The Rise and Outlook of ESG Investing

Key Takeaways:

- ESG aligns investments with personal values and beliefs while positively impacting society and the environment.

- Increasing institutional adoption and regulatory support: ESG investing is gaining traction among institutional investors.

- The ESG investment landscape is experiencing rapid innovation, with financial institutions developing new tools and methodologies to evaluate and measure ESG factors.

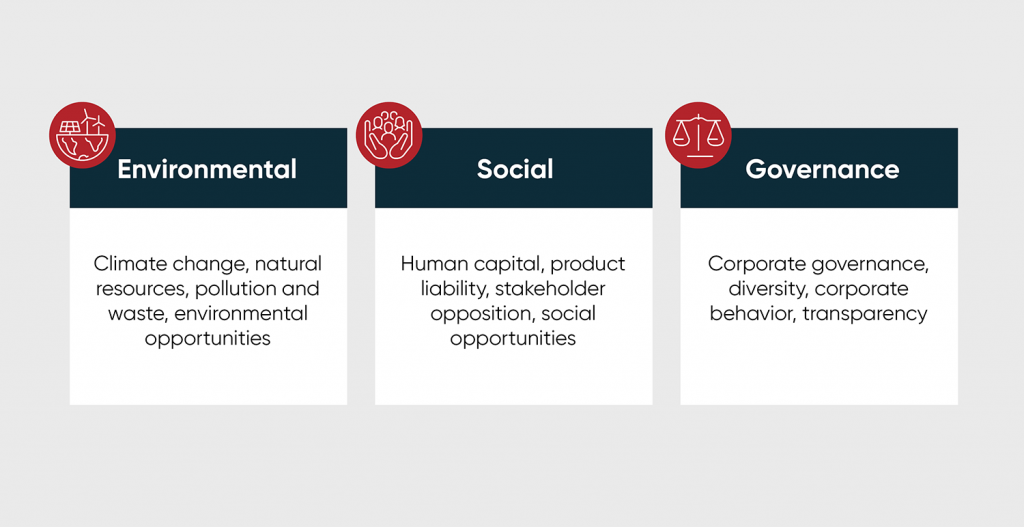

With the growing interest and popularity of ESG assets, this article attempts to shed light on the potential benefits of this rising investment trend. ESG stands for Environmental, Social, and Governance criteria – framework companies use to assess their sustainability. The environmental factor checks how a company conserves nature. Social factor examines how a company treats the people outside and inside it. At the same time, governance considers how the company is governed by leadership.

Based on these criteria, ESG investing evaluates an investment strategy’s financial return and overall impact. An investment’s ESG Quality Score gauges its sustainability in these areas.

The 2022 Sustainable Investment Overview by the US SIF Foundation revealed that the U.S. has $8.4 trillion invested in its sustainable funds and assets. One of every eight U.S. investor dollars is in a sustainable fund (1). So this begs the question, what are ESG investments, and what role could they play in a portfolio?

Understanding ESG Quality Score

The ESG scores involve analyzing a company’s performance in important ESG areas, such as carbon emissions, water usage, labor practices, board diversity, executive compensation, and transparency in reporting.

The ESG Scores combine multiple data points and indicators to assess a company’s sustainability and ESG performance. These data points are often gathered from various sources, including company disclosures, regulatory filings, third-party databases, and independent research. The scores are then weighted and aggregated to generate a single numerical value that reflects the company’s ESG performance relative to its peers.

ESG Factors

Environmental Factors in ESG Investing

- Climate change

- Pollution and waste

- Environmental opportunities

The screening criteria for environmental and impact investing typically involve evaluating a company’s resource usage, waste management, carbon footprint, and commitment to renewable energy. These criteria help investors identify companies prioritizing environmental stewardship and demonstrating sustainable practices.

The Forefront of Environmental Stewardship

Numerous companies are leading the way in environmental stewardship and setting an example for sustainable business practices. One such company is Tesla Inc., renowned for its electric vehicles and clean energy solutions. Tesla’s commitment to reducing carbon emissions and its contribution to the widespread adoption of electric cars have earned it recognition as an industry leader in environmental sustainability (2).

