What is Behavioral Finance?

Understanding How Behavioral Finance Bias Can Affect Your Investments.

Behavioral finance is a subfield of behavioral economics that highlights the impact of psychological influences and biases on the financial decisions of investors and financial practitioners. The subfield explains market anomalies, such as steep rises or falls in stock prices. Behavioral finance is not just a theoretical concept; it has practical implications for investor protection. The U.S. Securities and Exchange Commission (SEC) integrates insights from behavioral finance across its various programs to help safeguard investors. While there isn’t a specific team solely focused on behavioral finance, the SEC uses these principles to understand investor behavior, develop regulations, and conduct educational initiatives. This helps in crafting policies that consider how real-world investors often make decisions influenced by emotions and biases, rather than purely rational analysis.

Behavioral biases in finance and investing attempt to explain why investors react emotionally instead of rationally. Dozens of emotional biases may apply to investing. Let’s discuss a few more common ones that may occur during or after a market downturn.

As investors, what are the primary reasons for making your investment decisions?

Many would think:

- Market fundamentals (price-to-earnings (P/E) ratio, beta, etc..

- Systematic selection process

- Current prices, market cap, company outlooks, dividends, etc..

- Your financial goals

However, many investors make their decisions based on how they feel. Multiple factors contribute to understanding behavioral finance:

- Media influence

- Influence of friends or family

- Emotions (both optimistic and pessimistic)

- Misjudgment of information

- Previous investment experiences

Media Influence

Whether it is the financial media or local news, getting away from all the coverage seems more difficult. Whether it is fact or fiction, what is being reported influences our decisions.

Influences:

- Financial Media — CNN, CNBC, Fox Business, Bloomberg

- Internet — blogs, market commentary, social media

- Magazines

Media Influence and Banking

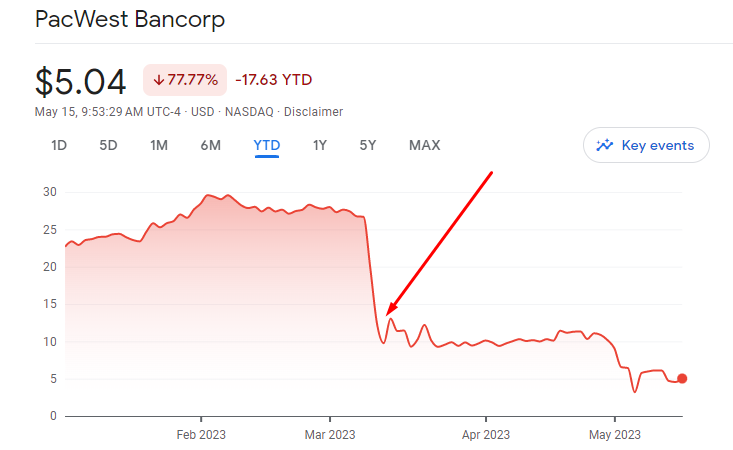

During the 2023 banking crisis, other smaller and regional banks’ stocks fell by more than 50% based on speculative reports from media outlets. The factors contributing to this decline are multifaceted and can be attributed to various market dynamics and company-specific considerations. While the financial media coverage is not the sole contributor, it does bring to light all the additional contributing factors that created a perfect storm in the American banking infrastructure. PacWest Bancorp (ticker symbol: PACW) experienced a significant decline, as pictured above in this example.

Market Volatility: The stock market may have experienced increased volatility due to macroeconomic factors, investor sentiment, or geopolitical events. Such market fluctuations can impact the stock price of individual companies.

- Economic Conditions: Broader economic conditions, such as changes in interest rates, GDP growth, or industry-specific trends, can influence the performance of financial institutions. Economic downturns or uncertainty may have affected investor confidence in the company’s prospects.

- Financial Performance: A decline in a company’s stock could reflect concerns about its financial performance. Factors such as declining revenues, increasing expenses, or underwhelming earnings reports might have impacted investor sentiment and decreased the stock price.

- Industry Challenges: The banking industry might have faced challenges, such as regulatory changes, increased competition, or shifts in consumer behavior. If investors perceived the ability to navigate these challenges as weaker than its peers, it could have contributed to the stock’s decline.

- Company-Specific Factors: Stock performance can also be influenced by factors unique to the company. These factors might include leadership changes, strategic decisions, mergers or acquisitions, or regulatory issues. Unfavorable developments in any of these areas could have adversely affected investor confidence.

Influence of Friends or Family

Everyone has probably heard, “I got a great stock tip.” With friends, family, or neighbors, topics surrounding investing, stocks, and financial decisions seem to come up.

- Do you feel comfortable taking investment advice from them?

- Have they shown to be successful at it?

- What sort of due diligence has been done on their part?

- Are they just quoting someone else or something read without thoroughly researching it?

- Do they know your risk tolerance?

Examples:

- “My neighbor told me we should be buying gold.”

- “I read an article that said another 2008 bear market is approaching.”

