Four Important Retirement Questions For Couples That Want to Retire at the Same Time

Key Takeaways

- Couples should carefully consider the financial and emotional consequences of retiring simultaneously before making the decision.

- One spouse retiring earlier can provide financial and relationship benefits, such as delaying Social Security, providing more years to save for retirement, and allowing for larger annual withdrawal amounts.

- Prioritizing savings is essential as relying solely on Social Security benefits may not sustain desired lifestyles during retirement.

The allure of couples envisioning a joint retirement, setting sail together into a new chapter of their lives. However, it’s crucial to carefully consider the implications of retiring simultaneously. This decision can have both financial and emotional consequences, especially when compared to scenarios where one spouse continues working while the other retires. It’s paramount to start addressing these considerations sooner rather than later, allowing both partners ample time to map out their retirement trajectories and ensure they align harmoniously.

Let’s take the example of Jack and Diane, who started dating in high school and married shortly after graduating college. They’ve always expected to retire simultaneously, and with both about to turn 62, their goal is within reach, thanks to their retirement planning.

While they plan to retire as soon as they can start collecting Social Security benefits, there are four important questions Jack and Diane – and any couple that wants to retire at the same time – should answer before making their decision:

1. Have you correctly calculated your cost of living in retirement?

Jack and Diane have spent countless hours crunching numbers and poring over their budget. However, like many retirees, they may not realize that their overall expenses could increase in retirement instead of decreasing.

Diane figured she’d probably save on gas for the car, wardrobe expenditures, and even 401(k) contributions after she retires. But depending on their lifestyle goals, higher healthcare, travel, and entertainment costs could offset these savings.

According to a 2015 study by the Employee Benefit Research Institute, 46% of older adults spend MORE money on living costs during their first few years of retirement than before retiring! And according to a 2021 EBRI study, 20% of retirees spend more than expected on housing costs, while 15% spend more than expected on their retirement lifestyle.

2. Are you leaving Social Security benefits on the table? When is the best time for each person to take Social Security?

Just because Jack and Diane would be eligible to draw Social Security benefits at 62 doesn’t mean they SHOULD. The longer they wait, the larger their benefits will be.

Not only will they get a larger monthly benefit if they wait until closer to their full retirement age, but Diane’s benefit would also increase further because she spent several years out of the workforce to care for their children. If she retires at 62, her employment gap will leave her just short of 35 years of earnings, taking a big chunk of her potential monthly benefit.

Social Security Eligibility & Retirement Benefits: A Case Study

You can receive your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to 70, your benefit amount will increase.

- You can elect to receive benefits starting at age 62, which will be 70-80 percent of your total benefits.

- If you delay taking your benefits until after your full retirement age, then you will receive more than your full benefit of

