Time in the Market, Not Timing the Market

Investing in the stock market is a long-term game, and investors who try to time the market often find themselves struggling to make consistent gains in investment markets. While the idea of buying low and selling high may seem like a winning strategy, market timing is notoriously difficult to execute. In fact, studies have shown that attempts to time the market often result in missed opportunities and lower overall returns.

On the other hand, investors whose investment strategy focuses on time in the market rather than timing the market tend to see more consistent gains over the long term.

In this blog post, we’ll explore the reasons why investors benefit from staying invested in the market and avoiding the temptation to try and predict short-term fluctuations in stock prices.

Market Timing Risk: Missing the Best Days

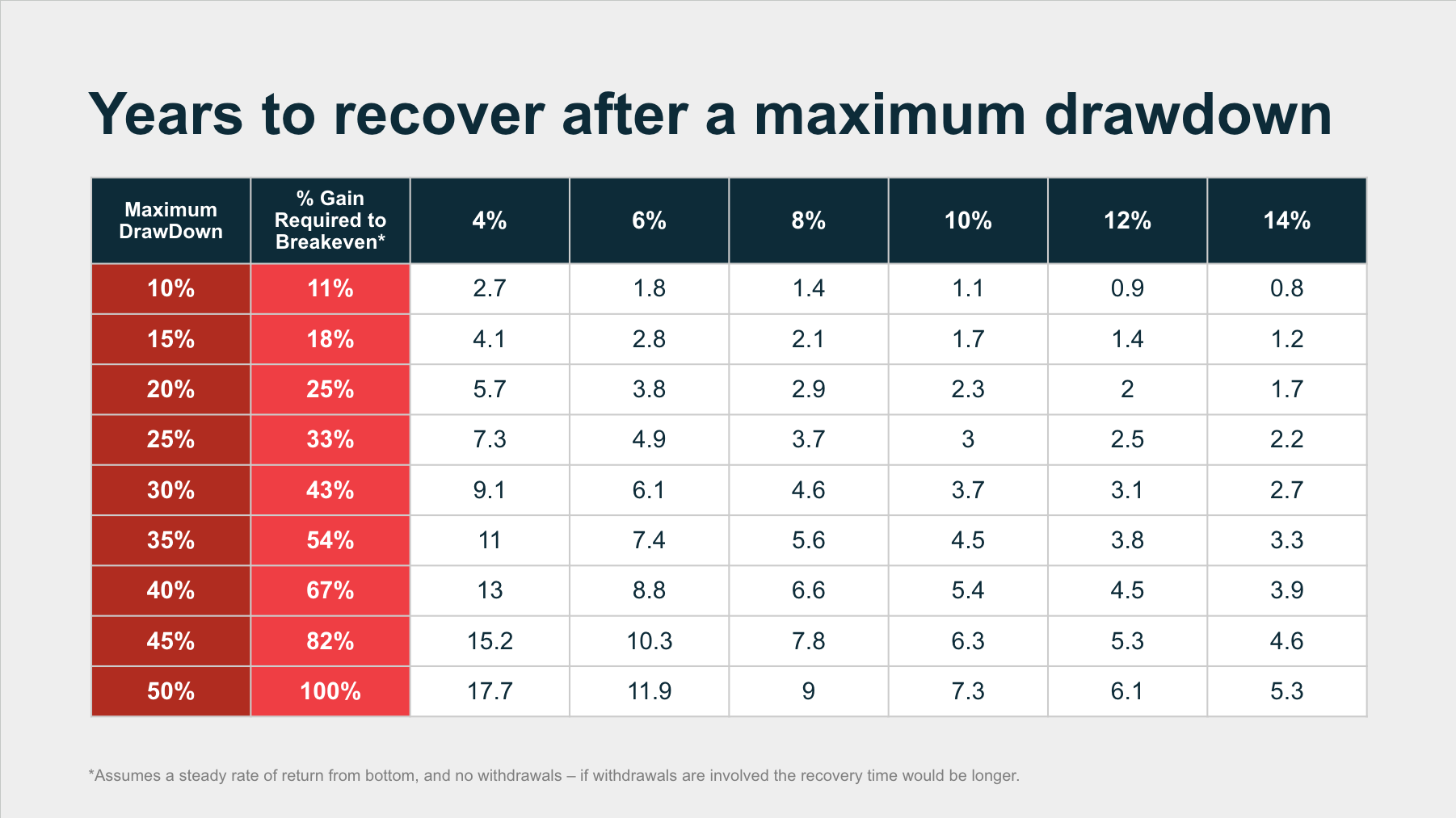

One of the reasons why investors try to time the stock market is to avoid the worst days that cause the biggest account declines. This makes sense as large drawdowns can take a significant amount of time to recover. When a 25% loss can take almost 5 years to recover at a 6% rate of return, wanting to avoid taking that loss — and avoiding a bear market in general — is understandable.

However, the risk of trying to time the market is that instead of missing a large drawdown, you miss a large increase and instead get lower returns. Because nobody has a magic crystal ball to predict future market results, timing the market is extremely difficult, and perfect timing is nearly impossible. Many market timers make emotion-driven decisions that make their situation worse. An emotion-driven investment decision has the potential to be the worst decision possible, causing an investor to make the misstep of mistiming an entry point and buying high or selling low when the goal is to buy low and sell high.

If any such decisions are made over time, the negative effect will compound. For a retirement investor, these missteps could significantly impact how much money they have when it’s time to retire.

