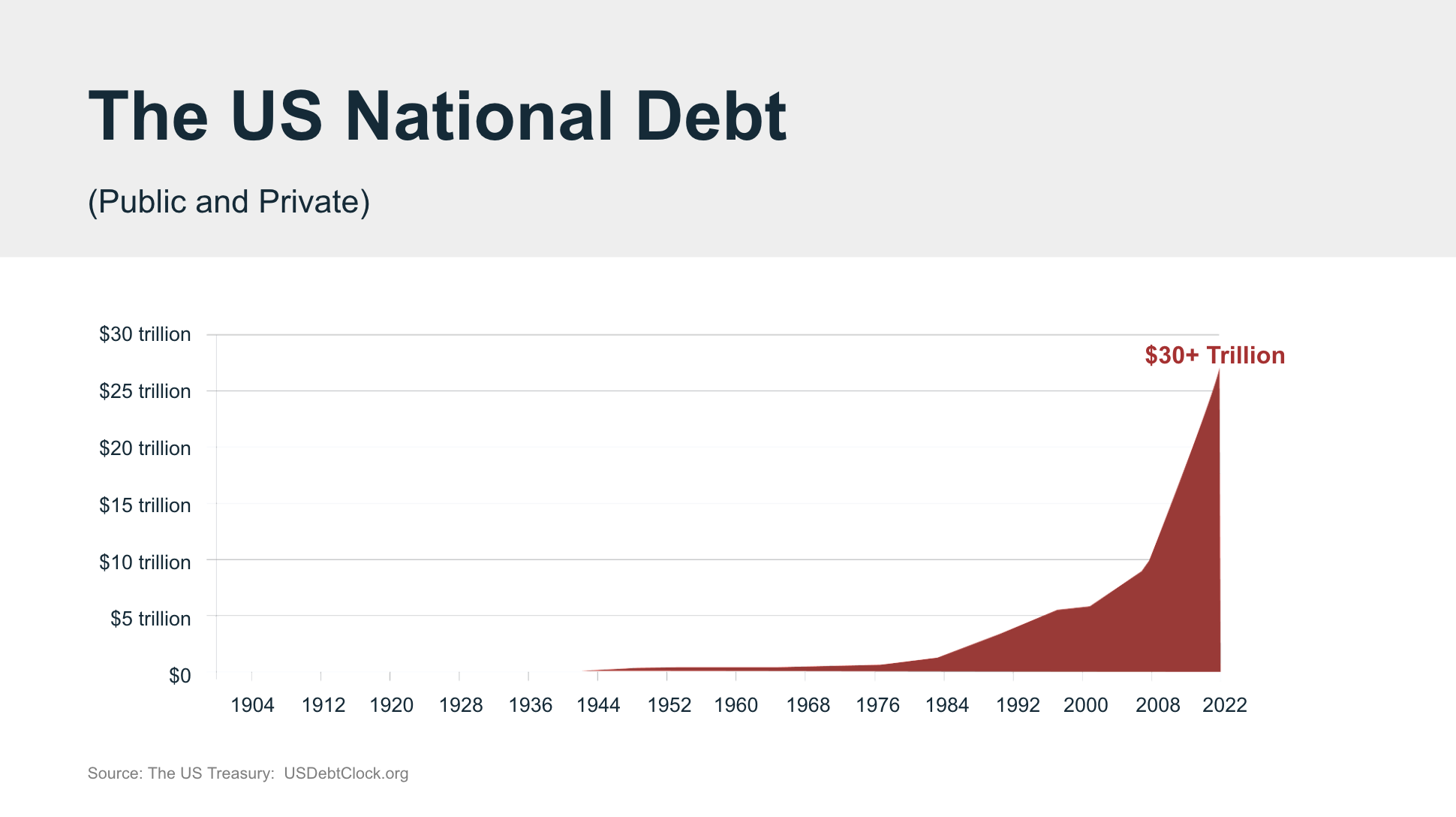

The United States’ national debt is the sum of all outstanding debt obligations incurred by the federal government. It has been growing steadily and rapidly for decades, and it is currently estimated to be over $31.6 trillion dollars.

For perspective, the debt-to-GDP ratio is 123%, which means the debt is now larger than the entire U.S. economy. The debt jumped substantially in recent years following the passage of several large stimulus bills in response to the COVID-19 pandemic, aggravating concerns that have been growing for years, and the issue has increasingly been a topic of political and economic debate.

