancy of a person reaching age 65 today is over 20 years versus just under 14 years in 1940 — which means retirement savings have to last longer.

Additionally, one of the biggest financial challenges that living longer could bring is unexpected medical bills, increased medical costs, and the potential need for costly long-term care. It is important to plan for these potential medical expenses in advance to minimize the risk of an unexpected healthcare event draining out your savings, even if you are in good health as you approach or enter retirement. The costs of healthcare and long-term care alike have been on a consistent march upward for many years — as has been insurance, and Medicare famously does not provide long-term care coverage.

Planning for a longer retirement

If you’re in or approaching the preservation financial phase of life, you still have time to significantly increase how much you have saved for retirement. There’s even been some help from Congress. Thanks to the Secure Act 2.0, workers over 50 will be able to make larger catch-up contributions to their retirement accounts starting in 2023. Depending on how much you think you’ll be able to save, it might make sense to work longer — though you may be able to switch gears to working part-time or in a consulting role instead of full-time. Younger people still in the accumulation phase should also make sure they are saving more for retirement so that they have more assets to work with.

RETIREMENT TIP:

For people already in retirement, options are limited. Riskier investment strategies are generally not a smart choice at this stage of life as the potential cost of a risky investment going wrong is too high. Returning to work is an option available to younger retirees still in good health, though perhaps not a desirable one. Otherwise, you’ll need to reduce your living expenses to help your money last longer.

Retirement Risk #2: Changes to Social Security

The Risk of Potential Social Security Benefit Cuts

For many retirees, the Social Security benefits they will receive are a key component of their retirement income and their drawdown strategy. However, because of a number of factors, there is a significant risk that Social Security benefits will be reduced in the near future, substantially reducing income.

One of the major reasons is the likely insolvency of the Social Security trust fund, which is projected to run out of money around 2035 due to the increase in the number of retirees drawing benefits and a decrease in the number of workers paying into the system. In 2022, there were an estimated 2.8 workers per retiree; by 2035, that figure is estimated to drop to 2.3 workers per retiree.

Once the trust fund runs out of money, benefits will have to be reduced to levels covered by incoming tax revenue. Currently, the Social Security Administration expects that this would be enough to cover 76% of scheduled benefits. A 24% benefit reduction would be a significant impact for many retirees and would force them to cut back on spending, draw down their retirement savings faster, or even back into the workforce.

Could cuts be avoided?

