Researcher Identifies Five Major Retirement Risks

What is the most serious risk to our retirement?

Retiring can be exciting, but it’s important to recognize the risks and plan accordingly. Recent research has identified five major retirement risks that retirees must address—from investments to healthcare needs. These issues are not equally concerning, so the most severe understanding can help you adjust your retirement strategy. In this blog post, we’ll look at these five risks in detail, assess their potential impact on retirement planning decisions, and offer advice on how best to manage them. Read on for a comprehensive review of the most significant retirement risk areas!

These risks encompass a diverse array of financial risks and challenges:

- Longevity: Outliving Your Money

- The US National Debt

- Social Security

- Medicare & Unplanned Healthcare Expenses

- Inflation & Market Volatility

Retirement Risk #1: Longevity

Outliving Your Money

As retirement ages trend earlier, the average life expectancy is also rising. This can be attributed to advancements in healthcare, improved nutrition, and overall healthier lifestyles. In 1940, a 65-year-old could expect to live for nearly 14 more years; today, that figure has grown to just over 20 years. This demographic shift is evident as the population of individuals aged 65 and older is projected to surge from approximately 57 million in 2021 to around 76 million by 2035. (1)

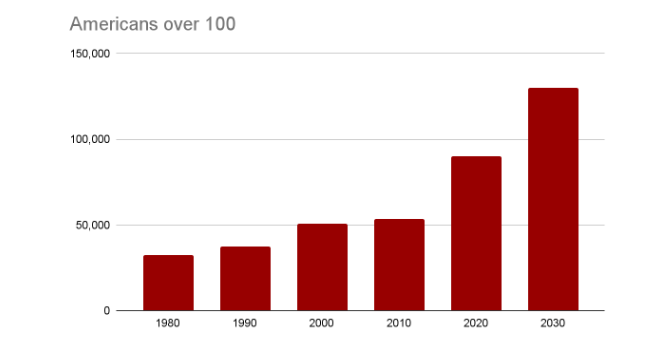

There are over 90K centurions – up from ~53k in 2010.

Living Longer Than You Planned

As per data from the U.S. Census Bureau, the count of centenarians in the United States escalated from over 53,000 in 2010 to 90,000 in 2020. It’s anticipated that by 2030, the number of centenarians in the U.S. will likely exceed 130,000.

Looking ahead, the year 2046 will mark a significant milestone as the initial batch of surviving baby boomers reaches the age of 100. This milestone will propel the growth of U.S. centenarians even further. Projections indicate that by 2060, the number of centenarians in the country will surge to over 600,000. (2)

Will you live to be 90+?

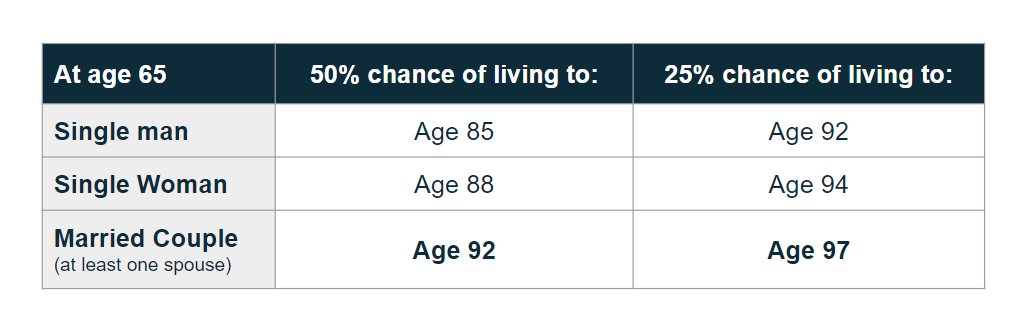

Upon reaching 65, individuals face varying probabilities of life expectancy. For a single man, there’s a 50% chance of living to age 85 and a 25% chance of reaching 92. On the other hand, a single woman has a 50% chance of living to 88 and a 25% chance of getting to 94.

