Inflation Overview

Inflation is defined as the rising cost of a good or service over some time. Whether it is food, medical expenses, transportation, energy prices, or housing, inflation has different impacts over time.

Inflation may differ slightly for Retirees (CPI-E) because of higher costs and inflation

for Healthcare and Housing.

Not only do retirees have to plan for longevity in retirement, but “you have to” consider the impact of inflation on your living expenses over time.

How is Inflation Calculated

The Bureau of Labor Statistics program uses Consumer Price Index (CPI) to measure monthly consumer goods and services price changes in over 200 categories.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) calculates annual cost-of-living adjustments for Social Security recipients.

How to Calculate Inflation Rate Using GDP

The inflation rate can be calculated using the GDP deflator. The GDP deflator measures the prices of all new, domestically produced, final goods and all services purchased in an economy. Here are the steps to calculate the inflation rate using GDP:

- Obtain the nominal GDP and real GDP for the period of interest.

- Calculate the GDP deflator by dividing the nominal GDP by the real GDP and multiplying by 100. GDP Deflator = (Nominal GDP / Real GDP) x 100

- Calculate the inflation rate as the percentage change in the GDP deflator between two time periods: Inflation Rate = ((GDP Deflator in Current Period – GDP Deflator in Base Period) / GDP Deflator in Base Period) x 100

For example, if the GDP deflator for inflation measures, the current year is 120. The GDP deflator for the base year is 100; then the inflation rate calculation would be ((120-100)/100) x 100 = 20%.

Things Cost More Over Time

Over the years, the cost of milk has increased steadily, from $1.06 in 1964 to $1.94 in 1984, $3.06 in 2007, and $3.66 in 2021. In contrast, a new home’s cost has increased significantly, from $30,000 in 1964 to $110,610 in 1984, $221,000 in 2007, and $374,900 in 2021.

During the same period, average income increased from $6,080 in 1964 to $12,866 in 1984, $34,335 in 2007, and $67,000 in 2021.

Why Inflation May be Slightly Different for Retirees

- Increased medical costs

- Housing and living status changes

- Limited transportation needs

Relative Importance of Expenditure Categories in Consumer Price Index

The Consumer Price Index for the Elderly, or CPI-E, calculates inflation for people over 62. Historically, due to medical expenses, this inflation adjustment is slightly higher. Since 1984, CPI-E has been 5.1%, higher than Headline CPI.

Knowing the weight of different expenditure categories can help you budget for retirement expenses, anticipate future costs, and make informed decisions about your retirement savings and investments.

For example, individuals approaching retirement age can analyze their current spending patterns and estimate their future expenses for housing, healthcare, food, and other categories to develop a comprehensive retirement budget. They can use this budget to determine their desired retirement income and evaluate whether their current retirement savings and investment plans are sufficient to meet their financial goals.

Individuals can identify categories experiencing higher inflation rates and adjust their budget and investment strategy accordingly by analyzing the relative importance of expenditure categories over time. For instance, if healthcare costs are rising faster than average for other expenditure categories, individuals may need to allocate more of their retirement savings toward healthcare expenses.