However, without due diligence and proper evaluation, seeking advice from financial professionals who can navigate the complex nature of retirement savings is always important.

Emotions

Without a doubt, emotions play the most significant factor in our investment decisions. To be more precise: fear and greed.

- When markets go up, investors want to be more aggressive.

- When markets go down, investors want to become more conservative.

Emotions are at the core of behavioral finance, which is a relatively new field of study that seeks to combine behavioral and cognitive psychological theory with conventional economics. Behavioral finance theories attempt to explain why people make irrational financial decisions.

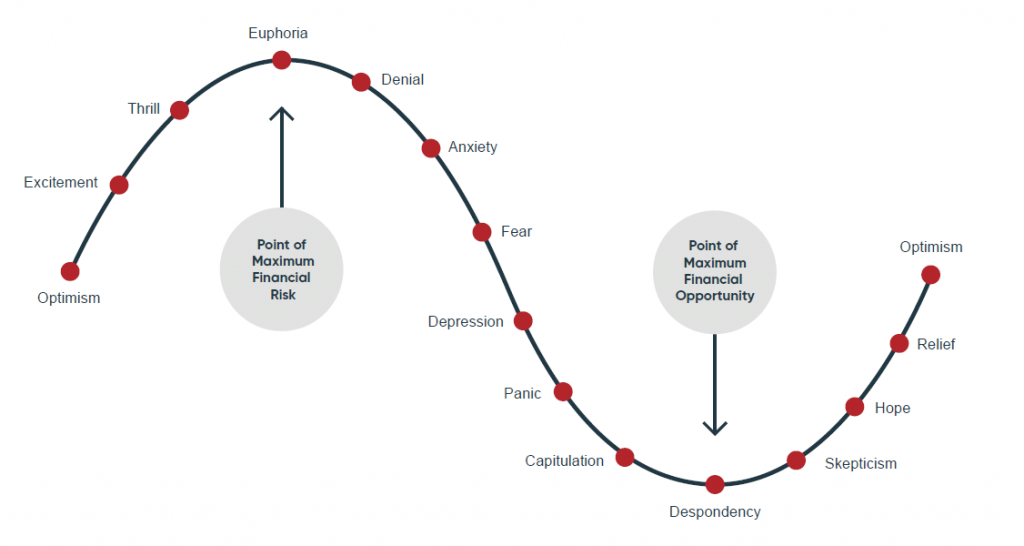

The metaphor, “Markets are like a rollercoaster,” is often true concerning investors’ emotions.

- When markets go up, investors tend to be more optimistic and willing to take more risks potentially (called chasing returns).

- When markets go down, pessimism sets in, and investors do not think their investments will recover (called panic selling).

By trying to time the market, individual investors tend to get in and out at the worst times by buying high and selling low. This often leads to poorer portfolio performance and significantly lower returns.

Investing and Behavioral Finance Concepts

We must acknowledge our susceptibility to decision-making biases: emotional and cognitive. Emotional bias relates to our feelings and influences our choices, while cognitive bias alters our thought process and interpretation of information. By being aware of these tendencies, we can avoid irrational investment decisions, which may negatively impact our portfolios.

Emotional Biases

Loss Aversion

- More sensitive to market decreases than efficient market increases.

“Studies suggest that losses are 2x as powerful, psychologically, as gains.” —Amos Tversky & Daniel Kahneman.

Research from preeminent behavioral economics and finance experts Daniel Kahneman and Amos Tversky shows that investors tend to feel the pain of financial loss far more intensely than the pleasure of financial gain of the same size.

Investors who have lived through painful market crashes may become fearful of further losses. The fear can lead to inappropriate and overly-conservative investment decisions—such as pulling all money out of the market and into a savings account.

Sure, money in an FDIC-insured bank account is safe; but it’s still not risk-free. Inflation risk—the risk of the returns you earn from a savings account not keeping up with the inflation rate—is a real possibility.

Examples:

- Every minor correction investors made to their portfolio following the market conditions downturn 2008.

“The last thing you want is a big market correction taking a chunk out of your portfolio when you’re nearing retirement or in those first few years.” says Chris Hoffman, Founder and investment Advisor Representative of Hoffman Financial Group.

- Investors hold on to losing positions too long to avoid realizing losses but are quick to sell winning positions to lock in gains.

Overconfidence

- having too much confidence in investment decisions can lead to belief in control over the market than they do.

Overconfidence can cause investors to take on too much risk, invest too heavily in a single asset, or ignore important information that contradicts their beliefs. Emotional overconfidence can also cause investors to hold onto losing positions for too long, hoping the market will eventually turn in their favor. This bias can be especially dangerous during periods of market volatility, when investors may be more likely to make impulsive decisions based on emotion rather than logic.

Examples:

- An investor makes inaccurate assumptions and estimates about their investment.

- Putting too much money into one specific stock.

Cognitive Biases

Recency bias

- Using the past to project future outcomes regardless of relevance.

