Key Takeaways:

- How can the sequence of returns risk affect your withdrawal for retirement?

- Creating a strategy to mitigate the sequence of returns risk

- How to appropriately plan for negative returns in a market downturn

What is the Sequence of Returns Risk?

Several forms of risk must be considered in investing, such as interest rate risk or stock market volatility. Still, there is also the risk of diminished investment returns. The order in which they are withdrawn can present a real and significant impact on your retirement savings. This risk is called the “sequence of returns risk,” which can cause savings to run out far before the saver’s need for them does.

Investments can often provide growth within a retirement portfolio, and other assets provide income. As funds are withdrawn, the ideal scenario is that the growth portion of a diversified portfolio will keep up with the withdrawals and replenish those funds.

If there is a prolonged downturn in those investments providing growth during the early years of retirement, sometimes referred to as the fragile decade, it could result in the funds being extinguished faster. With the lower values of the assets funding the investment portfolio, there is a need to sell more of those investments to meet retirement income needs.

When more growth investments are sold, fewer assets can generate returns in the future to offset withdrawals. When this happens early in retirement, it has a more profound impact on the overall value of the retirement portfolio and its ability to maintain sufficient funding for ongoing withdrawals in the future.

This sequence risk is a risk that investors may face in negative portfolio returns towards the end of their careers or early retirement. This is a significant concern as retirees have limited time to recover from losses, which are made even worse by the simultaneous withdrawal of income distributions. Understanding this risk and preparing accordingly is crucial to ensure a secure financial future.

Now, let’s look at two scenarios of the impact of return risk.