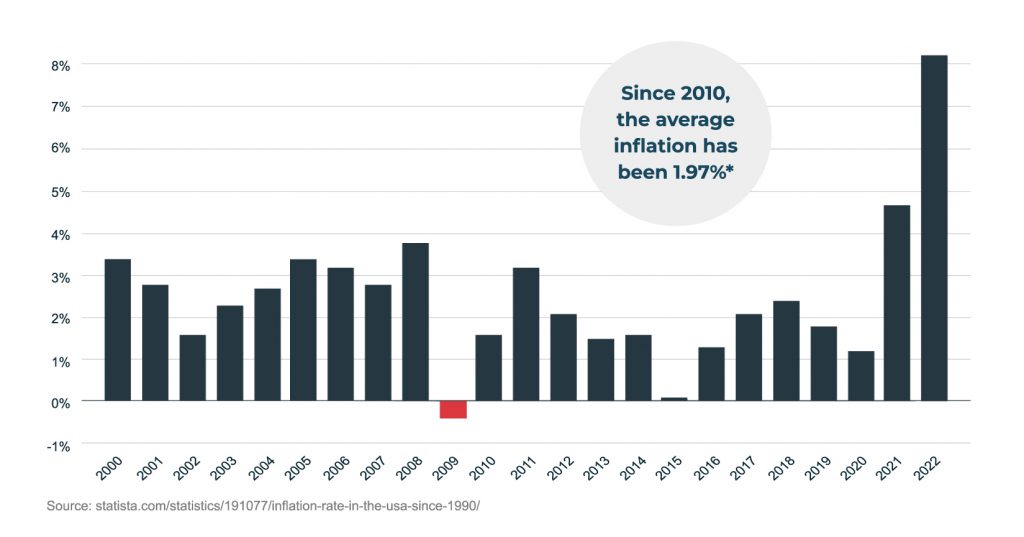

Historical Inflation Rates

Historical inflation rates provide valuable insight into past economic conditions and help individuals make informed financial planning, investment, and monetary policy decisions.

During the 1970s, inflation rates were relatively high, with an average rate of around 7% per year. However, inflation rates have generally been lower since the 1980s, with an average rate of about 2-3% per year.

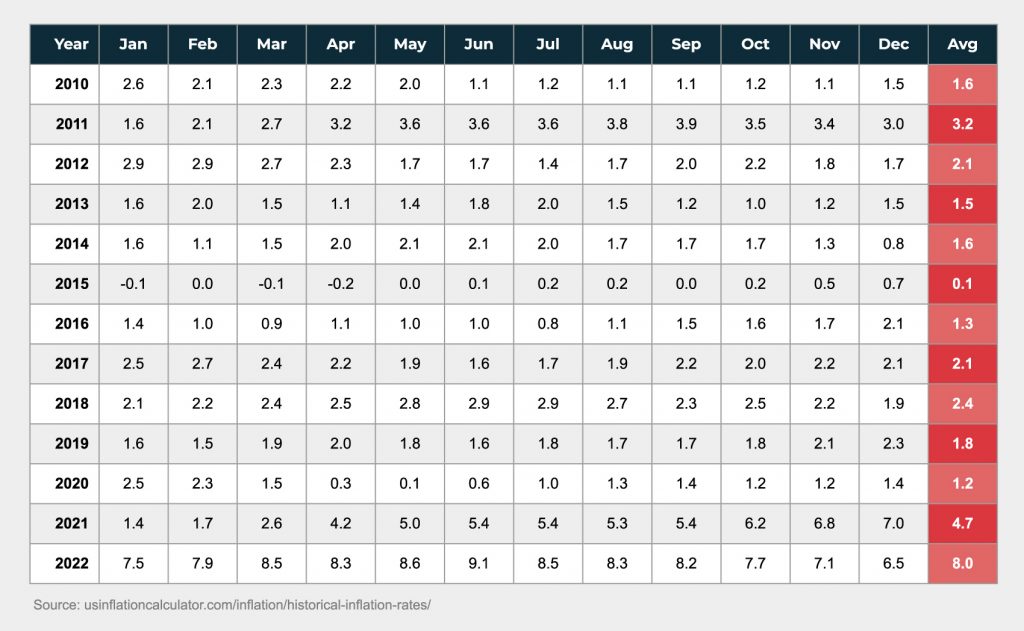

Inflation Rates in the United States from 2010 to 2022

The table shows the inflation rates in the United States from 2010 to 2022. Inflation rates fluctuated during this period, with an average rate of 1.6% in 2010, increasing to a peak of 3.2% in 2011 before declining to an average of 1.5% in 2013. Inflation rates gradually increased from 2014 to 2019, with an average of 2.1% in 2018, before declining slightly to 1.2% in 2020.

Recently, inflation rates increased significantly in 2021 and 2022, with an average of 4.7% and 8.1%, respectively. These figures suggest that inflation has been a persistent factor in the U.S. economy in recent years, and individuals and policymakers should consider the impact of inflation on their financial planning and policy decisions.

Impact of Inflation on Your Lifestyle

- It will erode your purchasing power over time.

- The impact can increase your “income gap” over time, even more so if you live on a fixed income.

- Compromise the growth of your investments, questioning how to keep up with the current inflation.

