Understanding and Preparing for Market Volatility

Regarding investing, one golden rule holds without fail: the market strongly dislikes uncertainty.

The internet has allowed us to stay informed about global events every hour, every day, throughout the year. This continuous news stream frequently brings unexpected and unwelcome surprises beyond our control. It’s almost unavoidable to experience emotional reactions in such situations. Particularly, when the unfortunate news pertains to financial markets, it becomes even more challenging to overlook, given that nobody enjoys losing money.

The Bear Market

Market volatility, often called the ups and downs of the stock market, plays a significant role in investing and trading. Grasping Market volatility isn’t just for financial experts—it’s a skill that can benefit anyone looking to make informed decisions about their money.

In this blog, we’ll define market volatility, explore its causes and effects, and equip you with strategies to navigate turbulent financial waters during high market volatility. So, whether you’re a seasoned investor or just starting your financial journey, join us as we unravel the mysteries of market volatility, a topic crucial for safeguarding your financial future.

What is Market Volatility?

What exactly is market volatility, and a stock’s volatility? Why should investors and traders care?

Market volatility refers to the fluctuations in market indexes or changes in the prices of financial assets like stocks, bonds, or commodities within a certain period. In simpler terms, it’s the roller-coaster ride your investments take as their values go up and down.

Understanding market volatility is crucial for investors and traders because it directly impacts their investments’ risk and potential return. When markets are highly volatile, the potential for both significant gains and losses increases for market participants.

Market Volatility and Stock Prices

The stock market and prices are closely intertwined with market volatility. Let’s consider a hypothetical scenario. Company XYZ’s stock is known for its steady performance, steadily increasing. However, the stock market reacts swiftly when unexpected economic news or geopolitical events hit the headlines. The stock price of Company XYZ might experience sharp declines due to the heightened uncertainty, reflecting the fear index and the increased market volatility.

Moreover, market volatility can make predicting future market price movements more difficult. For instance, if market volatility is low, investors may assume that prices will remain relatively stable, leading them to make investment decisions based on this expectation. However, with high volatility, sudden market shocks can disrupt these assumptions and cause significant price swings.

Conversely, investors may become wary when the market or volatility index is high, fearing further price fluctuations. This fear can lead to selling pressure, causing stock prices to plummet further. It’s a cycle where market volatility influences investor sentiment and stock prices, and stock prices, in turn, affect market volatility.

Strategies for Dealing with Stock Market Volatility

Your #1 goal in investing is to protect investments above all else.

Now that we’ve uncovered the essence of market volatility let’s explore some practical strategies to handle it effectively. The first key approach to the bear market is risk management techniques. These involve setting limits on the amount of capital you’re willing to risk on any single investment, which can help protect your portfolio from significant losses during turbulent and volatile market times.

Limit Large Drawdowns

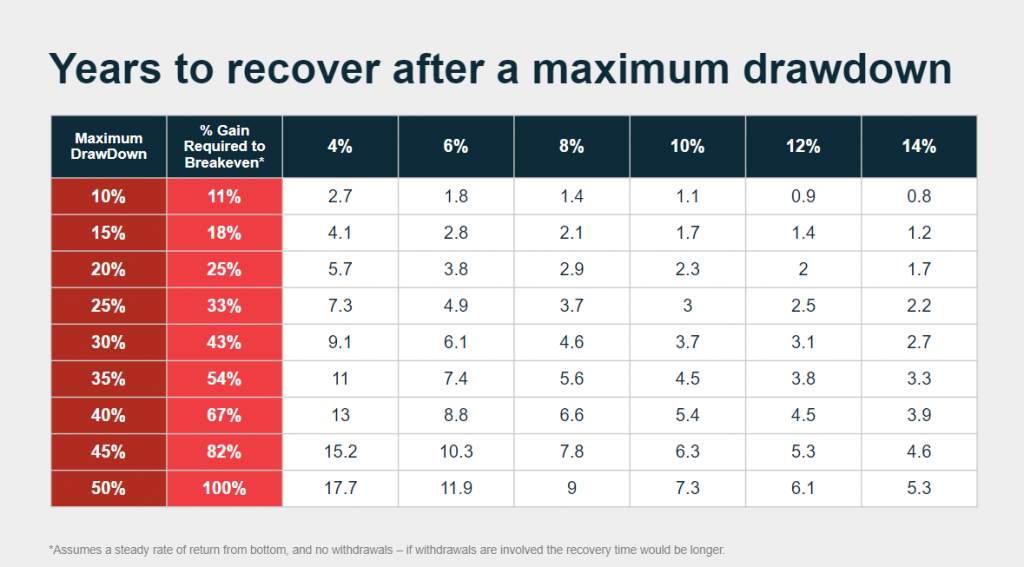

While maximum drawdowns don’t happen often, they can profoundly impact your portfolio. Rebounding from such downturns usually takes several years to reach the pre-crash portfolio value. The above graph illustrates the relationship between the Maximum Drawdown (expressed as a percentage) and the Percentage Gain Required to break even after experiencing these drawdowns.