The dynamics of longevity risk shift slightly for a married couple, where at least one spouse is present. The chances of one spouse reaching 92 are 50%, and the probability of hitting 97 is 25% (3). These figures highlight the diverse range of potential lifespans individuals and couples might encounter as they navigate retirement.

How to Prepare Your Money to Outlive Your Life Expectancy

What strategies can you employ to counter the extra costs of an extended lifespan?

- Consider trimming your budget and reducing living expenses

- Adjust your investment strategy and plans accordingly

- Extend your working years beyond your initial plan

Retirement Risk #2: The US National Debt

The US National Debt, encompassing the cumulative impact of budget deficits, has surged significantly over the past 15 years, tripling in magnitude. Presently standing at an astonishing figure of over 31 trillion dollars, this mounting debt highlights a concerning trend. The absence of a budget surplus since 2001 has contributed to this escalating financial burden, underlining the challenge of reining the nation’s financial obligations. Addressing this issue becomes increasingly vital to ensure the country’s long-term economic stability and sustainability.

How much is the federal budget?

- Defense Budget Expenses: This signifies the segment of the national budget directed towards military-related outlays. The U.S. Defense Budget 2021 designates a substantial $752 billion for such expenditures.

- Social Security Program and Disability Pensions: Geared towards offering financial stability to retirees and individuals with disabilities, the cumulative outlay for Social Security and related expenses amounts to approximately $1.2 trillion.

- Medicare/Medicaid and Other Healthcare Programs: Collectively, healthcare benefit programs, encompassing Medicare and Medicaid, receive a designated budget of $1.4 trillion.

- Other Miscellaneous Expenses: These encompass a range of categories, including transportation infrastructure development, comprehensive veterans’ benefits and support, international affairs engagements, and the funding of public education initiatives.

These categories add up to a robust 6.3 Trillion dollars for fiscal year 2022. (4)

National Debt Potential Solutions

To address the existing national debt, a viable approach involves generating a surplus, achievable through either of the following avenues:

- Increasing revenue by adjusting taxation

- Implementing prudent budget reductions across various expenditure categories

Retirement Risk #3: Social Security

The Social Security Board of Trustees 2021 annual report shows that the cash reserves of Social Security are projected to be exhausted by 2034, a year sooner than their 2020 report had predicted. After that, it’s anticipated that annual taxes will only be sufficient to cover approximately 76% of the annual benefits.

Will Baby Boomers Bankrupt Social Security?

The baby boomer generation, a significant demographic that emerged during the 1960s and 1970s, was born between 1946 and 1964. This expansive group started turning 62 in 2008. As we look ahead to 2031, the youngest boomers will have surpassed the full retirement age for Social Security, set at 67 for those born in 1960 or later. This milestone will coincide with a population of 75 million individuals aged 65 and above—almost double that of 39 million seniors in 2008. (4)

Social Security Funds

As of 2020, retirement assets in the trust funds supporting retirees and individuals with disabilities were nearly $2.9 trillion. These funds are divided into two main categories: the Federal Old-Age and Survivors Insurance (OASI) trust fund, and the Federal Disability Insurance (DI) trust fund. Together, they are collectively referred to as OASDI. (5)

How Social Security Works

Three distinct sources of income support Social Security’s financial foundation. These include payroll taxes, interest generated from surplus funds held by the Treasury and taxes levied on benefits received by current beneficiaries.

The primary funding stream for the trust funds is derived from payroll taxes, with employees and employers contributing 6.2% of their earnings, up to the taxable maximum set at $160,200 for the year 2023. Approximately 90% of Social Security funding originates from these payroll taxes. The remaining funds are obtained through the interest earned on the fund’s securities and taxes imposed on benefits. (6)

In 1945, there were 41.9 workers per Social Security beneficiary.

Social Security Trust Fund

At present, approximately 2.7 workers are supporting each beneficiary. However, by 2035, this ratio will decline to about 2.3 workers per beneficiary. Meanwhile, life expectancy has increased, leading to longer benefit durations.

