Key Takeaways

- Management fees for retirement plans, such as 401(k), Roth IRA, and IRA, can significantly impact investment returns.

- A higher management fee reduces the amount of money available for compounding and long-term growth, potentially leading to lower retirement savings.

- Retirement plans have multiple fees, including investment, plan administration, individual service, and 12b-1 fees that could impact overall plan value.

Investing in retirement plans, such as a 401(k), Roth IRA, or IRA, is critical to securing your financial future. These plans offer the power of compounding, a remarkable phenomenon that allows your money to grow exponentially over time. However, while the potential for significant returns is present, it is important to be mindful of one often overlooked aspect: management fees.

This article will highlight the critical importance of monitoring management fees to fully capitalize on the benefits of saving in retirement plans. By understanding the impact of these fees on plan assets and minimizing them, you can safeguard a more substantial portion of your hard-earned money and maximize your long-term wealth.

The Cost of Fees

Investment funds impose management fees to cover the costs of managing and other operating expenses of the fund. These fees are typically a percentage of the total account or fund balance and are usually deducted from the fund’s returns. While management fees may seem insignificant at first glance, their impact on investment returns can be substantial. The higher the management fee, the more it eats into your returns, reducing the amount of money available for compounding and long-term growth.

Consequences of High Fees

If an American worker contributes $4,000 to her retirement account every year. Assuming an 8 percent annual return and no employer match contribution, she could amass a substantial nest egg over 35 years. However, if she pays a 1 percent management fee, her account balance would reach an impressive $584,000. In stark contrast, if she pays a higher 1.5 percent management fee (just half a percentage point of higher fees), her account balance would shrink to $522,000. That seemingly small half-percentage point difference in fees would have cost her a staggering $62,000 in potential retirement savings.

Compounding Effect of Fees Over Time

The consequences of high management fees extend beyond the immediate impact on investment returns. These fees have an opportunity cost that compounds over time. By diverting a portion of your returns towards fees, you effectively reduce the amount available for reinvestment and the compounding effect of your money. The compounding effect is the snowballing growth when investment returns generate additional returns over time. Therefore, every dollar paid in fees reduces your immediate returns and diminishes the potential growth and compounding of your investments in the future. Over the long term, the compounding effect can significantly amplify the impact of investment management fees, making it vital to minimize them to optimize your retirement savings.

The Extent of Fees in Retirement Plans

Retirement plans like 401(k)s, Roth IRAs, and IRAs, Americans’ fees can be staggering. According to reports from Jason Furman and Betsy Stevenson of the Council of Economic Advisers, Americans collectively shell out between $8 billion and $17 billion in fees yearly for these accounts. Although often overlooked or misunderstood, these fees can significantly impact the overall value of retirement savings. Individuals need to be aware of the fees they are paying and take necessary steps to minimize them to maximize their long-term financial well-being.

Surprisingly, many individuals remain unaware of the amount and purpose of the fees associated with their retirement accounts. The National Association of Retirement Plan Participants found that many Americans have limited knowledge of the fees they pay or why they are charged in the first place. This lack of awareness can lead to individuals unknowingly losing out on potential savings due to high management fees.

Industry Standards for Management Fees

While the exact percentage may vary, management fees between 1 percent and 2 percent are generally considered high. On the other hand, management fees below 1 percent are more widely accepted as reasonable. The most efficient practice will be assessing the fees charged by the funds within your 401(k) plan and comparing them to these industry benchmarks.

If you discover that your plan’s management fees are higher, it may be worth exploring alternatives, such as low-cost index funds. These funds typically charge significantly lower management fees, ranging from 0.05 to 0.25 percent.

Understanding Retirement Plan Fees

To access this information, start by reviewing your plan documents, specifically the 408(b)(2) disclosure or “summary plan description.” These documents should outline the management fees associated with each fund in your plan. Don’t hesitate to contact your plan administrator for a comprehensive breakdown of the total fees.

Note that management fees are not the only costs you may encounter. Administrative fees and recordkeeping fees are often included in the total plan fees. Understanding these additional costs will give you a clearer picture of the overall fees associated with your 401(k) plan.