Another notable example is Unilever, a multinational consumer goods company. Through various initiatives, including the Sustainable Living Plan, Unilever has significantly reduced its environmental impact. This plan outlines the company’s commitment to sustainable sourcing, reducing waste and greenhouse gas emissions, and improving water management. Unilever’s dedication to environmental stewardship demonstrates its proactive approach to addressing pressing ecological challenges (3).

Furthermore, Patagonia, an outdoor clothing and gear company, exemplifies environmental sustainability through its sustainable sourcing practices, commitment to fair labor, and support for environmental causes. Patagonia is renowned for its high-quality products made from recycled and responsibly sourced materials. It actively advocates for environmental protection through its “1% for the Planet” initiative, donating 1% of its sales to environmental organizations (4).

Socially Responsible Investing

- Human capital

- Product liability

- Social opportunities

Social factors play a crucial role in ESG (Environmental, Social, and Governance) investing, encompassing a company’s impact on society and its stakeholders. Screening criteria often include assessing a company’s labor standards, employee welfare, commitment to diversity and equal opportunities, and contributions to the local community.

High Priority on Social Factors

Companies that prioritize social factors and demonstrate exemplary practices in these areas set themselves apart as socially responsible organizations. Microsoft Corporation has significantly promoted diversity and inclusion within its workforce.

Microsoft actively invests in programs to increase the representation of underrepresented groups, both within the company and in the tech industry as a whole. Their commitment to fostering an inclusive work environment is evident through initiatives like their diversity and inclusion training programs, affinity groups, and external partnerships focused on diversity advancement (5).

Starbucks Corporation also stands out for its labor practices and employee welfare initiatives. The company offers comprehensive benefits packages, including healthcare coverage and stock options, to employees, even part-time workers. Starbucks is also known for its commitment to fair trade practices and sustainable sourcing of coffee beans, ensuring its supply chain is socially responsible (6).

These examples highlight the importance of social factors in ESG investing and the significance of companies’ social responsibility efforts. Investors can support organizations prioritizing social impact alongside financial performance by considering a company’s labor practices, diversity initiatives, and community engagement. Investing in companies that demonstrate good social factor practices aligns with ethical investing values. It contributes to a more inclusive and equitable society.

Governance Factors

- Corporate governance

- Ethics

- Corruption & instability

Governance emphasizes the significance of strong corporate governance practices within companies. Solid corporate governance ensures companies operate with transparency, accountability, and ethical decision-making processes. Screening criteria often include assessing a company’s board structure, executive compensation, shareholder rights, and overall transparency in reporting.

Importance of Great Governance

High priority on social factors sets them apart as responsible and trustworthy entities. One promising company in this regard is Unilever. Unilever has consistently showcased a commitment to strong corporate governance by implementing robust board structures prioritizing diversity and independence. Their board composition includes many independent directors with diverse backgrounds, ensuring a wide range of perspectives and minimizing potential conflicts of interest (7).

Another company known for its wealth management and solid governance practices is Johnson & Johnson, a global healthcare company. Johnson & Johnson has established rigorous executive compensation policies tied to performance, aligning the interests of executives with long-term shareholder value. The company also strongly emphasizes risk management and compliance, with clear accountability and oversight structures (8).

ESG Trends

ESG Rising Popularity

The popularity of ESG investing has experienced significant growth in recent years, reflecting rising demand for sustainable investment options. In the United States alone, the number of ESG mutual and exchange-traded funds (ETFs) has surpassed 500, showcasing the increasing availability and diversity of ESG investment choices.

This growth was particularly striking compared to a decade ago when only around 100 ESG funds were in the market. The expansion of ESG investment options highlights a shift in investor preferences towards aligning their financial goals with their values and promoting positive environmental, social, and governance practices.

With a broader range of ESG funds, investors have greater flexibility in building portfolios that reflect their sustainability objectives. This trend signifies a growing recognition of the potential for ESG investing to deliver both financial returns and positive impact, driving the integration of environmental, social, and governance considerations into investment strategies.

Diversity in Assets

Bloomberg Intelligence has projected a substantial increase in assets dedicated to sustainable investing, with estimates suggesting that the figure may reach $50 trillion by 2025, compared to the current $35 trillion. This growth trajectory is impressive, considering that sustainable investments stood at $30.7 trillion in 2018 and $22.8 trillion in 2016, as the Global Sustainable Investment Association reported.

