Investing in an index fund is the perfect way to gain exposure to a wide array of publicly-traded companies while typically operating costs and portfolio turnover lower. Not only are they great core holdings for retirement accounts like IRAs or 401(k)s, but even Warren Buffett himself has recommended investing in these funds as preparation for your later years. With index funds you don’t have to worry about bear markets – day-to-day fluctuations will be taken care of by tracking popular indices.

What are index funds

Index funds are a type of mutual fund, or ETF (exchange-traded fund). Unlike traditional investment funds, which rely on investment advisors to actively buy and sell investments, index funds track a specific asset class by purchasing securities in the same ratio of distributions of that index. This makes it easy for individuals to create diversified portfolios with minimal effort.

Index Exchange-traded Funds

Index Exchange-Traded Funds (Index ETFs) are funds that mimic the performance of a particular stock index or benchmark. The difference between ETFs and index mutual funds is that ETFs can be traded during the day like stocks while the index funds are traded at the end of the trading day with a set price.

Index mutual funds

Index funds allow investors to take advantage of market performance without actively managing their portfolios. These funds are built to mimic the stock market index or a particular segment of it.

By investing in an index fund, investors have the potential to benefit from market movements while possibly limiting some of the higher fees that are typically associated with active and managed funds. In this way, investors seek to leverage the broader market performance, through lower-cost funds that are easier and potentially more efficient to manage.

How index funds work (example)

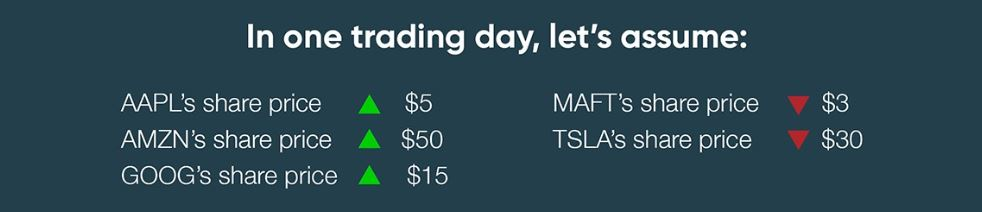

Imagine 5 technology stocks in an index fund. This index fund consists of 30% Apple, 30% Microsoft, 20% Amazon, 10% Alphabet, and 10% Tesla.

On this particular day of trading, it looks positive overall, because Apple, Amazon, and Alphabet’s price shares increased while Microsoft and Tesla fell.

In this example, it returned a $9.10 gain in one day of trading based on the percentage of each company in the index fund multiplied by the returns for that day.

If you have more questions about how index funds work or which one could be best for your portfolio then you should always talk to a fiduciary financial advisor to learn more about a particular stock or investment.

Index Funds vs. Actively Managed Funds

Passive Investing

Index funds are a passive form of investing. Passive investing is rooted in long-term discipline and typically offers a tax-efficient way to access a portfolio’s target asset allocation. Instead of attempting to beat the markets, passive investors seek to replicate a benchmark.

With this strategy, there is also less hands-on involvement from the investor so it is especially attractive for those who don’t have the time or energy to manage their own investments. It is an attractive choice for individuals interested in potentially achieving steady returns over time.

Potential Returns

The potential returns of Index funds vs. actively managed funds are a key consideration when determining which type of fund to invest in. Index funds are generally seen as the more conservative option due to their lower-risk strategy, while active and managed funds have the potential for higher returns with increased risk. This is because index funds track designated stock market or sector indexes, such as the S&P 500 or the Dow Jones Industrial Average in the US.

Associated costs with each type of fund

Investors should be aware of the costs associated with each type of fund when considering their investment options. Index funds generally have lower costs than actively managed funds due to their passive management strategies. This is because index funds do not require fund managers to buy and sell stocks, which translates into fewer fees for the investor. However, index funds may still incur some trading costs, such as transaction fees when buying or selling shares in an index fund.

In contrast, actively managed funds usually carry higher costs since these funds require a professional fund manager to predict market changes, choose stocks and manage investments. These services come with a price tag that is often passed on to investors in the form of higher fees. These fees can range from a few basis points to several percentage points of the amount invested in the fund. In addition to the management fee itself, investors may also incur additional costs associated with trading, taxes, and other administrative expenses charged.

Tax implications

Investing in a mutual fund carries certain tax implications that investors should consider when constructing a portfolio. Generally, taxes on a mutual fund is determined by the type of fund and the type of income generated by the fund.

When investing in index funds, for example, any dividends or capital gains earned from the underlying assets within the fund may be subject to taxation. These taxes typically vary depending on the investor’s individual tax situation and can include both short-term and long-term gains taxes. Additionally, since index funds do not require active management, investors may also benefit from lower tax bills due to their passive nature as well as lower trading costs associated with these types of investments.

Taxable income

On the other hand, more active management of the funds can generate taxable income in several different ways. For instance, distributions of dividends and interest payments received by shareholders can trigger taxation at either ordinary income rates or qualified dividends rates depending on the type of security held in the fund. Additionally, any capital gains earned from selling securities within an actively managed fund can result in taxes that may vary depending on an investor’s individual situation. Furthermore, investors should also take into account their own state’s tax laws when considering their investment options since these laws may differ across states and even between cities within a state.

Understanding how taxes apply to your investments is important for forming an effective investment strategy and portfolio allocation plan, especially for those looking to minimize their overall amount of taxes paid over time. Investors should consult a financial advisor or tax professional for more information about how taxes apply to their specific investments and portfolio construction plans in order to maximize their potential returns over time while minimizing their overall tax liabilities.

Index Funds or Stocks or Bonds

Many individuals ask the question: is an index fund better than stocks? The answer is not always a definitive yes or no. It depends on the individual investor’s goals and situation. Index funds can be an attractive option for those who are looking for a low-cost, diversified way to invest in the stock market without having to spend time researching and selecting individual stocks.

Index fund benefits

The primary advantage of investing in an index fund is the cost savings because most index funds have lower fees than actively managed mutual funds due to their simplified structure. Not having to actively research market trends can also potentially reduce costs.

Another benefit of investing in an index fund is diversification which can help protect investors against losses on individual stocks by allowing them to spread their investments across multiple sectors and industries. This helps reduce volatility over time as well as protect against losses on any one particular stock or sector.

Index fund potential downsides

However, despite the advantages offered by an index fund, there are some drawbacks that should be taken into consideration before investing. Index funds typically have higher trading costs than individual stocks due to the fact that they involve buying multiple shares at once rather than just one share at a time. Additionally, since these funds follow indexes, investors may miss out on potentially larger returns that could come from actively selecting stocks based on research and analysis of company fundamentals and market trends.

While both stocks and index funds can provide investors with potential returns, it ultimately comes down to personal preference when deciding whether or not to invest in either option. Those who want low-cost and diversified investments might find an index fund beneficial while those who prefer picking their own stocks may find more success going this route instead. Ultimately it’s important for all investors to understand the pros and cons associated with both types of investments so they can make informed decisions about where their money goes into play best for them given their own unique financial situation.

Request a no-cost, no-obligation advisor consultation today!

Get StartedSubscribe to our newsletter to stay updated

-

Previous

What is Dividend Income?

-

Next

What Should I Do With My Old 401k?