Other Investment Fees

Don’t let unexpected fees catch you off guard. These fees could include the following:

-

Investment Fees

The most significant portion typically comprises investment management expenses and other investment-related services. These fees are often calculated as a percentage of the assets held within the account. Within the realm of investment fees, there are several components to consider, such as expense ratios, sales loads, and additional costs.

Actively managed funds, which involve a team of professionals making investment decisions, generally carry higher investment fees compared to passively managed funds, which aim to mirror the performance of a specific market index.

-

Plan Administration Fees

Plan administration fees encompass various aspects of general management, including record-keeping, accounting, legal, and trustee services. These fees also contribute to providing additional services that account holders may have access to, such as customer service representatives, educational seminars, and electronic access to plan information. While some employers may cover these fees on behalf of their employees, in many cases, they are passed on to the account holders as a flat fee or a percentage of the total balance.

-

Individual Service Fees

These fees come into effect when participants utilize specific options, such as taking out a 401(k) loan, rolling over their investments to an Individual Retirement Account (IRA), or seeking professional financial advisory services. Unlike the core management and administration fees, service fees are charged separately to participant accounts, reflecting the cost associated with the particular feature or service utilized.

-

12b-1 fee

One of the most well-established charges is the 12b-1 fee, derived from the corresponding section of the Investment Company Act of 1940. Primarily categorized as marketing and distribution expenses, 12b-1 fees compensate intermediaries selling 401(k) plans to employers. These fees typically have a cap of 0.75% of assets, with some funds also implementing a 0.25% shareholder services fee.

Fiduciary Financial Advisor

Fiduciary financial advisors are dedicated advisors who operate transparently fee-only, providing comprehensive financial services such as budgeting, retirement planning, debt management, and goal setting for various financial milestones. Their compensation is typically derived solely from their clients, calculated as a percentage of the assets under management (AUM).

What sets fee-only advisors apart is their commitment to comprehensive advice and transparency. They typically should not receive commissions, referral fees, kickbacks, or hidden forms of compensation from third parties. Moreover, fee-only advisors often hold the distinction of being registered Investment Advisor Representatives (IARs). They are regulated by either the U.S. Securities and Exchange Commission (SEC) or state-level institutions.

This payment structure significantly reduces the likelihood of encountering conflicts of interest. Fee-only financial planners are not incentivized to recommend one investment product over another. Instead, they operate under a fiduciary responsibility, which obligates them to act solely in the best interests of their clients.

Pros and Cons of Fiduciary Financial Advisors

One of the most significant advantages of working with a fee-only financial planner is the assurance that they prioritize your best interests above all else. Their primary focus is to assist you with your financial matters without any conflicts of interest, as their compensation is not tied to the products they recommend or sell. Operating as fiduciaries, fee-only advisors are bound to act solely in your best interests, providing objective and comprehensive guidance.

However, it would be best to consider certain potential drawbacks of working with fee-only financial planners. Due to their reliance solely on fees for their services, their fees may be higher compared to advisors who earn commissions from product sales.

Financial Advisor Fees

Fee-only financial planners employ various fee structures to bill their clients. The most prevalent approach involves charging a percentage of the client’s assets under management (AUM), which refers to the funds the planner or advisor oversees on behalf of the client. This percentage typically scales with the amount of AUM.

Another method employed by fee-only advisors is hourly or monthly billing. In this model, clients are billed based on the time and effort devoted to providing financial advice and services. Alternatively, some fee-only advisors may charge a flat fee or employ a fee structure tailored to the specific services required by the client.

It’s worth noting that some fee-only financial planners exclusively cater to high-net-worth clients, which could result in higher costs due to the substantial assets involved.

The cost of engaging a fee-only financial planner will vary depending on the chosen fee structure, the specific services needed, and your investable assets. More experienced advisors may also command higher fees based on their expertise and track record. Discussing fee arrangements upfront and gaining clarity on the cost structure before engaging a fee-only financial planner is important.