- 8.0% (yearly rate increase) for anyone born in 1943 or after

- Maxes out at age 70

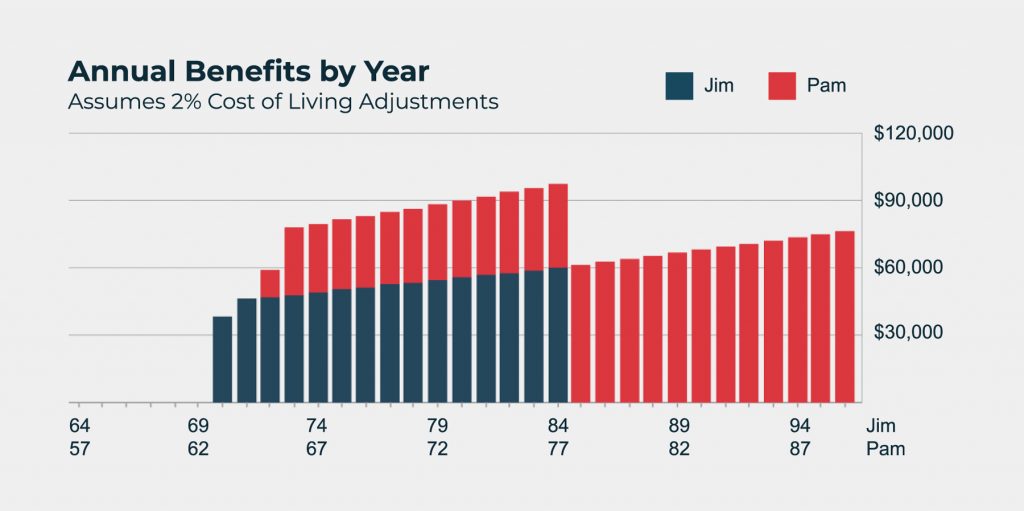

Let’s consider the hypothetical scenario of Jim and Pam, including their date of birth, full retirement age (FRA), monthly benefits at FRA, assumed lifespan, rate of return for the cumulative value of benefits, Social Security cost of living adjustment, effective income tax rate, and modified adjusted gross income.

Jim was born on February 3, 1958, while Pam was born on July 16, 1965. Their full retirement ages (FRA) are 66 and 8 months for Jim and 67 for Pam. If they start receiving Social Security benefits at their FRA, Jim’s estimated monthly benefit would be $2,667, while Pam’s would be $2,417.

Assuming they both live to age 85, the rate of return for the cumulative value of benefits is set at 0%. There is also a 2% Social Security cost of living adjustment to account for inflation. Their effective tax rate is 25%, and their modified adjusted gross income is currently $0.

Strategy 1

The strategy selected for this following example starts benefits for Jim at age 70 and Pam at age 65 (the start ages that will provide maximum benefits over the projected lifetimes).

Jim’s FRA benefit is projected to be $2,667, while Pam’s FRA benefit is estimated at $2,417. These amounts represent the monthly payments they would receive if they start claiming their Social Security benefits at their respective full retirement ages.

When considering their estimated lifespans, it is assumed that Jim and Pam will live to different ages. The assumption is that Jim will live until age 85, while Pam is projected to live until age 90. These projected lifespans factor into their retirement planning and the longevity of their Social Security benefits.

In March 2028, at the age of 70, Jim will experience an increase in his monthly benefit to $3,805 as he starts receiving his retirement benefits. At this time, Pam’s monthly benefit remains unchanged at $0.

However, in August 2030, when Pam reaches age 65, she will begin receiving her retirement benefits, resulting in a monthly benefit of $3,958 for herself. Meanwhile, Jim’s monthly benefit remains steady at $3,805. This change leads to a combined monthly benefit of $6,412 for both Jim and Pam.

A significant event occurs in January 2043 when Pam turns 78 with the passing of Jim. Pam’s benefit increases to $5,120. This adjustment reflects the transition from her retirement savings to combined survivor benefits based on her late spouse’s Social Security record.

