Advantages of Market-Linked CDs:

- Growth

- Security

- Diversification

An Overview of Market-linked CDs

Over the past decade, declining interest rates and elevated market volatility have left individuals questioning how to grow their portfolios without risking their retirement. The increased demand for investments that can deliver growth potential and preserve retirement accounts has led many retirees to consider market-linked certificates of deposit, sometimes known as equity-linked CDs.

A Market-Linked CD or ‘MLCD’ is an FDIC-insured certificate of deposit (CD) that allows individuals to participate in market growth while protecting their principal investment. Upside returns are linked to the performance of an underlying asset(s), such as an equity index, stocks, currency, commodity, or even an Exchange-Traded Fund (ETF). These CDs can also be called index-linked CDs or equity-linked CDs.

Generally, MLCDs are issued in $1,000 increments, beginning at $10,000, and the funds will typically mature within one to seven years. You must hold them until maturity to obtain a return of at least your initial investment. If an investor withdraws early and redeems their investment before maturity, they may receive a return less than their original investment.

Unlike a traditional CD or conventional CD from a bank, the Market-Linked CD (MLCD) provides a return based on the return of the underlying market. The MLCD may also offer a “participation rate,” which determines how much of the underlying market return the depositor will get. For instance, a 100 percent participation rate would capture the full return of the underlying market.

While some of those features might seem limiting, consider the MLCD’s risk-reduction quality. They can protect your principal as long as the MLCD matures. So, if the market is downturned during the CD’s term, the depositor would still get their principal amount back. In this respect, the market-linked CD can allow a depositor to participate in the upside of a rallying market while protecting the depositor if the market heads south.

With a market-linked CD, the return is not known at the inception of the CD’s term, which is very different from a bank or credit union CD, where the fixed return is known. The market-linked CD can also be a term that goes far beyond a bank CD. Opening deposits and fees may also be higher.

How Do MLCDs Work?

Market-linked certificates of Deposit combine the repayment of your principal in full at maturity that you receive from traditional CDs with the potential for capital appreciation that you can receive from equities. All payments over the applicable FDIC insurance limits are subject to the issuer’s credit risk. MLCDs are designed to protect against downside market movements at maturity while providing the opportunity to participate in the gains of an underlying asset. MLCDs may offer full upside participation, leveraged upside participation, or be subject to a maximum return. Some MLCDs may also provide a contingent coupon for individuals seeking current yield. In all cases, you will forgo dividends. You will receive full principal repayment at maturity, subject to the issuer’s credit risk for amounts over the applicable insurance limits.

The components of an MLCD

A large issuing bank offers a typical MLCD and will combine two main characteristics into a single investment: a zero-coupon bond component and an options component.

The bond component

The zero-coupon bond component provides principal protection at maturity because the index’s maturing value is equivalent to the initial principal. This component is purchased at a discount to face value, and the remainder of the initial principal is invested in options. This zero-coupon bond is a debt security issued at a discount from its face or maturity value and does not pay interest or “coupons” during its life.

The options component

The options component provides the performance link to the underlying reference asset (stock market, currencies, etc). Depending on the underlying reference asset, the options component may consist of one or several options. Since options are purchased and not the underlying reference asset, no cash payments result from distributions from the underlying reference asset. This option is a derivative contract that generally provides for parties to buy or sell a referenced asset in the future at a specified price.

Examples of an MLCD

For example, suppose an investor purchases an MLCD with an initial investment of $10,000. In that case, the CD might offer acquisition characteristics of $8,000 invested in a zero-coupon obligation structured to pay $10,000 at maturity (the protection component) and $2,000 invested in an option on higher returns on the underlying asset (the growth component). In this example, the option/growth component of the CD might offer the potential for payment at maturity of the CD linked to the return of a market index or some other asset.