Example of Market Timing Risk

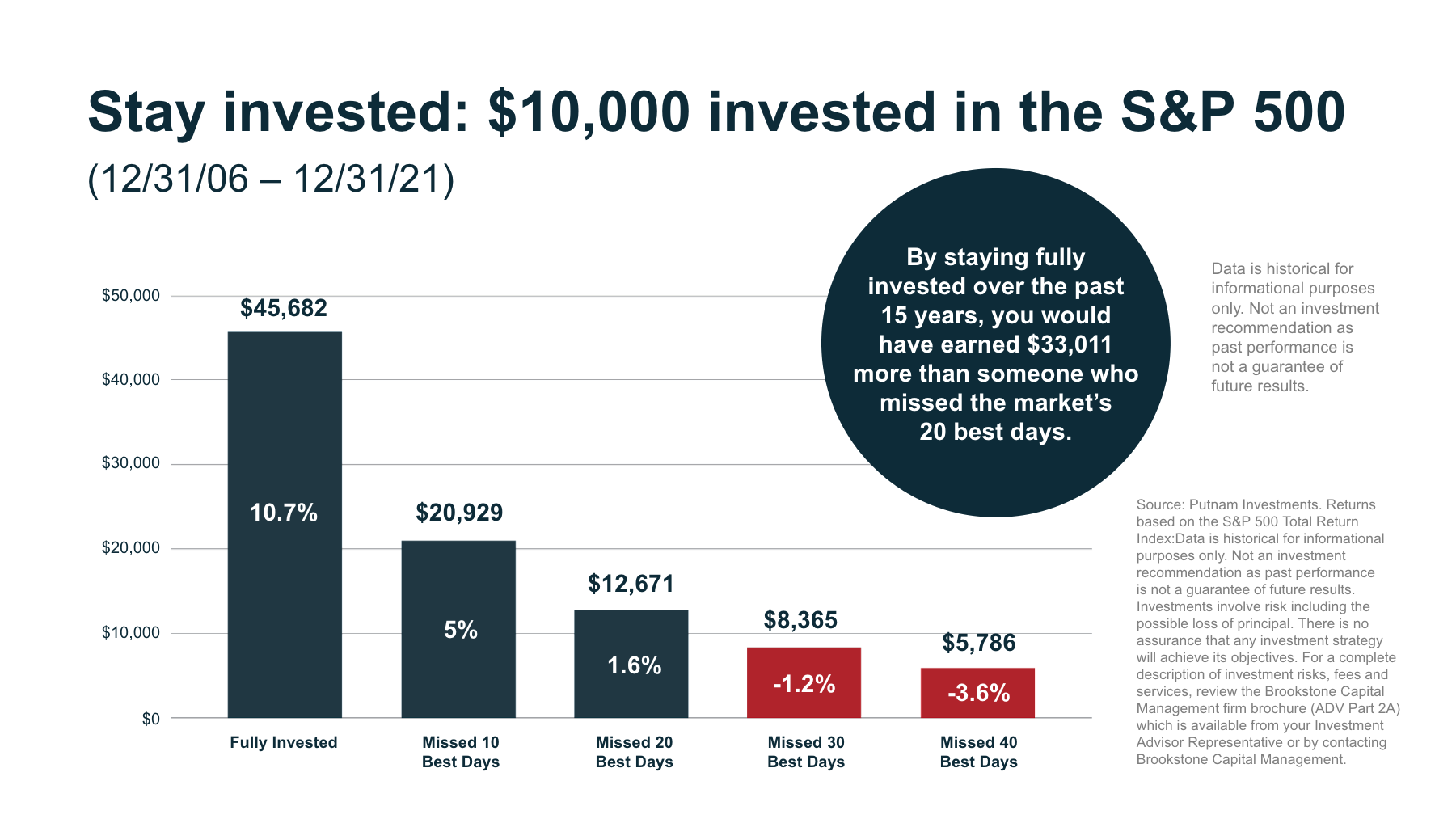

For instance, missing just the ten best market days over the 15-year time period between 2007 and 2022 reduced investment returns by over 50% for an S&P500 investor, with the annualized return dropping from 10.7% to 5%. And someone unlucky enough to miss the 30 best days would have lost money, with an annualized return of -1.2%. An investor that sells when 25% down to avoid potentially taking a 35% loss but ends up missing a significant recovery would be set back much further than if they’d just held.

For a retirement investor, missing these big days means a potentially significant impact on their retirement lifestyle. If the above example were applied to a worker who was 50 in 2006 that started with $100,000 in their retirement account, that account would have been worth $456,820 at the end of 2022 if it stayed invested in the S&P500 for the entire period – but only $126,710 if they tried to time the market and missed the 20 best days as a result. The investor that stayed fully invested has 3.6x as much money for their retirement and may be able to safely retire at 65, while the investor that timed the market may have to keep working for several years – and will still be behind, purely because they just a handful of market days.