As the baby boomer generation enters retirement, the number of benefit recipients will significantly rise, while the tax-paying population will represent a smaller portion of society. The Social Security Trust fund is anticipated to cover scheduled benefits until around 2034. Beyond that, the fund is projected to have the capacity to provide only 76% of the planned benefits, with ongoing tax revenues. (7)

Depletion of Social Security

The evolving demographics pose a challenge as there’s a potential for the system to face a shortage of funds, given the possibility of insufficient inflow compared to outflow. As long as employees contribute taxes, funds will be available for disbursing benefits.

Yet, the imbalance arising from a smaller workforce contributing and a larger beneficiary pool receiving benefits might result in reduced payouts unless Congress takes proactive measures to restore the fund’s resources before that point.

Potential Social Security Solutions

Raise the full retirement age for Social Security benefits: In the upcoming years, the full retirement age is set to increase to 67 for individuals born in 1960 and beyond. Discussions suggest that it could be raised to 69 or even 70, considering the considerable extension in lifespans compared to the inception of Social Security.

Raise the payroll tax rate to 15.08%: This proposal would increase the combined tax rate of 12.4% by 2.68%. Both employers and employees would contribute 7.54% each, as opposed to the current 6.2%.

Raise or eliminate the payroll tax cap: The threshold at which Social Security taxes must be paid is $147,000 in 2022, adjusted annually for inflation. Removing or raising the cap on payroll taxes could significantly enhance Social Security funding.

Our aim is not to provide a definitive solution to the Social Security depletion issue but to present potential strategies to navigate its potential challenges. The resolution for the long-term funding concern of Social Security might entail a combination of approaches, such as adjusting Social Security taxes upward, considering adjustments to benefit levels, and aligning the retirement age with the growing life expectancy. (8)

Find out more about Social Security here.

Retirement Risk #4: Medicare & Unplanned Healthcare Expenses

Viewing the payment of anticipated and unforeseen healthcare and medical costs as a fundamental necessity is crucial. Here are vital factors:

- Understanding the coverage and expenses linked to Medicare Parts A, B, C, and D

- Taking into account out-of-pocket healthcare charges not encompassed by Medicare, like premiums, deductibles, copays, as well as hearing, dental, and vision expenditures

- Evaluating the possibility of requiring long-term care

It’s projected that Medicare will only account for approximately 60% of retirement medical expenses. According to the Center for Retirement Research, couples aged 65 and above typically incur an average annual expenditure of around $7,600 on Medicare premiums and copays. (9)

Medicare Coverage

When it comes to Medicare offers a comprehensive framework for healthcare coverage during retirement, with various parts addressing specific needs. Medicare Part A ensures fundamental hospitalization coverage, while Part B extends range to outpatient care, encompassing doctor’s visits and diagnostic tests.

Medicare Part C, also known as Medicare Advantage, is a private alternative that combines Part A and Part B coverage while providing extra benefits. Part D, on the other hand, focuses on prescription drug coverage.

For those seeking additional support, Medicare supplement plans, or Medigap, offer private insurance solutions to help mitigate out-of-pocket expenses such as copays, coinsurance, and deductibles. This diversified approach allows retirees to tailor their healthcare coverage to their needs.

Despite its extensive coverage, there are certain healthcare aspects that Medicare does not include. Dental care, eye exams, hearing aids, acupuncture, and cosmetic surgeries are not covered by original Medicare. Long-term care is not part of Medicare’s coverage. If you anticipate a need for long-term care for yourself or a family member, exploring a separate long-term care insurance policy is advisable to ensure comprehensive support for health care expenses.

Medicare Part A

Medicare Part A covers short stays at a Skilled Nursing Facility (SNF). Here is the breakdown of covered costs depending on the length of stay:

- Days 1 through 20: Part A pays the entire cost of any covered services

- Days 21 through 100: Part A pays for all covered services, but you’re now responsible for a daily coinsurance payment

- After 100 days: Part A pays nothing. You’re accountable for the entire cost of SNF services.