For instance, if your portfolio suffered a 20% maximum drawdown, you would need a 25% gain to recover your initial value. As the maximum drawdown increases, the percentage gain required for recovery rises significantly. This emphasizes the importance of managing risk, as larger drawdowns and higher volatility will necessitate even more substantial gains to get back to where you started. Understanding this relationship is crucial for investors to make informed decisions and mitigate potential portfolio losses.

LEARN MORE ABOUT DRAWDOWNS HERE.

Why Do Volatility and Drawdowns Matter to Retirees?

In retirement, you rely on your accumulated assets to provide a steady income stream to support your lifestyle. High volatility, marked by significant price fluctuations in your investments, can lead to unexpected losses, eroding the value of your portfolio.

Drawdowns, on the other hand, represent the peak-to-trough decline in your investment’s value. These drawdowns can be especially concerning when they occur early in retirement, as they force retirees to sell assets at reduced values to cover their income needs, potentially depleting their savings faster than anticipated. Understanding the implications of volatility and drawdowns when taking withdrawals is essential for retirees to make informed financial decisions and ensure a secure and lasting retirement.

Understanding Sequence of Returns Risk

Some assets are geared for growth in a well-balanced retirement portfolio, while others provide income. The ideal scenario is that the growth-oriented portion of your portfolio keeps pace with your withdrawals, replenishing your funds as needed.

However, during the early retirement years, sometimes called the “fragile decade,” a prolonged downturn in growth-oriented investments can deplete your funds faster. The lower asset values mean you must sell more of these investments to cover your retirement income needs.

Selling more growth-oriented investments early leaves fewer assets to generate future returns, making it challenging to offset future withdrawals. When this occurs in the initial stages of retirement, it can profoundly impact your overall retirement portfolio’s value and ability to sustain your future income needs.

Sequence risk is particularly concerning as it can lead to negative portfolio returns towards the end of your career or early retirement when you have limited time to recover from losses, especially when coupled with simultaneous income withdrawals.

LEARN MORE ABOUT THE SEQUENCE OF RETURNS RISK HERE.

Hierarchy of Investing Principles

Recognizing the hierarchy of investing as a fundamental retirement success principle is important for ensuring your financial future with clarity and confidence.

Above all else, your time horizon takes precedence, significantly influencing how long your money lasts and when you can retire. Next is allocating your assets, which holds more sway than your specific investments.

Managing the mix among different asset classes is also key, as it directly affects your risk capacity and overall portfolio performance. Additionally, don’t overlook the significance of considering sub-asset classes within your investment strategy. By following this hierarchy and paying attention to these principles, you can make informed decisions to secure a prosperous retirement.

Portfolio Performance

The Asset Allocation (AA) decision is important in portfolio performance, accounting for over 90% of the outcomes. To put it in perspective, think of your investment portfolio as a pie. How you slice that pie, allocating different portions to various asset classes, has a far more significant impact on future market volatility and your returns than trying to time the market or picking individual investments.

Let’s say you have two investors, A and B stock with a beta each, each with $100,000 to invest. Investor A carefully diversifies their portfolio across various asset classes, while Investor B focuses on trying to time the market or picking the hottest stocks. Over time, Investor A’s diversified approach tends to deliver more consistent returns, while Investor B’s performance may be more erratic due to market timing and stock selection challenges.

In the long run, investors prioritizing asset allocation tend to have a smoother and more successful investment journey, as their investing strategy is built on the solid foundation of spreading risk and capturing market growth opportunities across the broader market and different asset classes. So, while market timing and security selection may grab headlines, the Asset Allocation decision should be at the forefront of your investment strategy.

How to Be Prepared for Stock Market Volatility

Market volatility is a dynamic force that profoundly impacts investors and their portfolios. As we’ve explored, grasping this phenomenon is crucial for making well-informed financial decisions and ensuring the security of your financial future. The connection between market volatility and stock market prices runs deep, and recognizing this relationship can empower investors to navigate the broader market’s fluctuations more effectively.

In your journey as an investor, it’s vital to acknowledge that market volatility is an inherent part of the financial landscape. However, this doesn’t mean it should be feared; consider it an opportunity. You can harness market volatility to your advantage with the right knowledge and strategies. Staying informed, maintaining a diversified portfolio, and remaining committed to your long-term financial goals are the pathways to a successful and bountiful retirement.

Partnering with a skilled financial advisor can be fantastic, particularly in volatile markets. A financial advisor can provide valuable insights, offer personalized strategies, and help you make sound decisions that align with your unique financial objectives. Their expertise and guidance can be crucial in navigating the ever-changing world of investing, allowing you to secure a brighter financial future for yourself and your loved ones.