Best and Worst Market Days Often Cluster Together

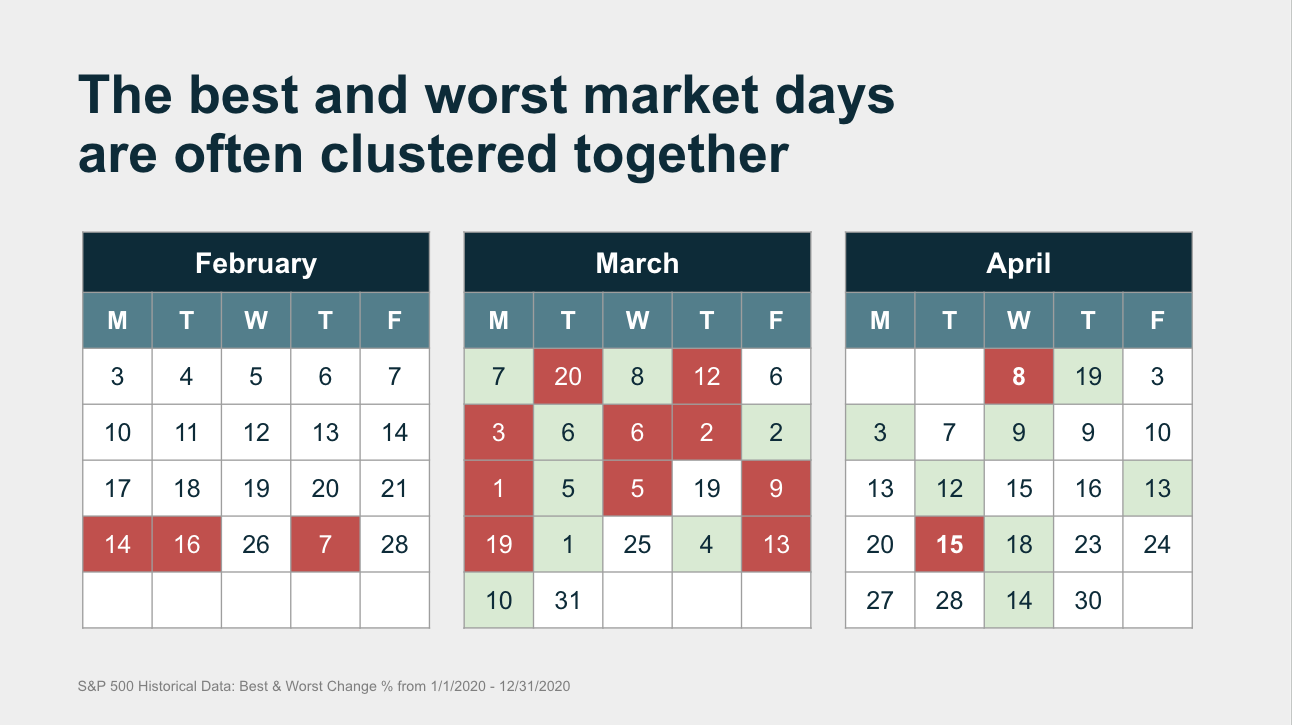

Timing the market successfully with an active management strategy is made more difficult by the fact that the best days are often clustered together with the worst days because the big days come during periods of high market volatility. In 2020, the bulk of the year’s best days and the year’s worst days were both in March.

With perfect timing, it would have been possible to sell in mid-February and buy after the market bottomed on March 20 to avoid the drawdown and profit entirely from the rebound back up. However, an investor who panic sold in the middle of March and stayed out of the market for three months would have missed out on most of the rebound while locking in most of the pullback’s losses.

While historical returns and past performance are not predictors of future performance, and this example is for illustrative purposes only, research shows that time in the market beats timing the market over longer periods.