Fund Expense Ratios Example

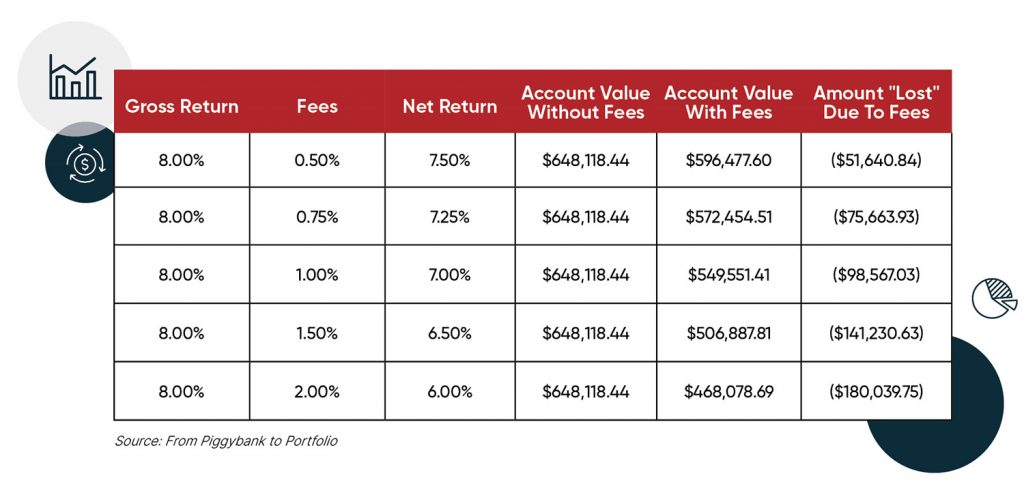

Envision a scenario where you diligently contribute to your retirement account over a 30-year career, with increasing annual contributions. In the first year, you contribute $3,000, and in each subsequent year, you raise your contribution by $250. Consequently, your contributions in year two amount to $3,250, in year three, $3,500, and in year four, $3,750.

During your entire career, you continue to increase your contributions incrementally. Assuming an 8% annualized return on your well-diversified portfolio, you may anticipate earning attractive gross returns. However, consider the impact of fees on your net returns. The level of fees you pay determines the actual return you receive.

To illustrate this, let’s compare different investment programs in the chart below, where the only distinguishing factor is the amount of fees paid. Everything else remains constant. Take a moment to observe the substantial disparity in the final retirement amount, depending on the extent of fees paid each year.

It’s common for individuals to aim for a withdrawal rate ranging from 3% to 5% of their investment portfolio annually.

Check out more information on the withdrawal rate strategy.

Building upon the previous scenario, let’s consider two individuals who followed a similar investment approach throughout their careers but with one key distinction: their fee payments.

While one person paid a reasonable 0.5% fee, the other incurred a higher 2% fee rate. The consequences of this investment fee disparity become evident when we assess their annual income during retirement. The person burdened with excessive fees would experience a shortfall of over $5,000 yearly. This translates to a monthly reduction of $420, highlighting the significant impact that paying high fees on their investment portfolio during their working years can have on their post-retirement financial well-being.

How to Read Your Statements

The Department of Labor recognized the importance of fee transparency and implemented a fiduciary rule to aid investors in making informed decisions. It emphasizes the requirement for administrators to disclose fees on statements and act in the best interests of plan participants.

However, many investment professionals argue that fees remain somewhat obscured despite these efforts. Administrators do not send annual bills explicitly outlining the costs of plan management and services, nor do they itemize fees on statements. Instead, fees are often presented in the context of reduced net returns.

When reviewing a statement, look for terms like “Total Asset-Based Fees,” “Total Operating Expenses As a %,” or “Expense Ratios.” Although these technical terms may not be participant-friendly, it is possible to decipher the meaning behind the numbers and gain a clearer understanding of the fees associated with your plan.

Get Educated About Retirement Plan Fees

If you have an investment advisor, carefully consider what you pay for their services. According to Forbes, the average advisor charges at least 1 percent. Ensure to thoroughly investigate the products your investment advisor recommends, as some advisors may expose you to additional fees (individual service fees such as commissions on certain investments) that they are not legally required to divulge.

Are you concerned about the fees that you’re paying for your retirement plan? One of our financial advisors can help you identify opportunities to save. Click here to request a no-cost, no-obligation consultation, or browse our advisor directory to find one.