What is the Value of a Financial Advisor?

Making important financial decisions can be complex, especially when planning for retirement, and no two retirements are the same. Professional guidance from a financial advisor tailored to your unique financial situation can provide invaluable insights that could help you protect your wealth, reduce your tax liability, and reduce the risk of running out of money in retirement.

The financial industry sometimes confuses investors by not clearly articulating different industry participants’ various roles and responsibilities. Many people don’t understand the many benefits of working with a financial advisor. If you’re not sure if working with a financial advisor makes sense for you, here are some of the ways a financial advisor can help you with retirement planning and reach your financial goals:

Personalized Financial Advice for Personal Finance

Retirement planning today is far more complex than it used to be, with the number of financial products and services available increasing yearly. At the same time, large investment companies have increasingly turned toward automation and don’t provide personalized advice for individuals.

If you work with a financial advisor, you’ll have someone to call to answer your questions, work with investment companies on your behalf (potentially saving you money on fees and commissions or giving you access to products not available directly to retail investors), and provide advice specific to your retirement goals.

Some of the questions a financial professional can help you answer include:

- What’s the best age to take Social Security?

- What type of life insurance or long-term care coverage is best?

- What does Medicare cover?

- What is the best investment strategy for me?

- Is taking a lump sum for a pension or annuity payout better?

- How much cash should I have on hand in retirement?

Your financial advisor can also act as your fiscal coach, helping you decide whether a particular expenditure makes up for your financial situation. They can help reduce procrastination, identify unique investment opportunities, or help course-correct when necessary.

Long-Term Financial Planning

Your financial advisor can provide advice and create a comprehensive, personalized plan to help you reach your retirement goals.

Additionally, they can help with income planning once you are nearing retirement and it’s time to start drawing down your assets. Income planning is crucial to making sure your assets last. From helping to determine which accounts to take withdrawals from first to making sensible investments that balance the need for current and future income, your advisor’s training and experience will help formulate the right drawdown strategy for you.

Investment Management

There is no one “right” investment. Your financial advisor can help you decide which of the vast array of options available is right for you. They can also educate you on other financial products and strategies you might not be aware of to get a better return on your money.

Some of the questions about your investment goals that your financial advisor will help you answer and pick investments for include:

- What is your risk tolerance?

- What is the timing of your investments? Do you need to have access to these funds if needed for a major life event?

- Is there any overlap between the current investment choices you have made?

- What are the tax implications and advantages, if any, of this investment?

- Are your investment returns keeping pace with inflation?

- What are the fees associated with my investments? And what’s the difference between Mutual funds and Exchange Traded Funds (ETFs)?

Many financial advisors will help you rebalance your portfolio and investment accounts to mitigate risk and limit large losses. This active management style can help limit large losses in your portfolio and retirement accounts.

Evaluating, monitoring, selecting, and adjusting investments takes significant time. A financial advisor will have a professional investment philosophy and investing strategy they implement for their clients. In addition, they can help prevent you from making an emotional decision that could affect your financial future.