Maximizing Time in the Market: Start Early, Contribute Often

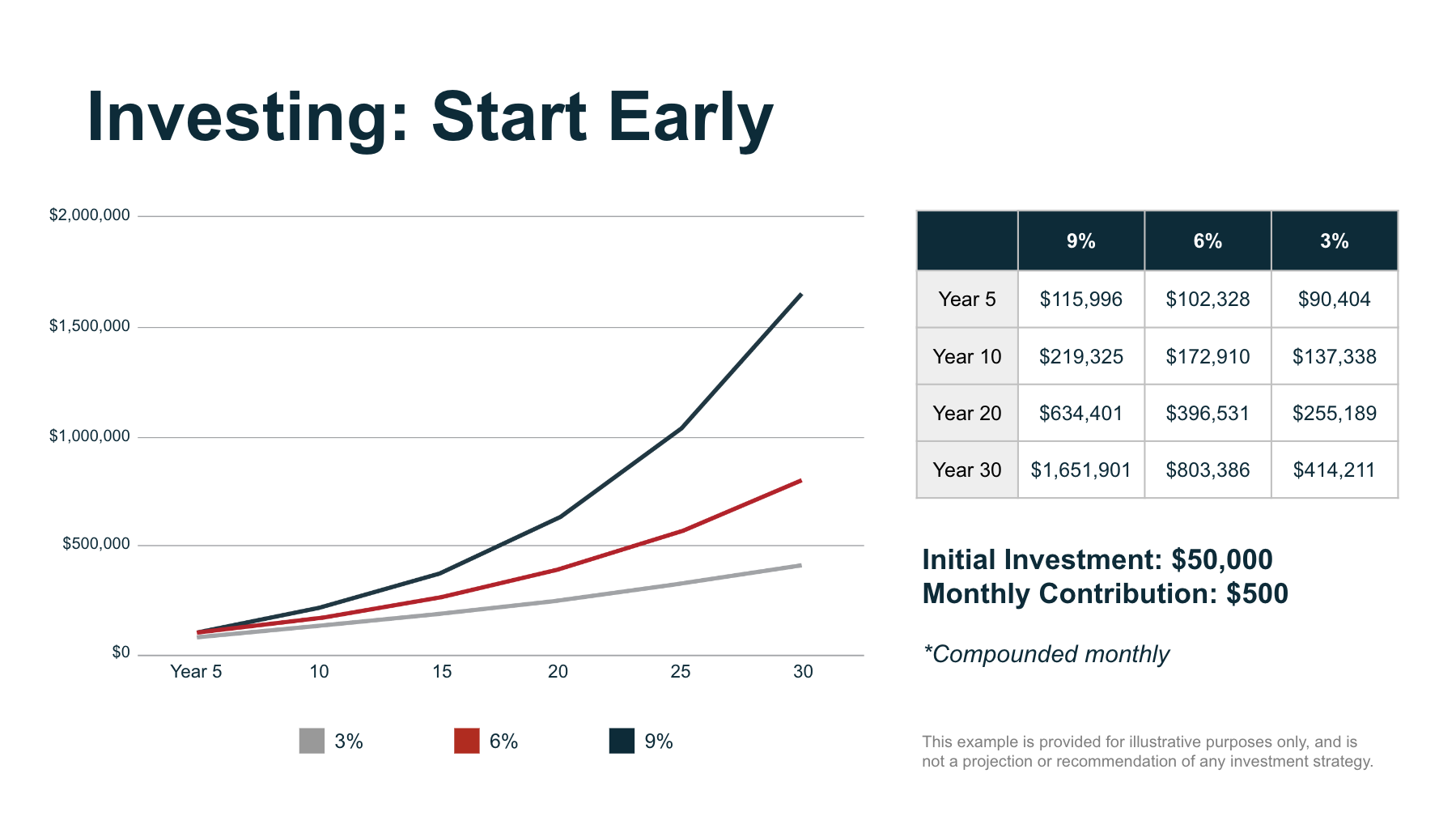

The best way to maximize time in the market is to start investing as soon as possible. The below chart shows the result of a $50,000 investment with a monthly contribution of $500 at different rates of return. As you can see, even at lower return rates, an early start produces substantially greater results.

An investing strategy for consistently making investments and avoiding emotional decisions based on market conditions is dollar-cost averaging (DCA). By investing a fixed dollar amount on a regular basis, an investor using dollar-cost averaging manages the effects of market volatility by smoothing out the average cost per unit of assets purchased (the dollar cost average). Over time, and in certain market conditions, it could result in a lower average cost and a higher return.

Time in the Market Strategy: Dollar Cost Averaging

While it’s important to note that DCA is an investment strategy that doesn’t always produce a higher return versus lump sum investing, this systematic approach can help investors stay the course by taking the guesswork out of when to invest. This way, you avoid the mistake of buying high and selling low while also ensuring that your investments don’t miss out on the big gains of the best market days. A DCA investor may even be more inclined to increase the size of their investments during a stock market downturn as they will get a greater return on those investments on the way back up.

Of course, this advice works best for younger people. If you’re already approaching retirement, you likely have 5-10 years before you have to start drawing down your retirement savings – but if you’re closer to 40, you still have a time horizon of 25-30 years (or more).