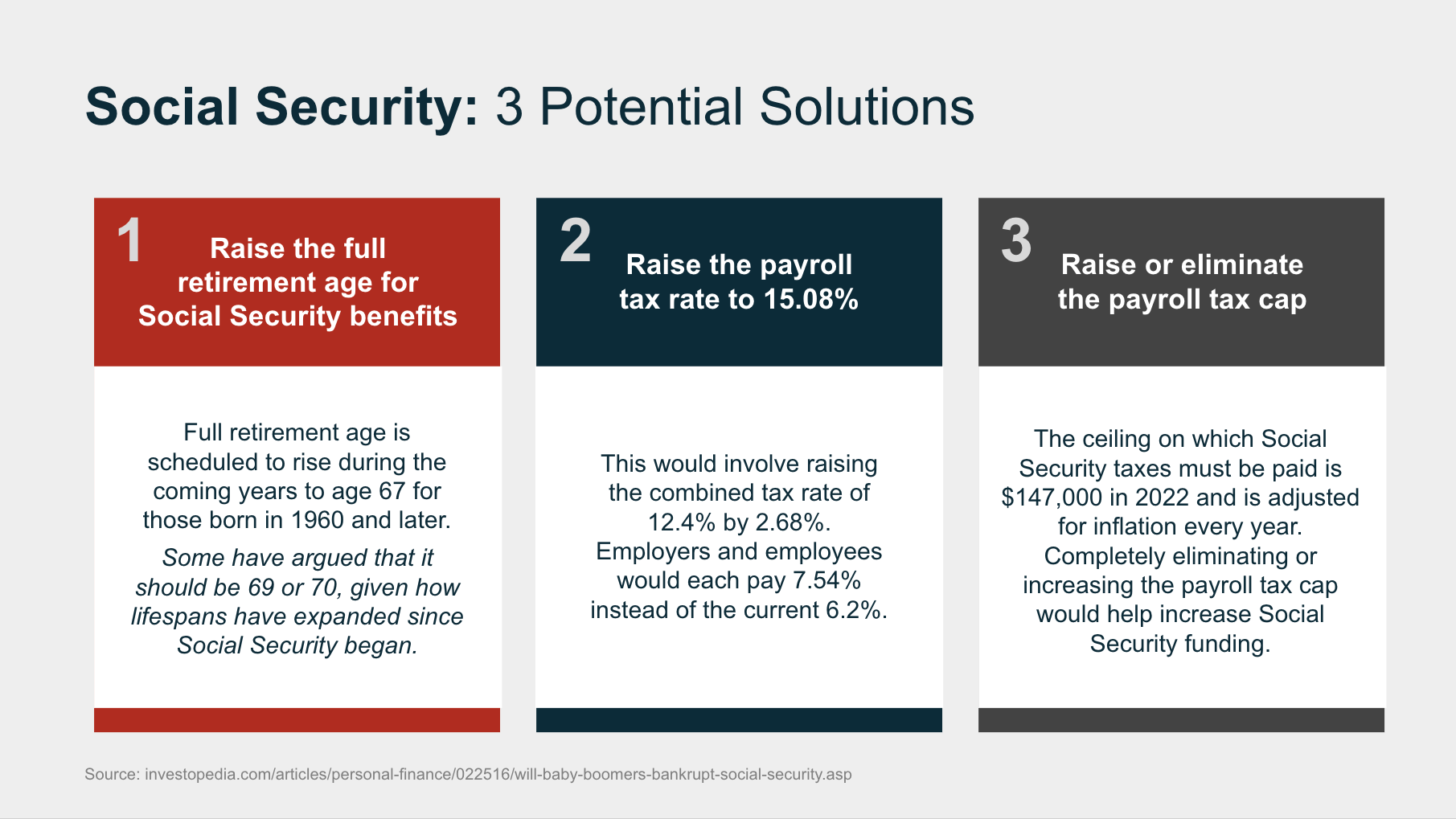

These projections are based on the current payroll tax rate of 12.4% and inflation-adjusted ceiling for payroll tax withholdings (set at $160,200 for 2023). According to the Social Security Board of Trustees, an increase in the payroll tax rate to 14.4% would be sufficient to provide benefits for the next 75 years, as would an immediate reduction of benefits by 13% — or a combination of the two.

Other measures that would help keep the Social Security Trust Fund solvent include raising the full retirement age range even further from its current 67 (for example, to age 70) or raising the withholding ceiling higher (or even eliminating it altogether).

In all cases, enacting the changes requires congressional action. However, despite passing several reforms to retirement planning in recent years, Congress has been slow to act on politically sensitive Social Security reforms even though the threat of the Social Security Trust Fund running out has been known for some time.

Retirement Risk #3: Inflation

Is Your Savings And Investment Assets Keeping Pace with Inflation?