HYPOTHETICAL EXAMPLE

Hypothetical Market-linked CD Terms

Issuer: Citi Big Bank

Term (Maturity date): 2 years

Underlying Reference Asset: Stock Market: S&P 500

Participation Rate: 100%

Maximum Return: 20%

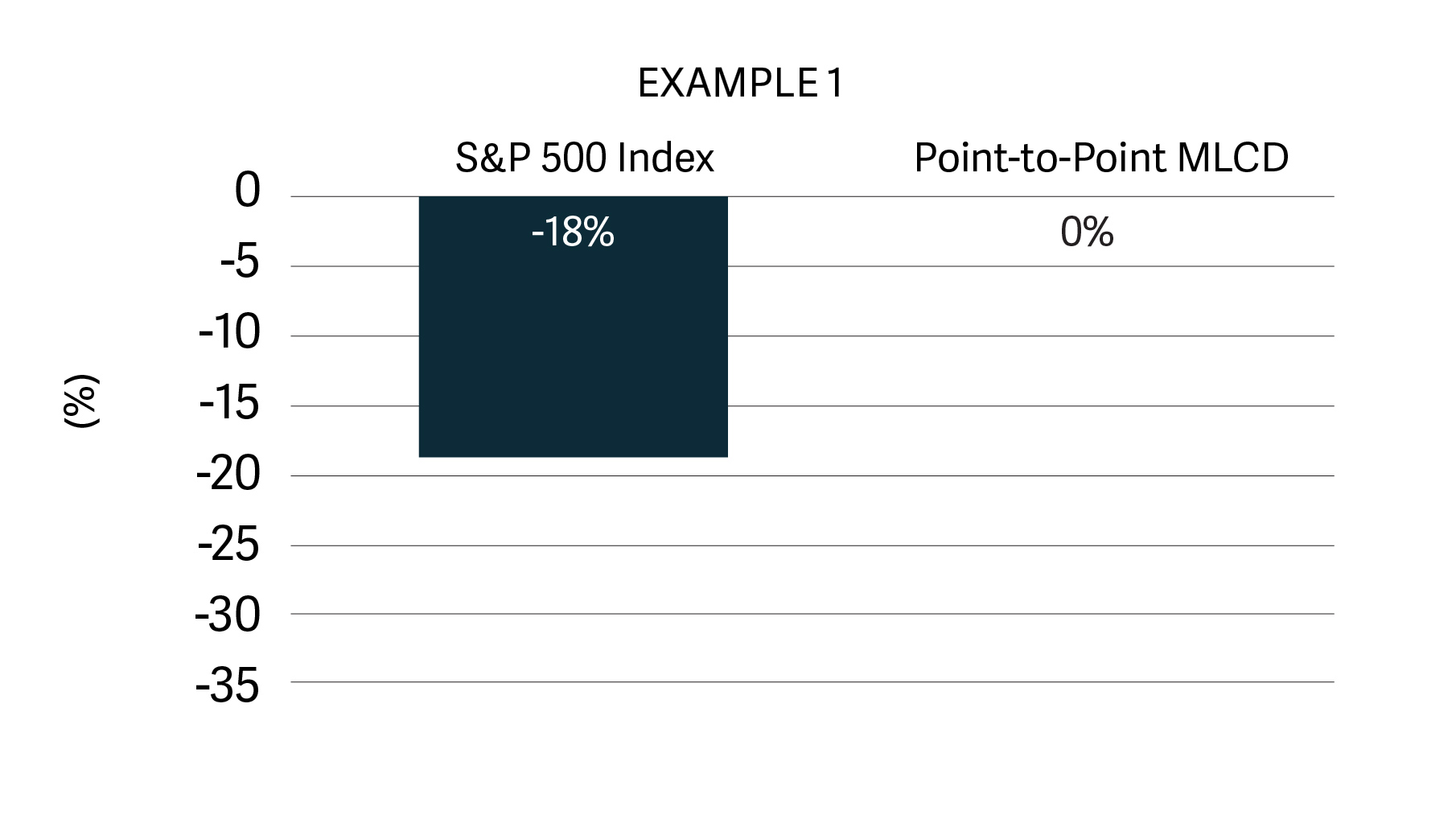

EXAMPLE 1:

The underlying index falls (the S&P 500 in this case) and has a negative return at maturity. The market-linked CD returns only the investor’s initial principal at maturity.