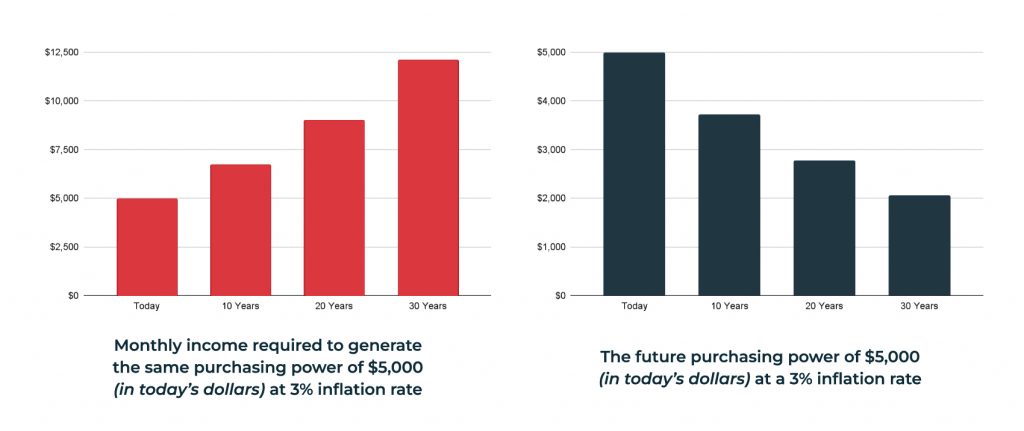

Inflation and Purchasing Power

To generate the same purchasing power of $5,000 in today’s dollars at a 3% inflation rate, a monthly income of $9,030 is required after 20 years, and a monthly income of $12,135 after 30 years.

The future purchasing power of $5,000 in today’s dollars will decrease significantly over time due to a 3% inflation rate. After 20 years, the purchasing power of $5,000 will drop to $2,769; after 30 years, it will decrease further to $2,060. That the same amount of money will be able to buy the same good or fewer goods and services in the future, making it essential to plan and invest wisely to maintain the value of savings and income.

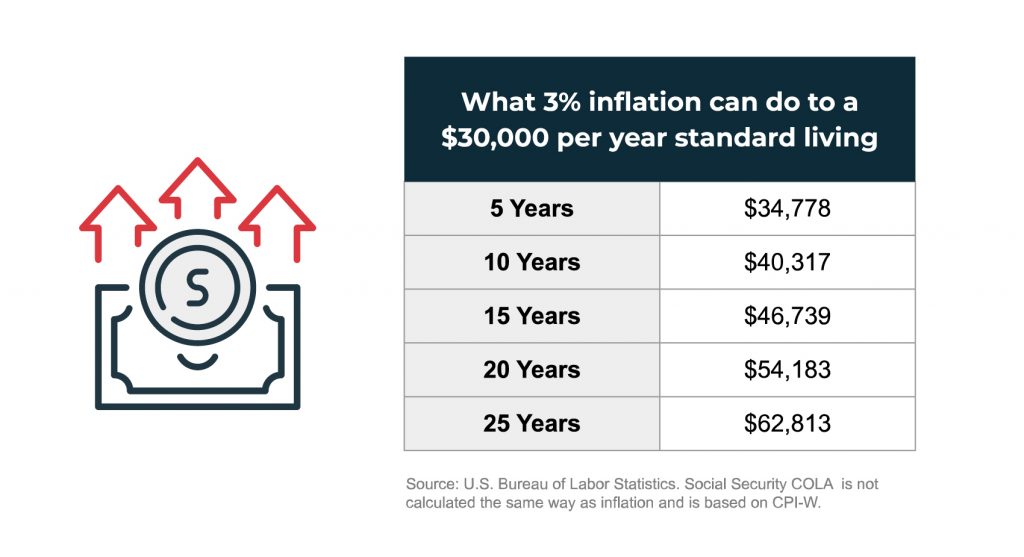

The Power of Inflation

$100 in the future is not the same as $100 today. The table illustrates what 3% inflation can do to a $30,000 per year standard of living.

Things will cost more over time.

Healthcare inflation at over 6% erodes the value of savings and diminishes returns. The Senior Citizens League reports that individuals over 65 have experienced a 74% increase in the cost of living adjustments since 2000. In contrast, Social Security COLA increases were only 43% during this period.