Rebalance Regularly to Manage Risk

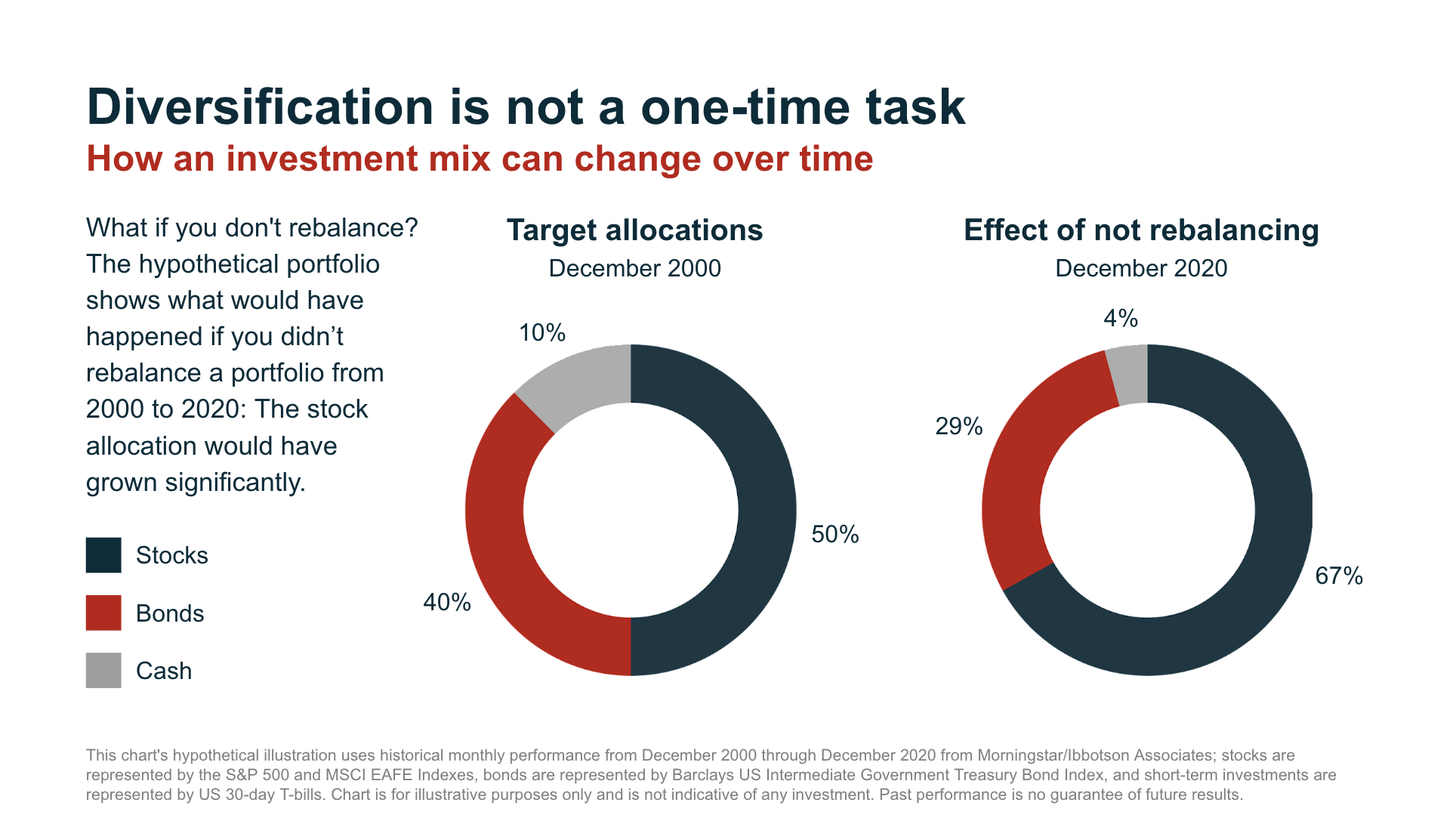

While it is important to stay invested for as long as possible, it is also important to adjust your portfolio periodically based on market changes to maintain your risk profile as assets do not grow at the same pace. For example, without rebalancing, a 60/40 portfolio of stocks and bonds could turn into a 70/30 portfolio because stocks outperform bonds. While this imbalance could have the benefit of providing greater overall returns, it also puts you at a greater risk of larger losses than you may be comfortable with should a bear market arrive.

In addition to scheduled rebalancing (such as quarterly or annually), some long-term investors use rules to rebalance based on performance. One example is rebalancing if any part of your mix of asset classes moves away from your target by more than 10 percentage points. This is called percentage drift.

Protect Your Investments With Professional Assistance

Like initial asset allocation, rebalances should be done as part of a strategic investment plan tailored to your goals and risk tolerance. Unless you’re an experienced investment professional, you shouldn’t attempt to create this plan by yourself. You will get much better results by working with a financial advisor. An experienced advisor will have a proven financial research approach and investment process they can use to make investment decisions that help deliver results for their clients.

For retirement investors, this investment plan would be part of a broader retirement plan tailored to your retirement goals and overall financial situation. In addition to creating your plan, your advisor will help you avoid making emotional decisions that hurt your long-term financial health, provide advice about other retirement-related matters, and, in some cases, find investment options that reduce costs or improve returns. Get started today by requesting a free conversation with a member of our advisor network.

Request a no-cost, no-obligation advisor consultation today!

Get StartedSubscribe to our newsletter to stay updated

-

Previous

Roth IRA Conversion

-

Next

Are Annuities a Good Investment