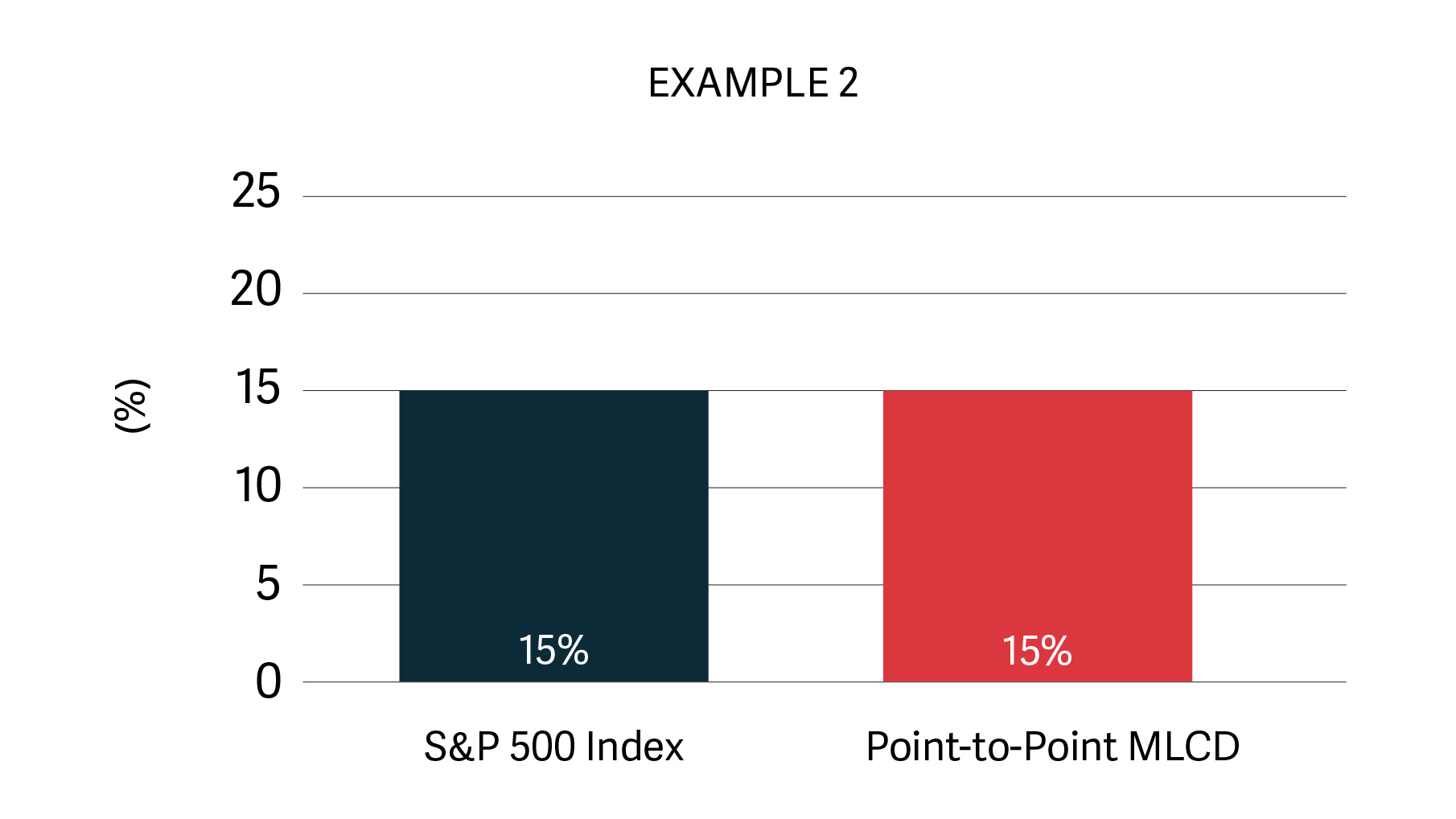

EXAMPLE 2:

The S&P 500 is up 15% at maturity. Since the participation rate is 100% in this hypothetical example, at maturity, the market-linked CD investor participates in 100% of the upside performance (15% in this example) of the underlying reference asset and the initial principal at maturity.

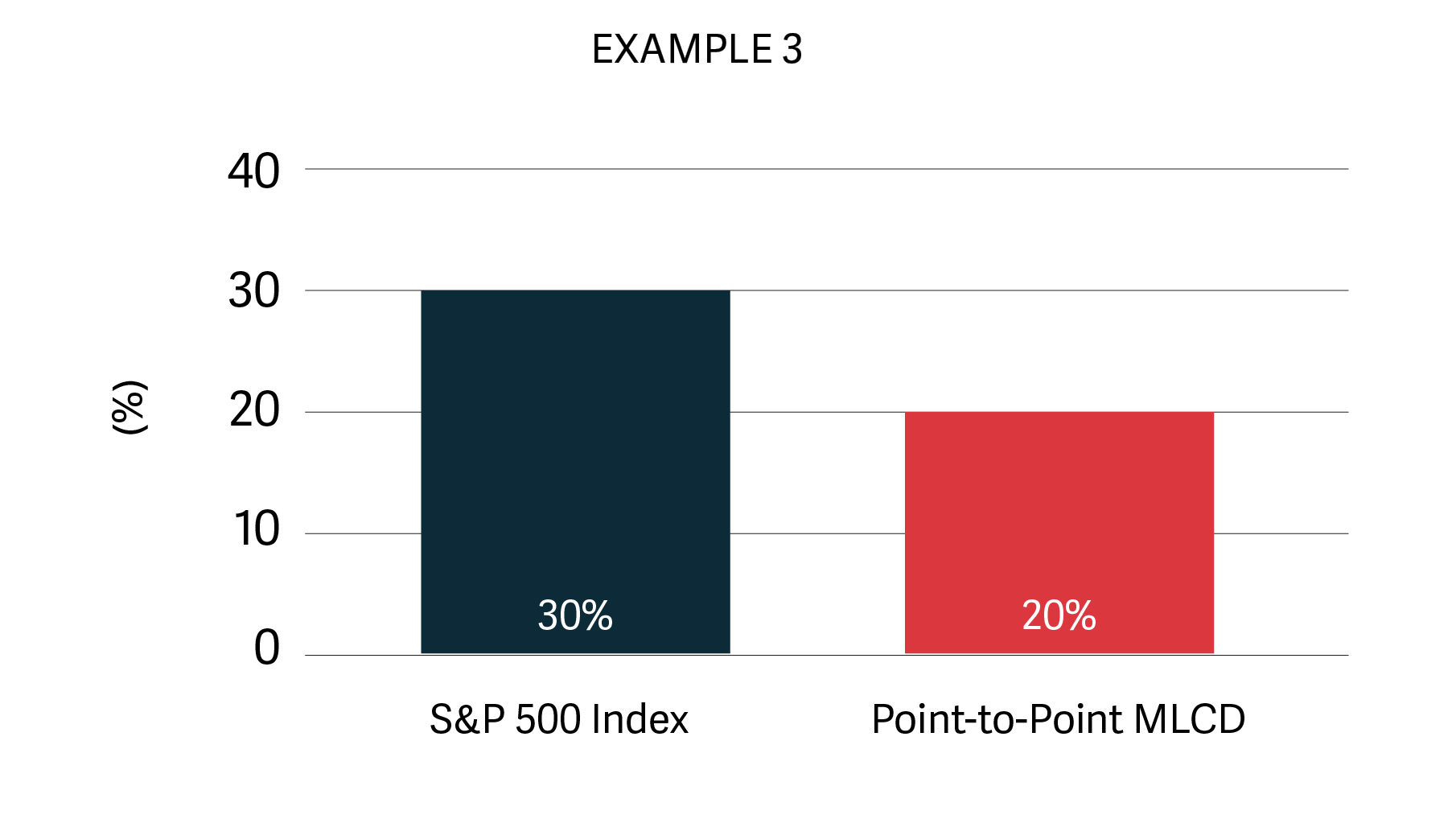

EXAMPLE 3:

The S&P 500 is up 30% at maturity. In this hypothetical example, the underlying reference asset’s performance at maturity exceeds the MLCD’s maximum return of 20%. Therefore, the investor only receives the MLCD’s maximum return (20% in this example) and the initial principal at maturity.

MLCDS Features and Benefits

Security: 100% Principal Protection & FDIC Insured

Market-linked CDs are principal-protected and backed by the issuing financial institution when held to maturity. Investors are protected from such losses if the underlying market declines over the stated period. As mentioned, MLCDs are also FDIC-insured, on principal assets only, up to the applicable limits. However, even though MLCDs are FDIC-insured, they do not protect against loss if MLCDs are sold or redeemed before maturity.

In 2023, the FDIC insurance limit increased to $250,000 per depositor, per insured bank, for each account ownership category.

Growth: Upside Market Participation

MLCDs can be linked to various underlying assets, including an equity index (e.g., the S&P 500), a basket of equities, commodities, or even currencies. The underlying asset to which a market-linked CD is tied has the potential to provide returns greater than those on traditional CDs, resulting in growth.

Estate Feature

The estate feature, also known as a “death put” or “survivor’s option,” is a benefit that may be appealing to individuals concerned about their estate because their beneficiaries can redeem the Market-Linked CD at par, without interest, before maturity upon death or adjudication of incompetence. The terms and conditions regarding redemptions, including amounts that may be available, are subject to the terms and conditions of the issuer.

Secondary Market