Examples of Sequence of Returns Risk

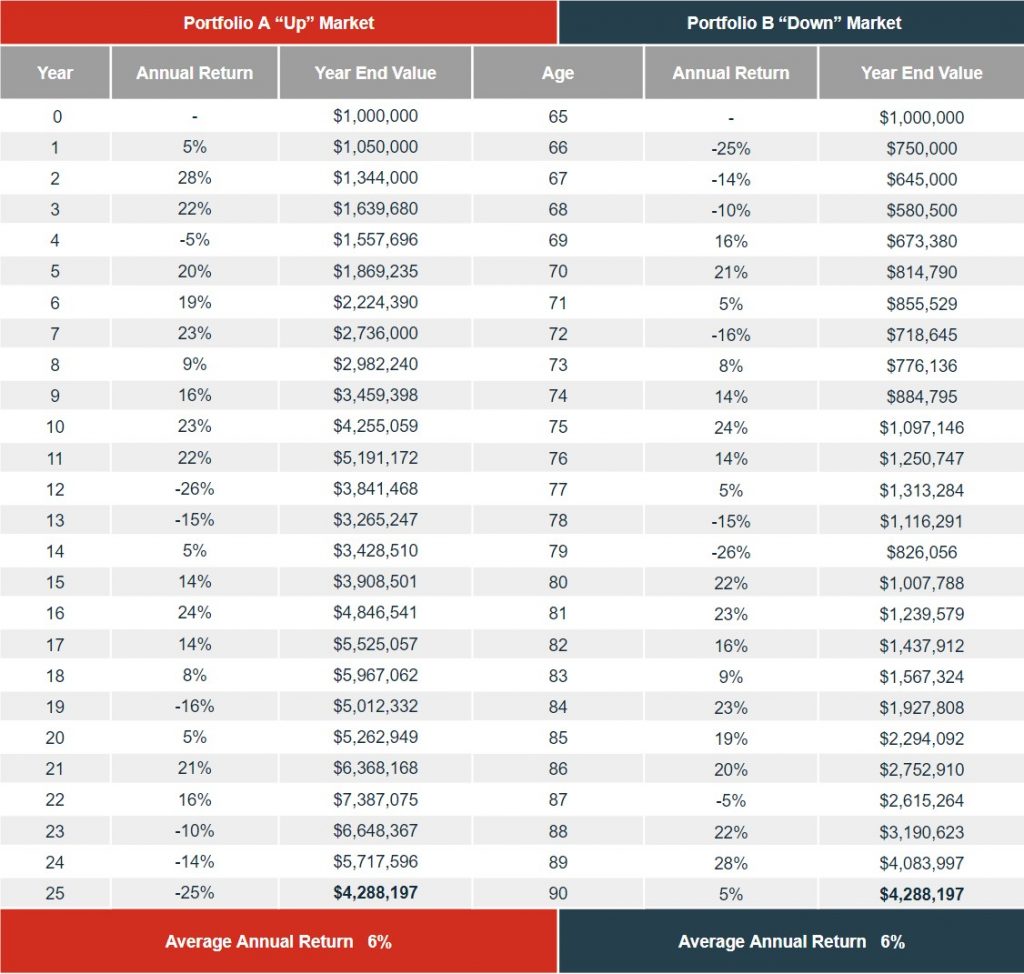

In this example, both portfolios had the same starting principal ($1,000,000) and an average return of 6% annual return that grows to the same value ($4,288,197) after 25 years. However, they experience their annual returns in inverse order from each other.

Distributions with Sequence of Returns

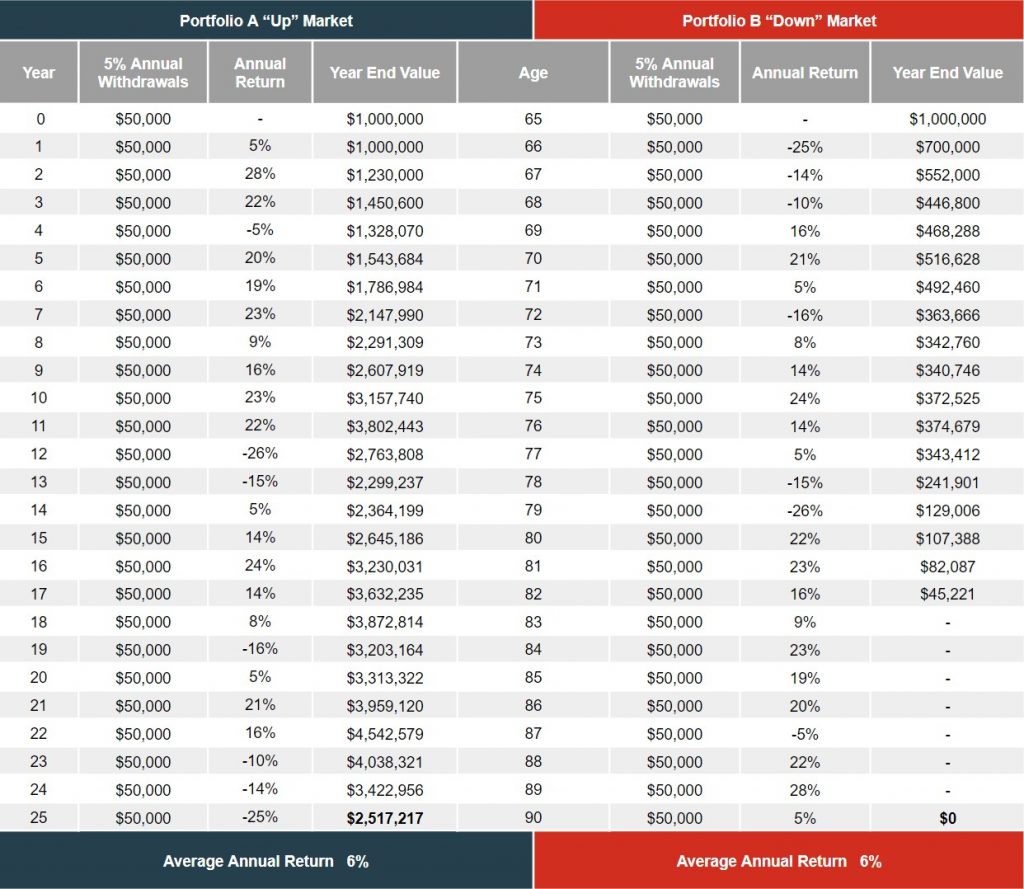

Portfolio A begins taking withdrawals during an upmarket, giving it the optimal environment to maintain its portfolio value long-term.