If prices rise 4% annually, What’s my money worth?

Case Study: Bill and Linda

- Bill and Linda are both 60 years old and plan to retire at age 65

- Living expenses: $6,000/month after-tax

- Current income: Both make $75,000/year (salary)

- Total retirement savings in 401k is $750,000 growing at 6%

- With life expectancy increasing, we want to be conservative by assuming a long life. We assume Bill and Linda will live to the age of 90 or 25 more years.

- Living expenses: $6,000/month in retirement after-tax

- A 3% inflation rate will be used in this case study.

*The hypothetical investment results are for illustrative purposes only. They should not be deemed a representation of past or future results. Actual investment results may be more or less than those shown. This does not represent any specific product or service.

At Retirement (65), Bill and Linda have:

- Retirement savings have grown to $1,130,000

- Both claim Social Security—$2,200/mo. each or $52,800 annually

- Combined pension income of $20,000

Annual Living Expenses

Multiplying the monthly income of $6,000 by 12 gives an annual income of $72,000, representing the estimated yearly living expenses.

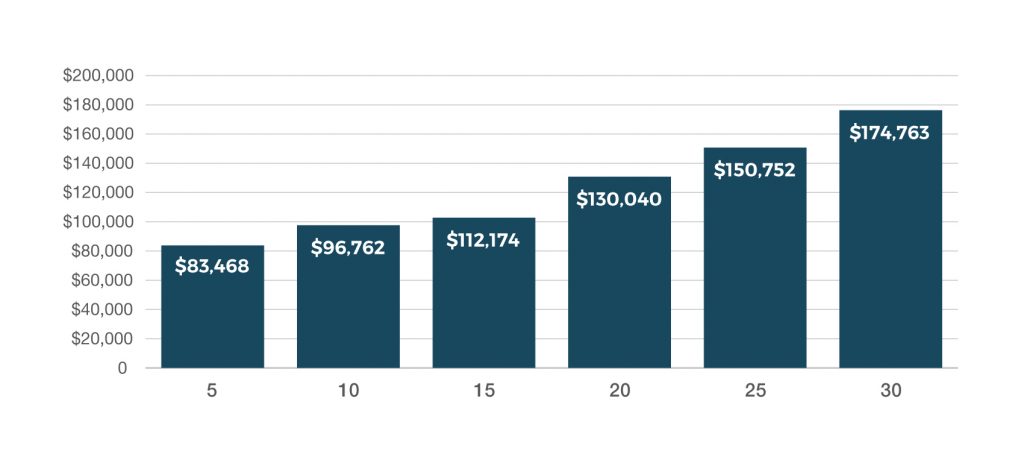

Retire in 5 Years

Assuming a 3% inflation rate for one period, the estimated inflation-adjusted living expenses for the next year would be $83,448, which is the result of multiplying $72,000 by 1.159.

To maintain inflation-adjusted living expenses, future living expense needs are as follows:

$2,625,067 of total income is needed in this case study example.

Calculating inflation allows us to understand better how it can impact our purchasing power over time, so we can make informed decisions and plan accordingly. Considering the potential impact of inflation on your living expenses, you can take practical steps to protect your finances and achieve your retirement goals.

As seen in the case study of John and Mary, even if you have substantial retirement savings, factoring inflation into the equation and planning for a long life is crucial. With a positive outlook and understanding of inflation’s effects, you can create a plan that maximizes your long-term savings and financial security.

Working with a financial advisor can be the optimal way to create a comprehensive financial plan that considers the impact of inflation on your retirement savings. With the help of a fiduciary advisor, you can develop a long-term strategy that considers changing economic conditions and helps you maintain your purchasing power.

Moreover, having a knowledgeable partner who understands your financial situation can provide peace of mind when it’s time to change your plan. Seeking the advice of a financial advisor can be an effective strategy for protecting your finances and achieving your retirement goals. Request a free consultation with a financial advisor today.

*Based on Consumer Price Indexes, Bureau of Labor Statistics, 2016

*Based on Consumer Price Indexes, Bureau of Labor Statistics, 2015

*Employee Benefit Research Institute and Greenwald & Associates, Inc. 2001-2015 Retirement Confidence Surveys