Cumulative Value of the Benefits: $2,021,188

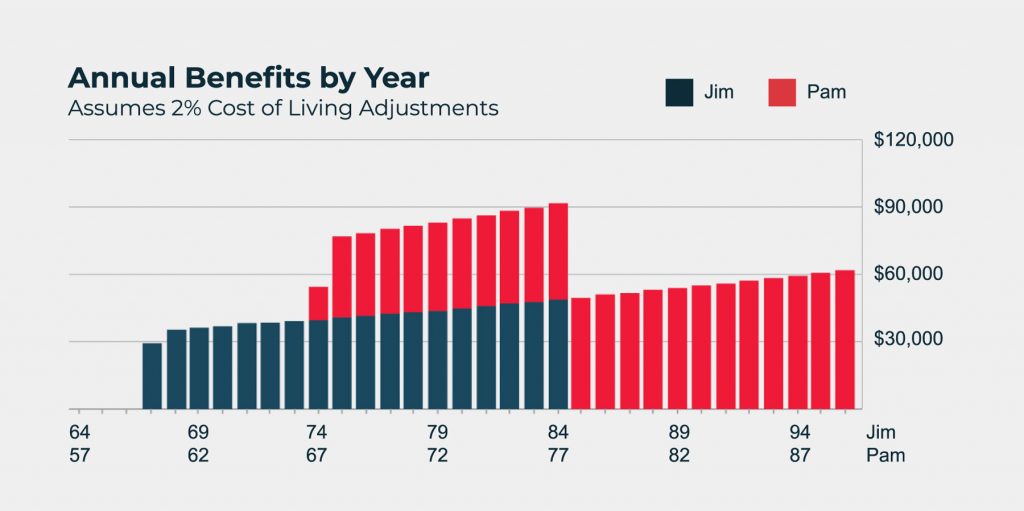

Strategy 2

In this second example, we will show Pam and Jim’s benefits if they both retire at the same age. The difference is how much less benefit would be received if an alternative start age combination is selected.

In March 2025, when Jim reaches the age of 67, he will receive his retirement benefits, resulting in a monthly benefit of $2,906. At this time, Pam’s monthly benefit remains unchanged at $0.

Moving forward to August 2032, when Pam reaches the age of 67, she will begin receiving her retirement benefits. Her monthly benefit will be $3,338, while Jim’s monthly benefit remains at $2,906. As a result, the combined monthly benefit for both Jim and Pam will amount to $6,284.

However, a significant change occurred in January 2043, when Pam turned 78, and Jim passed. Pam’s benefit transitions to survivor benefits. Her monthly benefit decreases to $4,150, reflecting the shift from her retirement benefits to survivor benefits based on her deceased spouse’s Social Security record.

Cumulative Value of the Benefits: $1,818,374

This example is for illustrative purposes only, does not consider your situation or needs, and is not a recommendation of a specific strategy.

3. Do you feel ready to retire?

The decision to retire is not just a financial one. Many people are surprised at just how big of an adjustment it is. Especially for married couples!

When spouses retire simultaneously, they suddenly start spending a LOT more time together. This requires them to establish a new normal with new routines and roles. Yet, if one spouse decides to continue working, this could cause resentment. Will the household chores fall on the retired spouse?

Sometimes, one spouse reluctantly agrees to retire because the other spouse is ready to stop working, but that may not be the best choice. Jack may be burnt out and ready to retire, but if Diane loves her job, is it a good idea for her to retire too? Maybe not.

4. Do you have a good retirement plan?

If you and your spouse are thinking about retiring together, the best thing you can do after talking to each other about the idea is to speak with a financial advisor. They can help you confirm that retiring at the same time is a good idea (at least financially) and help ensure you’re not overlooking any potential expenses or other financial downsides while putting together your retirement plan.

Don’t have an advisor? You can find your local Retirement Wealth Advisor by browsing our advisor directory or click here to have one reach out to schedule a no-cost, no-obligation consultation.

Should Couples Retire Together?

Experts agree that it generally makes more sense for one person to retire earlier unless couples are the same age and in the same health. This decision can bring both financial and relationship benefits. From a financial perspective, here are a couple of considerations.

Delays Social Security

Those benefits will increase if one spouse works longer and delays claiming Social Security benefits beyond the full retirement age.

RETIREMENT QUESTION TO ASK A FINANCIAL ADVISOR: WHAT IS THE BEST AGE TO TAKE SOCIAL SECURITY?

Retirement Savings & Income

The working spouse’s continued income provides the couple additional years to save for retirement. If a spouse works an extra three to five years, they will likely have a shorter retirement period, allowing for larger annual withdrawal amounts from their retirement assets. Choosing one spouse to work a few extra years can make a significant difference between having a financially strained retirement or a comfortable one.

RETIREMENT QUESTION TO ASK A FINANCIAL ADVISOR: HOW MUCH SHOULD OUR NEST EGG BE? HOW LONG WILL IT TAKE TO REACH?

Taxes in Retirement

Taxes will likely play a large role in when couples should retire. It’s important to seek tax advice before retirement to optimize your accounts. Understanding what accounts are taxed and how it affects other income sources (Social Security, pensions, etc..) will be critical to making your nest egg last longer.