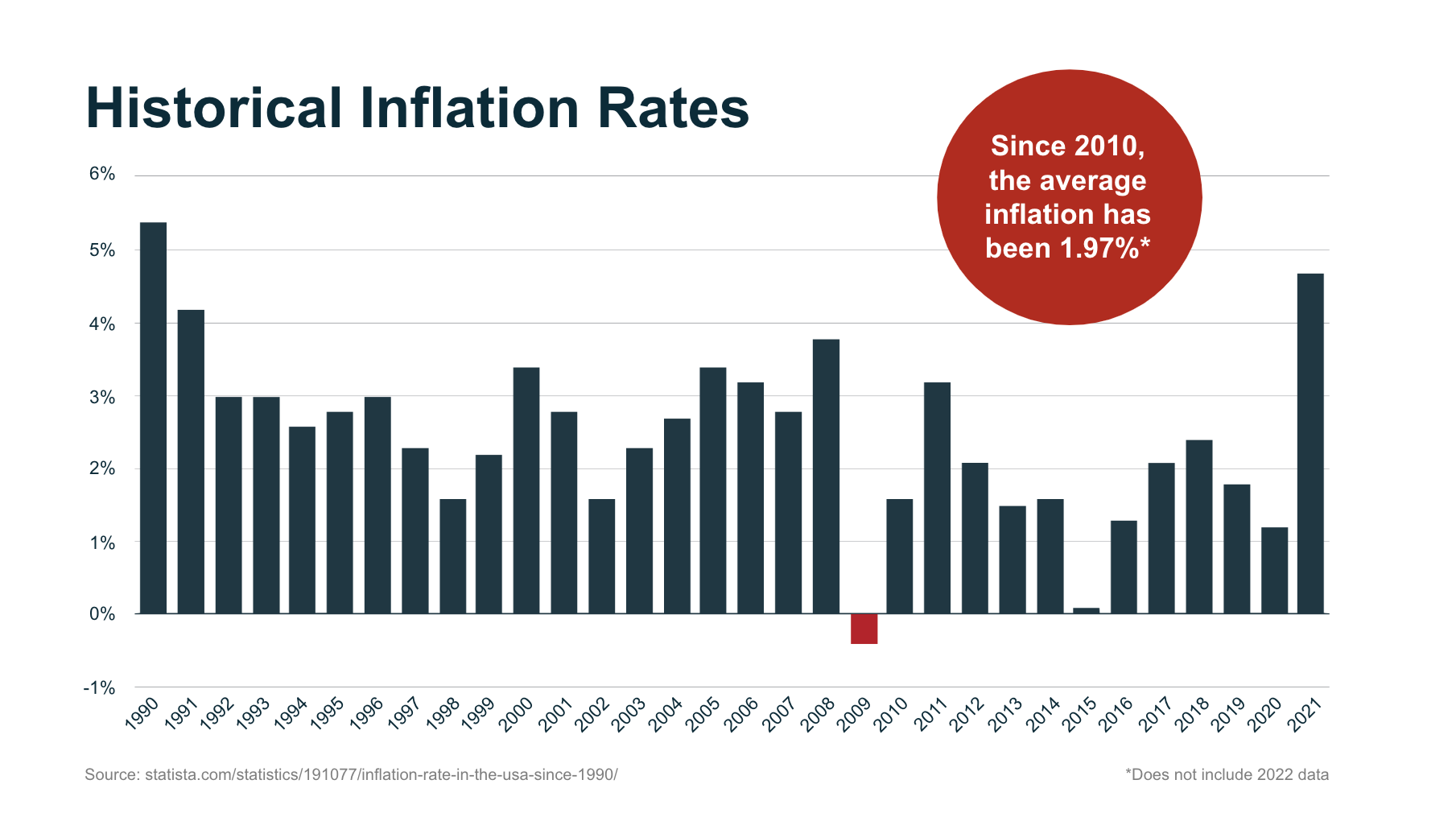

The 2010s were a period of historically low inflation and even the 90s and 00s saw inflation consistently at moderate levels. That ended in 2021 when inflation began spiking to levels not seen since the early 80s. The inflation rate for 2021 ended up registering at 7.0% and at 6.5% for 2022. While it has been trending downward for several months now, inflation is still elevated — and there’s no guarantee additional spikes won’t be seen in coming years. As many Baby Boomers know, the 70s saw two separate inflation spikes, with the second one coming after two downward years.

How does inflation affect retirees?