Medicare Part A provides comprehensive coverage for most hospice care expenses, although minor copays might apply for respite care, medical bills, or prescriptions. Remember that Medicare does not cover room and board costs during hospice care. Custodial care, which involves aid with daily activities such as eating, dressing, and personal hygiene, is not covered either. This type of care is a significant aspect of services offered in nursing homes and assisted living facilities. (10)

Long Term Care

Statistically, current 65-year-olds face a substantial 70% likelihood of requiring long-term care assistance at some juncture. Among this group, about 69% may need such services for three years, while a notable 20% could require assistance for five years or more.

It’s important to note that typical health insurance plans do not encompass long-term care provisions. This applies to both employer-provided health coverage and federal healthcare programs like Medicare. While Original Medicare doesn’t incorporate long-term care coverage, it might cover up to 100 days of skilled nursing services or rehabilitation in a nursing facility. Beyond this timeframe, beneficiaries are responsible for the entire cost of long-term care services. (11)

Long-Term Care Insurance

Without long-term care insurance, annual Long Term Care costs in 2020 range from $93,075 to $105,850 for care in a nursing home, $53,768 for homemaker services, $54,912 for a home health aide, $51,600 for the health care costs an assisted living facility, and $19,240 for adult day health care. The national average costs for long-term care in 2020 are as follows:

- Nursing homes: $255 per day or $7,756 per month for a semi-private room; $293 per day or $8,821 per month for a private room

- One-bedroom unit in an assisted living facility: $141 per day or $4,300 per month

- Home health aide: $150 per day ($24 hourly) or $4,576 per month (12)

Retirement Risk #5: Inflation & Market Volatility

Inflation is the gradual increase in the cost of goods and services over time. Various factors, such as food, medical expenses, transportation, and housing, contribute differently to the overall inflation rate.

For retirees, inflation, measured explicitly by CPI-E, can have slightly different implications due to the elevated costs and inflation associated with healthcare and housing. While planning for retirement longevity is crucial, it’s equally important to account for the influence of inflation on your ongoing living expenses.

How Inflation Affects Your Retirement

As time passes, inflation will gradually diminish your purchasing power. This could lead to a widening “income gap” over the years, mainly if you rely on a fixed income. Consider whether your investments will experience sufficient growth in your retirement income to match the effects of inflation.

Learn more: Inflation, Stagflation, and Your Retirement.

Retirement Risks

Planning for retirement can be complex. Longer lifespans than anticipated, the uncertainty behind potential changes to Social Security, potential gaps in Medicare coverage, inflation that continues to devalue your savings, and an ever-changing economic landscape with issues such as the national debt, cybersecurity risks, pandemics, and geopolitical tensions all pose significant threats to retirees’ financial stability.

While planning for all these variables in advance can be challenging, retirees must take a comprehensive approach when assessing their retirement plans and goals. Considering both current economic conditions and future trends as part of a rational approach allows you to make educated decisions regarding your retirement.

Don’t hesitate to get professional guidance from a fiduciary financial advisor when determining what works best for you and your retirement goals. You can make plenty of intelligent moves now to help secure your financial security later!

Request a no-cost, no-obligation advisor consultation today!

Get StartedSources:

1. ssa.gov/news/press/factsheets/basicfact-alt.pdf

2. US Census Bureau and Dudley Poston, Texas, A&M University

3. Annuity Mortality Table, Society of Actuaries

4. https://www.investopedia.com/articles/personal-finance/022516/will-baby-boomers-bankrupt-social-security.asp

5. https://www.investopedia.com/ask/answers/110614/how-social-security-trust-fund-invested.asp

6. Social Security Administration: Social Security History

7. http://ssa.gov/news/press/factsheets/basicfact-alt.pdf

8. http://investopedia.com/articles/personal-finance/022516/will-baby-boomers-bankrupt-social-security.asp

9. Employee Benefits Research Institute. Center for Retirement Research

10. http://healthline.com/health/medicare/does-medicare-cover-long-term-care#eligibility

11. LongTermCare.gov How Much Care Will You Need?

12. Cost of Care Survey: https://www.genworth.com/aging-and-you/finances/cost-of-care.html