Additionally, with interest rates rising, interest payments on the debt are growing as well, costing taxpayers billions of dollars annually. As the national debt grows and the interest payments increase, their potential impact on the economy becomes a more pressing concern.

Critics argue that the national debt has serious long-term effects on the economy as a whole. As the debt grows, the government is forced to borrow more money to finance its debt obligations, which can lead to increasing borrowing costs, inflation, and a weaker financial position. While some argue that the national debt is not an issue and that the government can continue to borrow indefinitely, others believe it is essential for the government to address the growing debt before it becomes unmanageable.

What is the Debt Ceiling?

The total amount the US government can borrow isn’t unlimited, however. It’s set by congress and is known as the debt ceiling. This is the legal limit on the maximum amount of borrowing that the U.S. government is allowed to do (not unlike the credit limit on a credit card). First created in 1917 to regulate government spending and increase fiscal accountability, the debt ceiling is set by congress and has been raised nearly 80 times since 1960.

If the U.S. government’s debt hits the cap, the U.S. Treasury becomes unable to borrow, putting the government at risk of running out of money. Should the Treasury be unable to make interest payments to Treasury bond holders – or meet other obligations – it would cause the government to default on its debt, take a credit rating hit, and potentially trigger many other financial consequences.

Politicians on both sides of the aisle have debated the benefits and drawbacks of the debt ceiling, with some arguing that it serves as a necessary tool to control spending and others arguing that it creates unnecessary economic instability.

What Are the Risks to Retirees?

The national debt level and associated debt ceiling challenges create certain risks for retirees and retirement investors.

Short-term risks arise when the debt level approaches the debt ceiling as that begins the political process to get it raised. While congress has always raised the debt ceiling in the past, there have been some close calls in recent years. Should the U.S. default on its debt, the market would likely react negatively or even crash, causing billions in retirement savings to evaporate as a result. The credit rating downgrade that is sure to follow would only increase borrowing costs, causing a slowdown of economic activity in general.

However, the government’s credit rating could also be downgraded for borrowing too much, as happened in 2011, when S&P downgraded the U.S.’ debt from AAA to AA+ shortly following a debt ceiling increase.

As debt servicing costs increase, the amount of money available to pay for other budget items decreases – or borrowing must increase further to compensate. If the government ever wanted to get serious about reducing the size of the national debt, there are only two options: reduce spending or increase taxes. Neither option is particularly popular with voters and both would have their own economic consequences. But potential tax hikes in the future are the bigger risk for retirees, who would then have less money left to live on – especially if the market experiences a decline at the same time.

What Spending Would Be Cut?