Recency bias relates to our ability to recall information obtained recently more quickly than information we received further in the past.

The 11-year bull market in U.S. stocks started after the Global Financial Crisis receded. Over the last decade-plus, most investors have become accustomed to seeing only gains in their investment accounts, so much so that many have forgotten the pain of 2007 and 2008. Some even believed it would go on for even longer.

Of course, this is not (and never will be) the case. In March 2020, markets across the globe were in freefall due to the COVID-19 pandemic and trouble in the oil patch, bringing the bull market to a screeching halt. But remember: just like the good times, the bad times don’t last forever (as we saw when the market rebounded in the rest of 2020).

Examples:

- The markets increased in the past two years and will be up again.

- I got a raise the last two years, therefore, let’s move into a bigger house because I should get it again.

Confirmation Bias

- Seek out information confirming their pre-existing beliefs, biases, or opinions while ignoring information contradicting those beliefs.

This can lead to flawed investment decisions and missed opportunities. Investors may also interpret new information in a way that supports their existing beliefs, even if the evidence does not support that conclusion. In investing, confirmation bias can manifest in several ways, such as only seeking out news or research that supports a particular investment or strategy or dismissing negative information about an investment as irrelevant or incorrect. This bias can be dangerous because it can lead to a false sense of security, causing investors to overlook risks and make poor investment decisions.

Examples:

- An investor bullish on a particular stock may only seek out news and analysis confirming their positive view of the company while ignoring negative information.

- Take all new data and stretch it to work in your favor, using it to confirm your investment decision.

Anchoring

- Investors base their decisions on irrelevant figures and statistics.

- Giving certain events more merit than they deserve.

- Basing investment decisions on some previous value in the past, even when evidence suggests the data is no longer relevant.

A tendency to rely too heavily on the first piece of information, such as the purchase price of a security, when making subsequent decisions. This bias can cause investors to hold onto security even when it is no longer a good investment simply because they are anchored to the original purchase price. Alternatively, investors may sell security too quickly because they are anchored to a price target set too low or too high. As a result, anchoring bias can cause investors to miss out on potential gains or incur unnecessary losses.

Examples:

- A stock that was once worth $80/share and is now worth $40/share would be perceived as a value even though there may have been fundamental changes to the company.

- You keep investing in General Electric because it is a Blue Chip stock with a strong history, even though recent evidence shows it is slashing its dividend and earnings are deteriorating.

Home Bias

- Giving more favor to domestic investments over international investments.

- Owning stock of a local company because it is in your home state or you work there.

Familiarity with the domestic financial market, a preference for investing in local companies, and a perception of more excellent safety in domestic investments can play a part in home bias. While home bias may feel like a safe and comfortable investment strategy, it can increase risk by reducing diversification and exposure to global market trends. Investors who limit themselves to domestic investments may miss out on opportunities for growth and fail to protect their portfolios against market fluctuations.

Examples:

- Ignoring the diversification benefits of international investing only because of location.

- You own a stock of a local company only because you are familiar with where they are based.

- Employees of certain companies tend to focus heavily on the stock of the company they work for.

Herd instinct

- Make investment decisions based on what everyone else is doing rather than conducting your research and analysis.

Investors succumb to herd behavior because they fear missing out (FOMO). Instead of conducting their research and analysis, they may base their investment decisions on what everyone else is doing. The question “If everyone else jumped off a bridge, would you?” is often used to caution against the herd mentality. This can lead to irrational decisions, taking unnecessary risks, or missing out on potentially profitable opportunities.

Examples:

- Relying on social media or news headlines for investment advice.

- Following the actions of prominent investors or gurus without fully understanding their investment philosophy or strategy.

- Panic selling or buying based on short-term market fluctuations.

So, what’s the best way to avoid behavioral biases during challenging markets?

Understanding behavioral finance concepts and how they affect one’s decision-making process is necessary. Understanding our tendencies and common biases is essential for better long-term financial decisions. While it’s difficult to avoid emotional biases altogether, there are practical steps we can take to help reduce their impact.

STEPS TO REDUCE BEHAVIORAL FINANCE BIASES

- Create a plan that aligns with your long-term goals and stick with it.

- Expect market corrections and downturns.

- Work with a fiduciary financial advisor. Working with a third-party expert is a great idea. An experienced financial advisor can help you control your emotions and prevent you from making decisions out of panic or fear. Click here for a free, no-obligation appointment with one of our advisors.

Educating ourselves, thinking about our options and financial choices in a longer-term context, and creating a comprehensive financial plan, while seeking guidance from a financial advisor are all effective ways to mitigate our emotional and personal biases. By taking these steps, we can make more informed and rational decisions that help us achieve our financial goals and secure our economic future.

Request a no-cost, no-obligation advisor consultation today!

Get Started

Subscribe to our newsletter to stay updated.

-

Previous

The Spendthrift Trust

-

Next

Estate Planning for Pet Owners