Emotional Decision Avoidance

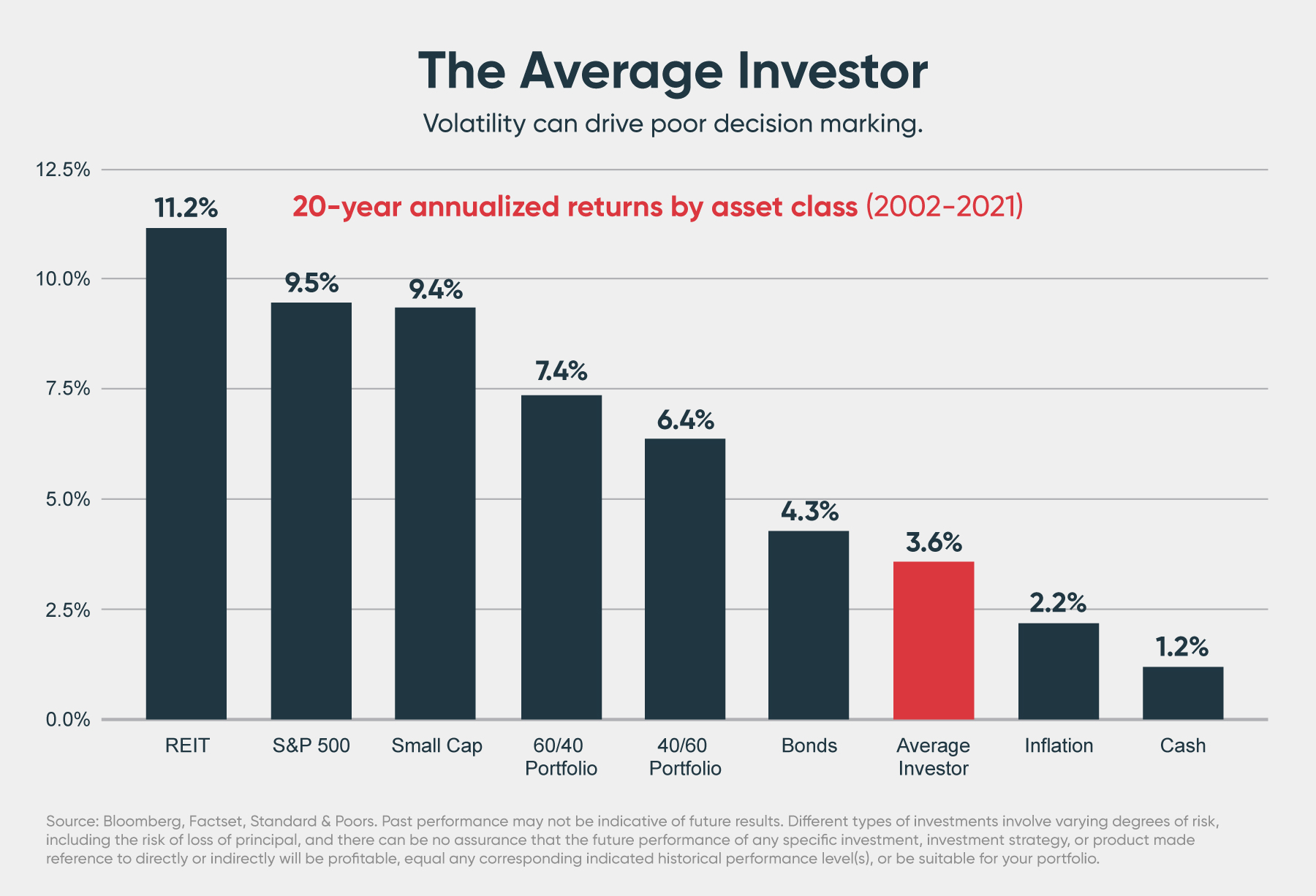

Over the long term, the average investor underperforms most asset classes, partly because of emotional decisions made due to volatility. As the chart below shows, an investor who stayed the course with a 60/40 portfolio from 2002 to 2021 would have outperformed someone who tried to manage their portfolio on their own by over 2x actively.

Multiple factors can cause emotionally driven investment behaviors and decisions. These include:

- Media reporting

- Online misinformation

- Family and friends

- Previous investment experiences

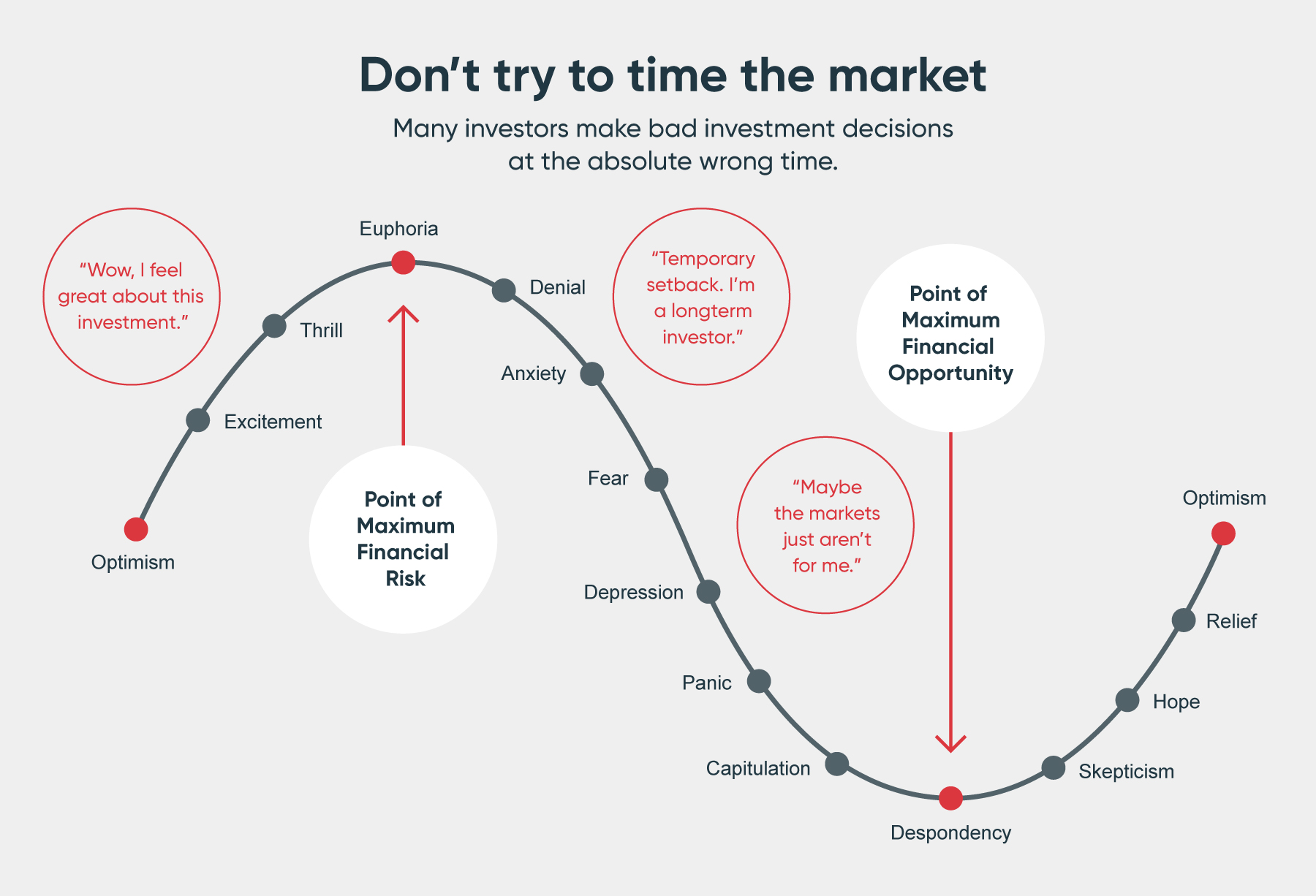

When markets are volatile, many investors make emotional decisions and start investing at the wrong time. By doing so, they end up hurting their long-term performance, such as selling at the bottom. At the same time, when markets are too upbeat, positive emotional sentiment can cause investors to buy at the top. In both cases, the emotion-driven decision sets back long-term performance and leaves you with less money for retirement.

A good financial advisor will be able to provide insights and education that help you avoid following the press, manage anxiety caused by market swings, and remove emotion from investment decisions. Avoiding these costly mistakes will improve the long-term performance of your investments and retirement plan.

Retirement Tip: Take advantage of dollar-cost averaging

Dollar-cost averaging (DCA) is an investment method used to help reduce the risk of timing a lump-sum investment. By investing a fixed dollar amount on a regular basis, the DCA process helps control the effect of market volatility by smoothing out the average cost per unit of mutual funds purchased. Over time and in certain market conditions, it could result in a lower average cost and a higher return.

While it’s important to note that DCA doesn’t always produce a higher return than lump sum investing, this systematic approach can help investors stay the course by eliminating the guesswork about when to invest.

Make Sure You Work with a Fiduciary Financial Advisor

A fiduciary has a legal responsibility to act in your best interest when offering investment advice and is held to a higher standard of care—their fiduciary duty. From selecting investments to creating an investment strategy to looking out for you and your family’s long-term financial situation, a fiduciary advisor advocates for your best interests. They take it upon themselves to stay on top of industry trends and deliver best-of-breed solutions to their clients.

A fiduciary financial advisor avoids engaging in any activity that could create a conflict of interest with any client. Should a conflict of interest arise, a fiduciary advisor will fully disclose that conflict to the client. Fiduciary advisors must avoid misleading clients and will make full and fair disclosure of all material facts (including fees) to clients and prospective clients alike.

While you may expect all advisors to act as fiduciaries, this is not the industry standard. Some advisors act more like brokers or salespeople where they receive a commission for selling a particular investment product, which puts their financial goals in conflict with yours.

Because of the lack of a conflict of interest, fee-only fiduciary advisors are best positioned to:

- Act as our fiscal coach to create a long-term personalized financial plan

- Rebalance your portfolio and investment accounts to help mitigate risk and limit large losses

- Determine the most tax-advantaged strategy for your retirement

- Help you avoid paying excess commissions to stockbrokers

- Provide insights and education that help take emotions out of investing

- Educate you on financial products and strategies that help you get better returns – without putting pressure on you to buy

- Offer advice and answers about other common retirement topics such as Social Security, estate planning, and tax planning strategies.

In all, working with a fiduciary advisor can potentially improve investment outcomes significantly—perhaps even several percentage points per year—by improving investment decisions, reducing fees, and optimizing taxes. Over time, that could amount to hundreds of thousands—if not millions—of dollars in additional retirement savings you may not have had if you’d managed your money yourself.

Then there are benefits that a dollar value cannot be placed on, like the time you save on managing your money and the peace of mind of knowing that your retirement is in good hands.

Get Started with a Free Personal Financial Advisor Consultation

We are a nationwide network of fiduciary financial advisors dedicated to helping clients achieve their retirement goals. We use our Results In Advance Planning, a comprehensive financial plan, which is a personalized and straightforward approach to financial planning that lets you see the potential results of your plan before you make a decision—not after—because we test different strategies before implementation.

Request a no-cost, no-obligation advisor consultation today!

Get StartedRegistered Investment Advisors and Investment Advisor Representatives act as fiduciaries for all of our investment management clients. We have an obligation to act in the best interests of our clients and to make full disclosure of any conflicts of interests, if any exist. Please refer to our firm brochure, the ADV 2A item 4, for additional information.

Subscribe to our newsletter to stay updated

-

Previous

Social Security Restricted Filing

-

Next

Inheriting a Roth IRA