Portfolio B starts taking annual withdrawals in a down market and depletes the entire portfolio before age 83.

The Impact of RMDs (Required Minimum Distributions) on the Sequence of Returns

Not forgetting about your RMD – this mandatory annual withdrawal investors must make from their retirement account is essential. The amount is calculated based on your age and account balance, and not taking it could result in IRS penalties. RMD applies to account holders who are 73 or older and have a traditional IRA, SEP IRA, SIMPLE IRA, or employer-sponsored retirement plan such as a 401(k). You are not required to take RMD if you have a Roth IRA.

Therefore, knowing how and when to take distributions to mitigate sequence risk is essential since you will likely have to withdraw your retirement accounts.

Managing Sequence of Returns Risk in Your Retirement

What can an investor saving for retirement do to reduce the risk of this scenario?

Diversify Your Investment Portfolio

Diversifying your investments can mitigate the risk of the sequence of returns. Investing in a range of assets can minimize the effects of market volatility on your portfolio. Avoid putting all your eggs in one basket and reduce your exposure to the stock market over time.

Consider a phased retirement approach. By gradually adjusting your investments over time, you can protect yourself from the sequence of returns risk. This approach recommends you lower your exposure to the stock market by reducing the percentage of stocks in your portfolio with each passing year.

Use a retirement bucket strategy. A bucket strategy involves dividing your portfolio into different “buckets” of investments, each designed for a specific goal and to provide a different type of return. This simple approach divides your retirement income into short-term, mid-term, and long-term needs. Keeping these buckets filled appropriately ensures that your income needs are always met, regardless of market volatility. This can help you avoid selling at losses should you need access to funds.

Spend Conservatively And Cut Expenses

Another mitigating strategy would be to reduce expenses, postpone large expenditures, and avoid selling off investments impacted by a correction or bear market. Even a rebounding market will not compensate for withdraws in the early retirement years during a downturn.

Work With a Financial Advisor

A financial advisor can help you understand the sequence of returns risk and develop a strategy to manage it. Understanding your finances can help you create a sound retirement plan to protect your portfolio value while taking distributions and ongoing withdrawals.

Mitigating Sequence Risk with a Certified Financial Planner

Retirement planning can be a baffling task in today’s era, with the plethora of financial products and services available at our fingertips. The good news is that having a fiduciary financial advisor working by your side can make all the difference in protecting your nest egg and achieving your retirement goals and long-term returns.

In the age of automation, most large investment companies barely offer personalized guidance for individuals; hence, having a go-to advisor to answer your queries, communicate with investment companies (resulting in potential money-saving and access to unique products), and align your investment objectives to your retirement goals can help give you peace of mind.

Financial advisors often help retirees build sufficient retirement savings, create a withdrawal strategy, and estimate a retirement date that assures that the savings will last for as long as the retiree needs the funds.

Don’t run out of money in retirement. Get started with a free personal financial advisor consultation!

We are a nationwide network of fiduciary financial advisors dedicated to helping clients achieve their retirement goals. We use our Results In Advance Planning, a comprehensive financial plan, a personalized and straightforward approach to financial planning that lets you see the potential results of your retirement plan before you make a decision—not after—because we test different strategies before implementation.

Request a no-cost, no-obligation advisor consultation today!

Get Started

Sources:

Rob Berger/Benjamin Curry, “How To Understand Sequence of Returns Risk,” (2021, July 6), Forbes.com, Advisor, Retirement

“Timing Matters: Understanding Sequence of Returns Risk,” (2022, April 7), Charles Schwab, Retirement Income