This illustrates the remarkable expansion and momentum of sustainable investing in recent years. The upward trend indicates a fundamental shift in investor behavior as more individuals and institutions recognize the importance of incorporating environmental, social, and governance factors into their investment decisions.

The significant rise in sustainable assets reflects the growing awareness of the potential for aligning financial goals with responsible and sustainable practices.

Benefits of ESG Investing

ESG offers numerous benefits, aligning investments with personal values and beliefs while positively impacting society and the environment. This approach allows investors to support businesses aligning with their values, whether promoting renewable energy, supporting fair labor practices, or championing diversity and inclusion.

Beyond personal alignment, ESG investing has a broader societal impact. It encourages companies to adopt sustainable practices, reduce their carbon footprint, and contribute to social welfare. Investing in companies prioritizing ESG criteria can contribute to the transition to a more sustainable and equitable economy.

Studies have shown that companies with strong ESG performance often exhibit better financial performance and risk management. An ESG investing strategy empowers individuals to make a positive difference in the world while potentially achieving financial returns, creating a potential win-win scenario for investors and society.

Risks and Challenges in ESG Investing

ESG investing comes with its share of risks and challenges that investors need to navigate effectively. One significant challenge is the issue of greenwashing, where companies misrepresent their environmental or social practices to appear more sustainable than they are. Greenwashing highlights the importance of clear definitions and standards for ESG criteria and rigorous verification processes to ensure transparency and credibility.

Data Obstacles

Another challenge is the limited availability and consistency of ESG data and metrics. While progress has been made in this area, there is still a need for standardized reporting frameworks and reliable data sources to facilitate informed decisions.

Investors also face the task of balancing financial returns with ESG considerations. Striking the right balance requires assessing the potential trade-offs between pursuing high economic returns and investing in companies that meet strict ESG criteria. The obstacle of data inconsistency calls for thorough analysis and a deep understanding of the specific ESG risks and opportunities associated with different industries and companies. These factors are a great reason to consult a financial advisor to help navigate these possible deterrents.

Outlook for ESG Investing

With increasing institutional adoption and growing regulatory support worldwide, the outlook for ESG investing is promising. Institutional investors, such as pension funds and asset managers, recognize the importance of integrating ESG factors into their investment processes to manage risks and enhance long-term performance.

This trend is driven by a greater understanding of the materiality of ESG issues and their impact on financial outcomes. Moreover, regulatory bodies are implementing guidelines and disclosure requirements that encourage transparency and accountability in governance ESG investing practices, further solidifying the mainstream acceptance of ESG investing.

Innovation in ESG investment products and strategies is also expanding rapidly. Financial institutions are developing new tools and methodologies to evaluate better and measure ESG factors, enabling investors to make more informed decisions.

A growing range of ESG-focused investment products, such as ESG-themed exchange-traded funds (ETFs) and green bonds, provides investors diverse options to align their investments with their values. These advancements contribute to the accessibility and attractiveness of ESG investing for a broader range of investors.

Potential developments in ESG investing include refining ESG data and metrics, allowing for more accurate assessments of companies’ ESG performance. Better data will enable investors to evaluate better and compare companies’ sustainability efforts. Similarly, integrating artificial intelligence and machine learning techniques in ESG analysis holds promise for more sophisticated and data-driven decision-making processes.

ESG Investing Strategies

ESG investing offers significant importance and benefits for both investors and society as a whole. Individuals can positively impact critical environmental, social, and governance issues by aligning investments with personal values and beliefs.

ESG investing not only presents an opportunity to generate financial returns but also contributes to improving society and the environment. With increasing awareness, institutional adoption, and regulatory support, ESG investing is becoming more accessible and influential in the investment landscape. Contact a fiduciary financial advisor today to learn how ESG investing strategies can fit into your portfolio.

Request a no-cost, no-obligation advisor consultation today!

Get StartedWith the rising trend of ESG investing, learn how to align your financial goals with your values while positively impacting society and the environment. With growing institutional adoption and regulatory backing, now is the perfect moment to learn about the potential benefits of this investment strategy.