RETIREMENT QUESTION TO ASK A FINANCIAL ADVISOR: ARE OUR RETIREMENT ACCOUNTS TAX-OPTMITZED?

Health Insurance & Long-Term Care

Medicare probably won’t cover all your medical expenses, and there is a chance at least one, if not both, partners may need long-term care at some point during retirement. Understanding how Medicare works and knowing your options should you need long-term is critical for retirement planning.

RETIREMENT QUESTION TO ASK A FINANCIAL ADVISOR: WHAT DOES MEDICARE COVER, AND WHAT ARE OUR LONG-TERM CARE OPTIONS?

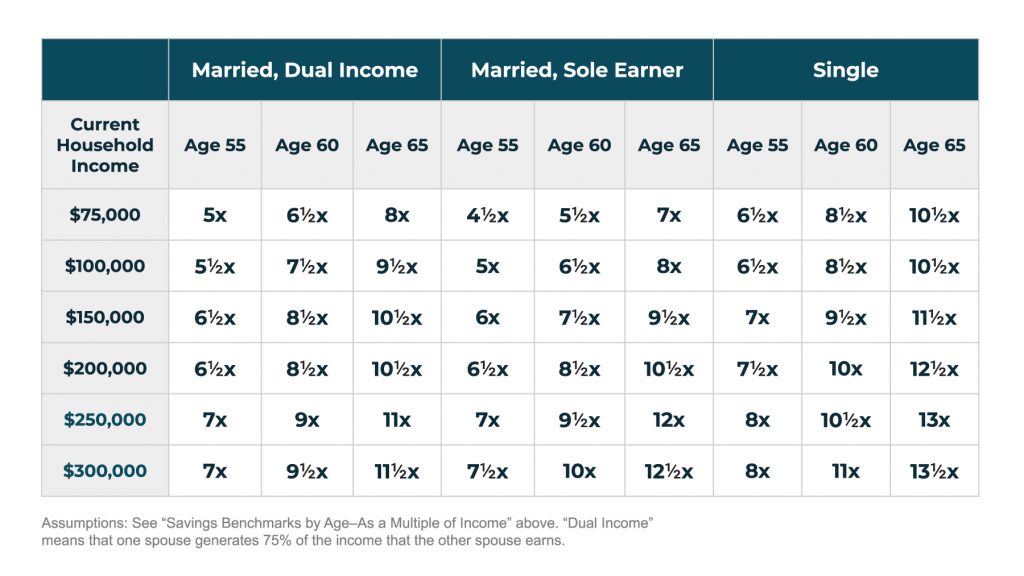

Benchmarks for Married Couples

Financial experts recommend that couples in their 60s should have a retirement account totaling seven to seven and a half times their annual household income. For example, a couple with a dual income of $75,000 per year should aim to save $525,000 to $562,500.

Here’s a breakdown of savings targets based on income and age based on a recommendation by T.Rowe Price:

Don’t Rely Solely on Social Security

As of January 2022, retired couples on Social Security receive an average monthly benefit of $2,753. This amount is comparable to minimum wage, which may not be enough to sustain your desired lifestyle during retirement. Ensure a secure future by prioritizing your savings.

Retirement Planning & Investment Strategy

Couples aspiring to retire together must carefully consider several critical questions before deciding. The financial and emotional consequences of retiring simultaneously can significantly impact your retirement journey. Couples must accurately calculate their cost of living in retirement, considering potential expense increases.

Leaving Social Security benefits on the table should be evaluated, as delaying claiming can lead to larger monthly benefits. Remember that retirement readiness is not solely a financial matter, as couples must be prepared for the adjustments and new dynamics that come with spending more time together.

Seeking the guidance of a financial advisor can help ensure that couples have a solid retirement plan in place, addressing any potential financial hardships and overlooked expenses. While retiring together may be the ideal scenario for some couples, carefully considering these factors will help pave the way for a secure and fulfilling retirement.