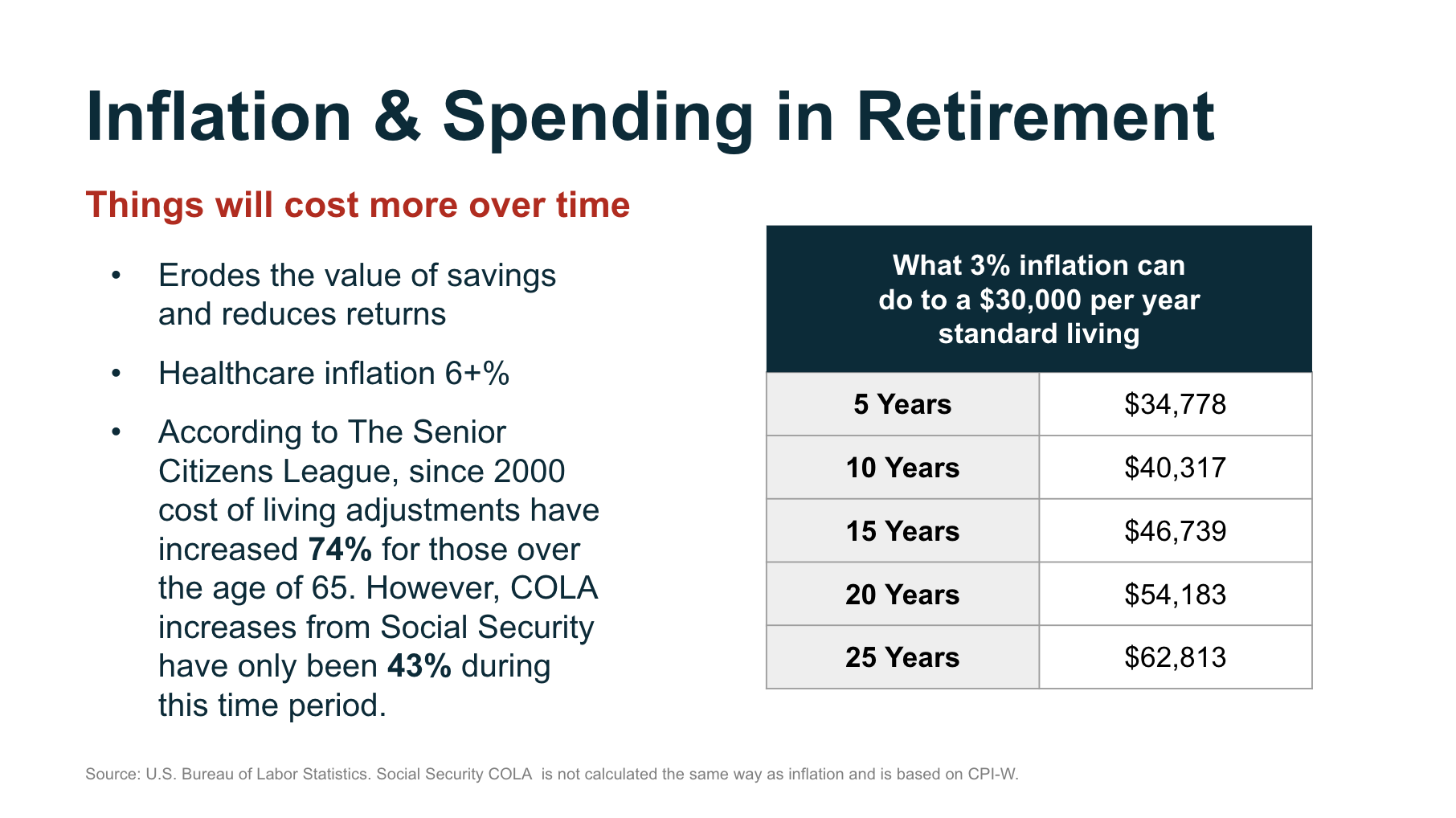

Inflation hits retirees harder than workers because it can greatly reduce your spending power. While workers typically see higher wage increases during times of higher inflation and also have the option of finding new jobs that pay more, retirees are largely stuck with what they have. Though social security benefits are indexed to inflation, these are just one source of retirement income — and cost of living adjustments typically don’t go up as much as they should. Additionally, returns on retirement investments often decline during times of high inflation even if savings account yields go up thanks to increase rates. In all, inflation means you have to use more of your retirement savings each year to maintain the same lifestyle.

What can retirees do to manage inflation risks?

Because inflation eats purchasing power away over time (meaning the same income covers less and less in goods and services) and expenses in retirement aren’t as easy to reduce as many people think, its important to take potentially high inflation rates into account when planning for retirement. While measures like downsizing your house and skipping vacations can help retirement savings last longer, having more money stashed in your nest egg than you think is necessary and minimizing spending in your early retirement years are the measures most likely to help you avoid running out of money later on. Having a proper retirement income plan is key to maintaining your lifestyle and ensuring your financial security once you reach your retirement age.

Financial Planning Can Help Protect You From Retirement Risks

While there are many financial risks that could deplete your retirement savings, careful planning can help you mitigate these risks. A personalized financial plan that takes a potentially longer lifespan and the associated costs into account, adjusts for inflation, and includes a scenario in which Social Security benefits get reduced can put you on the path towards a solid and sustainable retirement and help your savings last throughout your golden years.

If you’re not sure where to start, our financial advisors can help. Request a consultation from a fiduciary financial advisor to get started today.