Some issuers may maintain a secondary market but are not obligated to do so. Investors should purchase a Market-Linked CD to hold it to maturity. Currently, there is no established secondary trading market for MLCDs, and therefore, limited opportunities, if any, to redeem before maturity. Suppose clients can redeem Market-Linked CDs before maturity. In that case, the CDs may be redeemed at less than the original amount due to fluctuations in the underlying assets and other market factors. Liquidity varies by issuer. Some may provide daily liquidity, while others allow redemptions on the secondary market on a limited basis.

Versatility

Market-linked CDs work as highly versatile instruments that can be used for growth or principal protection and may fit a variety of market outlooks. This flexible characteristic of Market-Linked CDs is reflected in the array of available performance structures. However, many MLCDs have complex payout structures that impact returns, so it’s essential to understand the components of the MLCDs. It may be best to work with a trusted financial advisor if considering them because they may not be suitable for all.

Diversification

Market-linked CDs typically expose various underlying markets, including domestic and foreign equities, commodities, and currencies. Investors may achieve several investment goals through a single purchase, such as growth potential, diversification, and capital preservation.

MLCDs Risk and Other Considerations

MLCDs should be purchased to hold them until maturity. Some MLCDs may offer an early redemption opportunity, allowing holders the option to redeem before maturity. Generally, MLCDs held to maturity are entitled to full return of the principal amount invested. A secondary market for the MLCDs may develop, although there is no guarantee that any person will maintain a secondary market. As with all investments, each market-linked CD has specific terms, risks, and unique features. Common MLCD considerations are highlighted below. Before investing, individuals should consult their financial advisors and read the applicable offering documents.