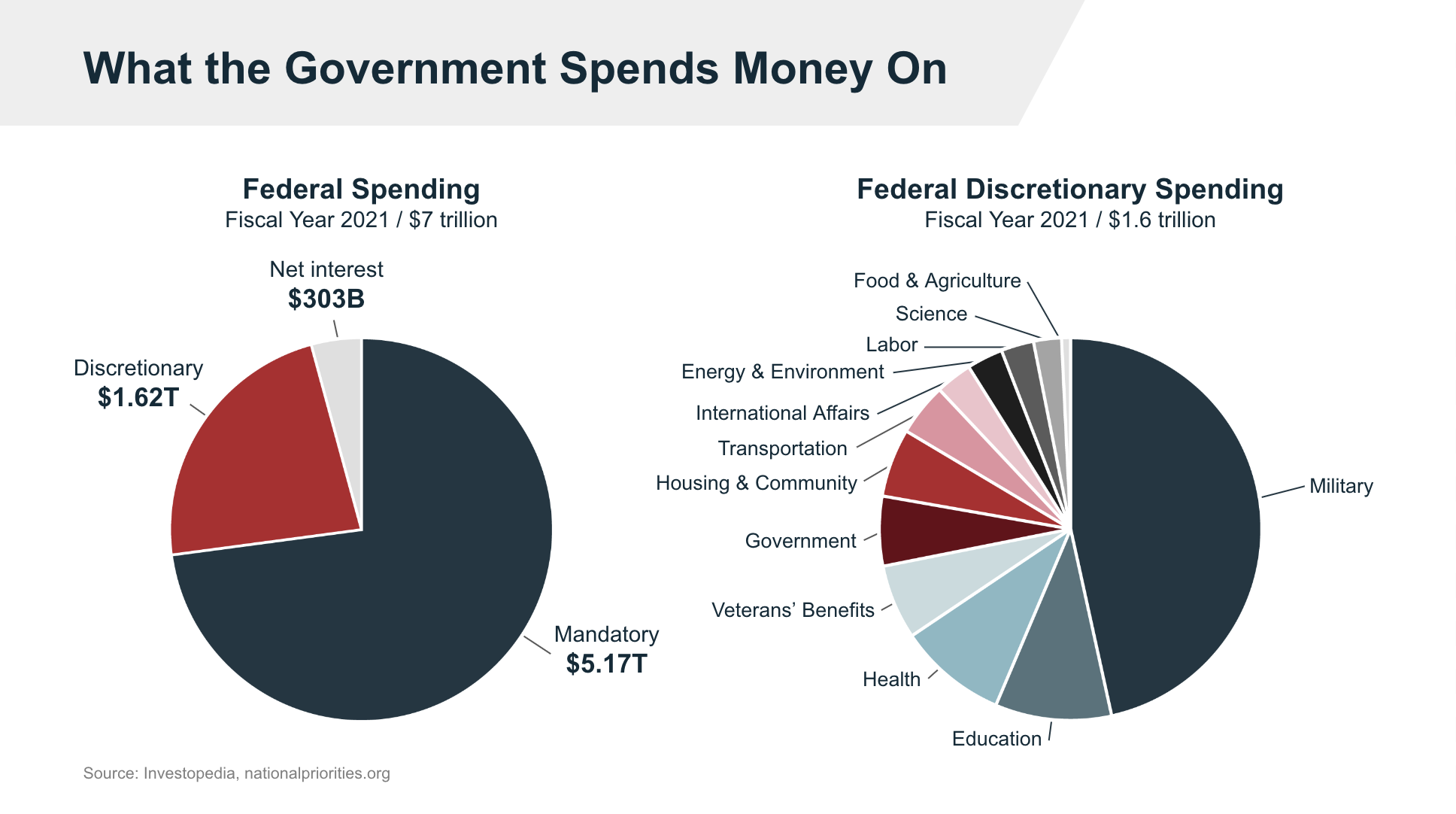

Federal budget spending falls into two main categories: mandatory and discretionary. Mandatory spending is required by law includes programs like Social Security and Medicare, while discretionary spending is determined entirely during the budget planning process. As a result, discretionary spending would likely be cut first despite being a small part of the total budget.

While discretionary spending cuts won’t affect Social Security benefits, they could lead to a slowdown in the economy and reduce market returns, hurting the growth of retirement investments.

Congress could also pass new laws to change mandatory spending amounts. However, lowering spending on popular programs is politically dangerous and it is unlikely to happen unless serious financial issues are encountered.

What Tax Hikes Could Be Expected?

Tax hikes also tends to be politically unpopular, but in some situations become seen by politicians as necessary. Were congress to move to hike taxes to pay down the debt, it would likely start by looking at increasing tax rates for higher income individuals. This would come in the form of increased income rates for upper income brackets, increases in capital gains tax rates, and increased gift and estate tax rates and lowered exemption amounts, among other possibilities. These increases would be in addition to any other tax hikes that could be required, such as raising the payroll tax to shore up the Social Security trust fund.

With provisions of the 2017 Tax Cuts and Jobs Act (“TCJA”) set to sunset after 2025, income tax increases are already pre-written into law. Congress could potentially extend those provisions, but that depends in part on which party will be in charge after the 2024 election and in part on the fiscal health of the US in 2025.

Prepare for Tax Risk With Long-Term Planning

Regardless of what happens in the near-term with the TCJA’s lower tax brackets, the overall level of the national debt indicates that tax hikes are far more likely to come than tax cuts. It is better to act now to prepare your retirement investments for any potential hikes that could come.

If you’ve been considering a Roth IRA conversion, for example, it might be best to perform that before 2025 to avoid the risk of paying taxes on that conversion at higher rates. Any changes to your portfolio should be made as part of a comprehensive retirement plan so that they’re structured in a way that minimizes your potential tax liability in the future but without any undue risk exposure. Request a free consultation with a financial advisor today to discover how good planning can help your retirement and what options may be suitable for your unique financial situation.