Liquidity

Market-linked CDs are generally not traded on any exchange or are rarely traded, and they can be challenging to price. Due to the lack of liquidity, the market call price of MLCDs may be significantly discounted if redeemed before the maturity date. MLCDs should be considered buy-and-hold investments. The lack of a liquid secondary market makes MLCDs inappropriate for some who cannot hold them to maturity. Learn more about illiquid assets.

Credit Risk

While MLCDs are FDIC-insured up to applicable limits, the issuer’s creditworthiness is an important consideration, particularly for MLCD investments above the insurance limits. Any amount higher than the maximum amount insured by the FDIC is an obligation of the issuer and is not insured by the FDIC.

Call Risk

The issuer may redeem some Market-Linked CDs before the scheduled first maturity date, which can adversely affect an investor’s market-linked CD’s return. An MLCD may be callable at the issuer’s option. Should the issuer exercise that option, the investor will only receive the applicable call price and will not receive any interest payments that would have been payable for the remainder of the term of the MLCD.

Tax Considerations & Treatment

Important tax considerations relate to market-linked CDs, which are both guaranteed interest due during the product’s term and at maturity. For tax purposes, a market-linked CD’s return is generally considered interest income and is typically taxed at the holder’s ordinary income tax rate.

Inflation Risk

Even with 100% principal protection, an MLCD’s maturity value may be less than the inflation-adjusted original buy-in. Learn how you can protect your retirement nest egg against inflation.

Market, Opportunity, & Participation Risk

Market volatility and other market forces can affect the asset’s value underlying the growth component, both during the term of the Market-Linked CD and at maturity, which can affect the return. In addition, most MLCDs limit participation in any appreciation of the underlying asset by capping potential returns, even if the underlying asset is linked to equities.

For example, a 90 percent participation rate would mean capturing 90 percent of the return. Also, many market-linked CDs put a cap on the return. In a bull market, if the underlying index returned 25 percent during the CD term, the issuer might cap the return at 20 percent, for example. This would be even with a 100 percent participation rate.

How can MLCDs fit into my portfolio?

Investors who understand the risks associated with market-linked CDs can complement a balanced portfolio strategy and investment objective by offering the potential to realize enhanced returns compared to traditional savings or checking accounts. Like a regular CD, MLCDs may not be suitable for every investor. Still, they can be an excellent choice for those pre-retirees or retirees looking to preserve capital and limit downside risk without sacrificing the ability to participate in upside market movements.

Risk Reduction

Market-linked CDs are often included in a portfolio to manage risk because they provide access to the growth potential of equity markets while incorporating principal protection features that may better suit your risk tolerance.

Researcher Identifies Five Major Retirement Risks. Which is the Most Serious?

Diversification

Market-linked CDs can complement your objective. You may choose market-linked CDs to gain exposure to specific market segments that can be difficult to access through more traditional instruments. These markets, such as commodities or currencies, may be more attractive when accessed through a market-linked CD with principal protection and insurance—huge emphasis on the importance of diversification.

Cash Flow

Certain market-linked CDs are designed to offer the potential for periodic payments based on the performance of the underlying markets to which it is tied.

Are MLCDs suitable for you?

An equity-linked CD can provide value and security for investors seeking potential growth while mitigating downside risk. Like all investments, integrating market-linked CDs into a portfolio requires thoughtful consideration and consultation with a trusted advisor.

When considering market-linked CDs, you should ask yourself:

- To achieve the full benefit of a market-linked CD, can I hold it to maturity, or what are the early withdrawal penalties and implications?

- Does a market-linked CD return better suit my objectives than the current interest rate available on traditional CDs?

- If purchasing in a taxable account, am I comfortable with the tax implications?

MLCDs may help individuals create growth opportunities, generate income, and protect principles. The bottom line is that those considering a market-linked CD should read the disclosure information and know any tax considerations and fees. The market-linked CD offers one more financial instrument in an overall investment strategy.

To learn about MLCDs and how to incorporate them into your portfolio, contact a fiduciary financial advisor here.